The semiconductor business fell laborious on April 17 on information that gear producer ASML missed earnings and that competitors from China is heating up.

Superior Micro Gadgets (NASDAQ: AMD), which at one level was one of many best-performing S&P 500 elements yr so far, has plummeted 21% in only one month and is now at a three-month low.

Regardless of the sell-off, expectations are nonetheless extremely excessive for AMD. Let’s take a look at the expansion inventory to see whether it is value shopping for now or if the dangers outweigh the potential reward.

AMD’s transformation

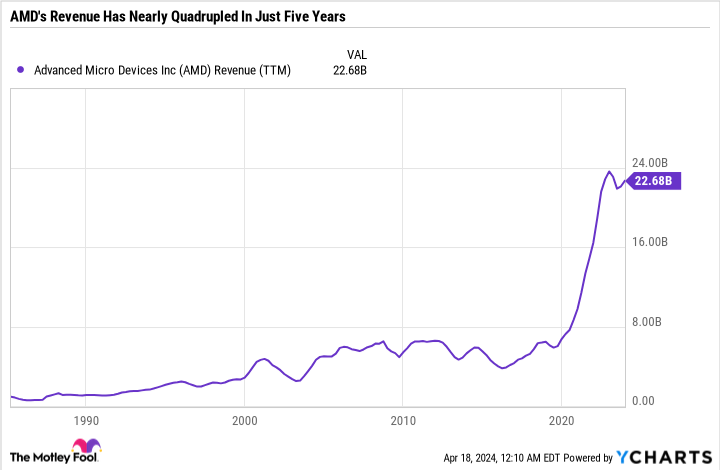

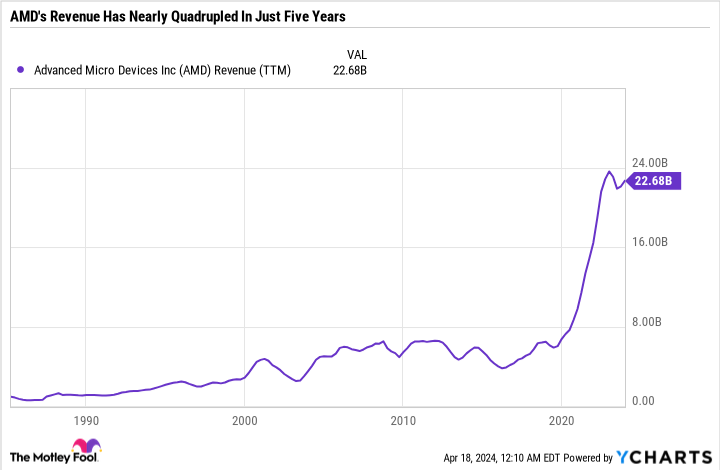

AMD spent many years within the shadow of Intel and different rivals as its development flatlined. However one have a look at AMD’s annual income chart, and it is easy to see that the corporate pole-vaulted into being a hypergrowth inventory.

AMD lengthy trusted its PC and online game segments to drive development. However two different segments have emerged lately — embedded and knowledge heart.

The embedded phase took off largely because of AMD’s $49 billion acquisition of Xilink — accomplished in February 2022. The phase focuses on integrating central processing items (CPUs) and graphics processing items (GPUs) into single-chip options for subject programmable gate arrays (FPGAs), which have tons of functions throughout a number of industries, and adaptive system-on-a-chip (SoC) merchandise, through which system elements are compressed onto one piece of silicon.

The acquisition was largely a man-made intelligence (AI) play. It helped set the stage for the launch in June 2023 of AMD Versal Premium VP1902 — the world’s largest SoC particularly focused for AI workloads.

The second development catalyst is AMD’s knowledge heart enterprise, which makes CPUs, GPUs, knowledge processing items (DPUs), FPGAs, and adaptive SoC merchandise for knowledge facilities to assist them course of the immense computing energy wanted to run AI fashions.

