There was loads of euphoric pleasure over all issues electrical car (EV) just a few years in the past. Each investor needed to seek out the subsequent Tesla. One option to play that was to put money into an organization that may help the general progress of EVs, quite than attempting to choose the subsequent profitable EV maker.

That is why shares of solid-state EV battery firm QuantumScape (NYSE: QS) soared in late 2020 after the corporate went public. However a lot of that pleasure was untimely because the adoption of EVs and the event of recent applied sciences would take years to play out. That gave affected person buyers a bonus.

Three years later, QuantumScape is nearer to commercializing its product and the inventory has plunged 90%. So now that the inventory has dropped, it is value digging into whether or not it’s the time to purchase QuantumScape.

Planning on a solid-state future

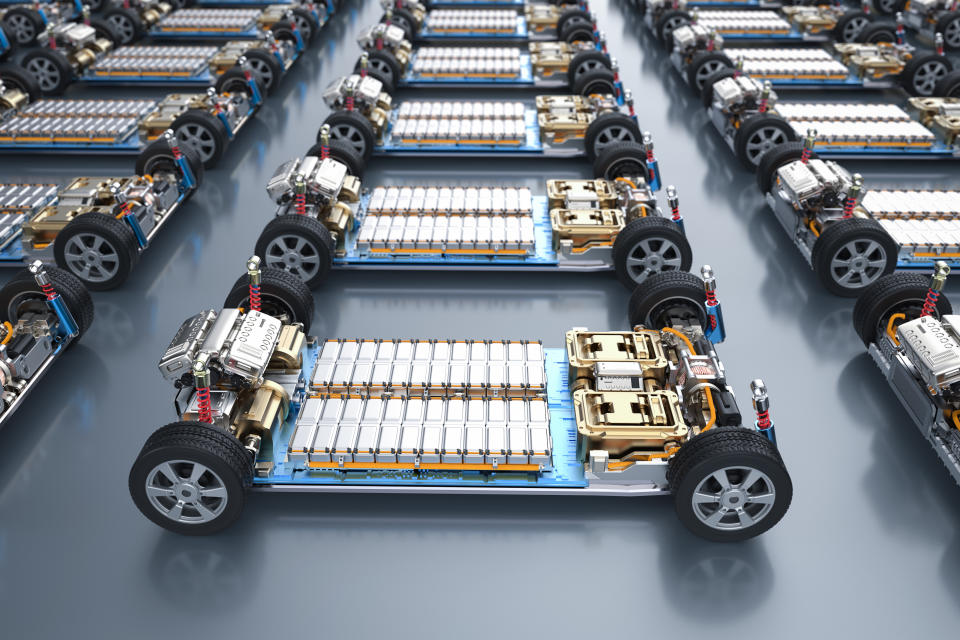

An funding in QuantumScape is a guess on the profitable commercialization of its solid-state battery know-how. Standard lithium-ion batteries used for EVs use graphite anodes. Whereas that works for the use case, it additionally has the draw back of a low power density. That limits the vary of present EV batteries.

QuantumScape’s resolution is to substitute anode-free lithium steel for the graphite. That would offer the very best power density for EV batteries and go a good distance towards addressing shopper hesitancy associated to vary nervousness. That resolution additionally has its personal challenges, nevertheless. The corporate is attempting to beat the scientific draw back by utilizing a ceramic strong separator to assist stabilize the lithium steel. Thus the “solid-state” terminology for the batteries.

Progress and hypothesis

QuantumScape has made progress on its battery design to make use of the know-how for EVs. It has efficiently scaled the battery cell layer rely in prototypes with out sacrificing capability retention — that means the batteries can final. It believes it’s in place to ramp as much as industrial-level manufacturing charges. And it has shipped prototypes to potential EV prospects for proof-of-concept testing. The corporate reviews a minimum of one potential buyer has achieved biking and power retention outcomes properly past QuantumScape’s acknowledged business targets.

QuantumScape’s inventory, nevertheless, stays fairly speculative. Even down over 90% from its excessive, the corporate remains to be valued with a market cap of greater than $3.5 billion. And it could possibly be a minimum of two extra years earlier than it doubtlessly generates significant income.

One bit of excellent information is that QuantumScape ended the third quarter with greater than $1.1 billion in liquidity. It believes its money stability will carry it into 2026. A few of that money got here from investments from one giant potential buyer. Volkswagen Group has lengthy been a accomplice for QuantumScape and is considered one of six automotive producers at present testing its battery cells.

That places QuantumScape inventory in an attention-grabbing place for buyers. If it declares continued progress towards profitable commercialization, the inventory will transfer larger in anticipation of gross sales. But when it fails, or one other firm with promising battery know-how beats it to market, the inventory may simply go to zero. That is why shopping for this inventory even whereas it is down is just for a speculative portion of any portfolio. Allocate accordingly, and that is one EV inventory which may be value betting on.

Do you have to make investments $1,000 in QuantumScape proper now?

Before you purchase inventory in QuantumScape, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and QuantumScape wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Howard Smith has positions in QuantumScape and Tesla. The Motley Idiot has positions in and recommends Tesla and Volkswagen Ag. The Motley Idiot has a disclosure coverage.

Is EV Firm QuantumScape a Purchase Whereas It is Down? was initially printed by The Motley Idiot