The consumer phase focuses on options for desktops and PCs, and the gaming phase primarily on GPUs and SoCs for gaming.

|

Metric |

Fiscal 2020 |

Fiscal 2021 |

Fiscal 2022 |

Fiscal 2023 |

|---|---|---|---|---|

|

Knowledge heart income |

$1.69 billion |

$3.69 billion |

$6.04 billion |

$6.5 billion |

|

Knowledge heart working earnings |

$198 million |

$991 million |

$1.85 billion |

$1.27 billion |

|

Knowledge heart working margin |

11.7% |

26.9% |

30.6% |

19.5% |

|

Shopper income |

$5.19 billion |

$6.89 billion |

$4.65 billion |

$6.2 billion |

|

Shopper working earnings |

$1.61 billion |

$2.09 billion |

($46 million) |

$1.19 billion |

|

Shopper working margin |

31% |

30.3% |

(1%) |

19.2% |

|

Gaming income |

$2.75 billion |

$5.61 billion |

$6.21 billion |

$6.81 billion |

|

Gaming working earnings |

($138 million) |

$934 million |

$971 million |

$953 million |

|

Gaming working margin |

(5%) |

16.7% |

15.6% |

14% |

|

Embedded income |

$143 million |

$246 million |

$5.32 billion |

$4.55 billion |

|

Embedded working earnings |

($11 million) |

$44 million |

$2.63 billion |

$2.25 billion |

|

Embedded working margin |

(7.7%) |

17.9% |

49.4% |

49.5% |

Knowledge supply: AMD.

AMD’s embedded and knowledge heart segments have been just about nonexistent only a few years in the past. Additionally they have the potential to be higher-margin segments than PCs, desktops, and gaming, which units the stage for AMD to develop its gross sales and earnings quicker.

Lofty expectations

AMD inventory surged in 2023 and to start out 2024 due to how effectively positioned the corporate is to monetize AI throughout its segments. The best challenges for AMD are competitors, sustained funding in AI, and the cyclicality of the semiconductor business. However from an funding standpoint, AMD has to justify its costly valuation with development.

Analyst consensus estimates name for $3.63 in fiscal 2024 diluted earnings per share (EPS) and $5.51 in diluted fiscal 2025 EPS. AMD experiences its Q1 fiscal 2024 earnings on April 30, that means we’re nonetheless just a little over 9 months away from figuring out the corporate’s full-year fiscal 2024 outcomes.

For context, AMD earned $2.57 in fiscal 2021 diluted EPS, so fiscal 2025 is basically anticipated to double from that degree. AMD has a ahead price-to-earnings (P/E) ratio of 42.4 and a 27.9 P/E primarily based on fiscal 2025 earnings. It has to ship some critical development for the inventory to look affordable, however AMD will start to look low cost if the inventory worth languishes and earnings look as if they’ll proceed rising at a strong tempo previous fiscal 2025.

Within the close to time period, a few of the biggest alternatives for AMD contain rising its market share within the AI chip market. On April 16, AMD introduced new merchandise for its business cell and desktop AI PC portfolio. Buyers ought to comply with how prospects obtain these new merchandise within the coming quarters. One other alternative is for AMD to take AI GPU market share from Nvidia, which presently has a close to monopoly.

A greater solution to method AMD inventory

AMD could possibly be in for a bumpy journey over the brief time period because of elements inside and outdoors its management. A greater solution to method investing within the firm is to contemplate the place it will likely be a number of years from now, not the place it will likely be if it hits subsequent quarter’s or this fiscal yr’s estimates.

AMD’s ticket to success is to compete on innovation and worth throughout its enterprise segments. In hindsight, the Xilinx acquisition seems to be sensible, as AMD can now leverage its diversified product providing throughout a number of segments. AMD nonetheless has lots to show, but it surely stands out as having a transparent path to gaining market share, whereas Nvidia appears to have extra to lose. However each firms ought to do effectively so long as the general market retains rising.

Since AMD’s valuation is predicated on earnings nonetheless comparatively far sooner or later, the inventory could possibly be underneath immense strain if development slows or there are broader business headwinds. I feel that for many traders, AMD is value leaving on a watchlist or just shopping for a starter place in, a minimum of till we get a greater thought of AMD’s position within the AI PC market.

AMD has excessive margin potential throughout its enterprise segments, however its margins are nonetheless comparatively low in comparison with Nvidia and different chip firms. AMD must show that its top-line development and margin growth have room to run.

Regardless of these challenges, traders with the next threat tolerance who want to add an AI inventory to their portfolio may use the sell-off as a shopping for alternative.

Do you have to make investments $1,000 in Superior Micro Gadgets proper now?

Before you purchase inventory in Superior Micro Gadgets, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Superior Micro Gadgets wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $466,882!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 15, 2024

Daniel Foelber has the next choices: lengthy July 2024 $180 calls on Superior Micro Gadgets. The Motley Idiot has positions in and recommends ASML, Superior Micro Gadgets, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief Might 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

Down 20% in 1 Month: Is It Time to Purchase the Dip on AMD Inventory? was initially printed by The Motley Idiot