A seismic shift is presently underway among the many world’s largest exchange-traded funds (ETFs), which may redefine the panorama of the ETF universe.

The SPDR S&P 500 ETF Belief (NYSE:SPY), the biggest ETF globally with over $500 billion in belongings beneath administration, skilled important outflows because the starting of the 12 months.

In distinction, its lower-cost friends, particularly the Vanguard S&P 500 ETF (NYSE:VOO), noticed an inflow of investments.

What’s driving this development?

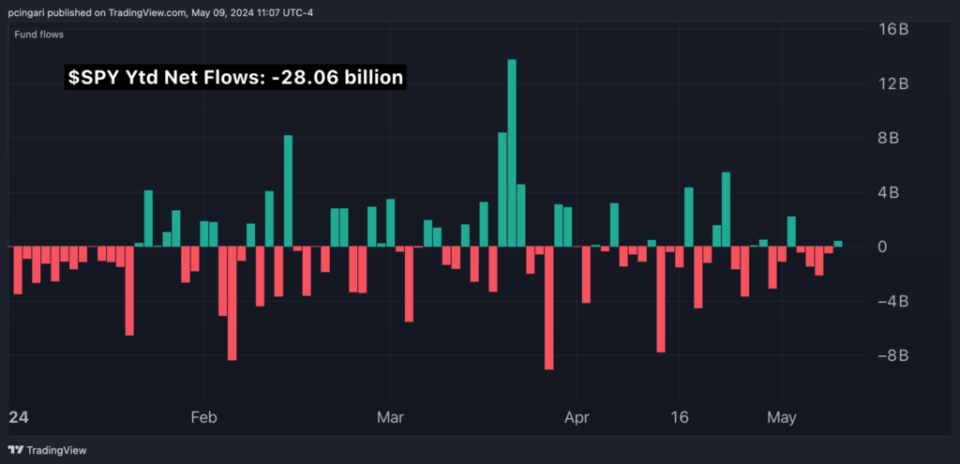

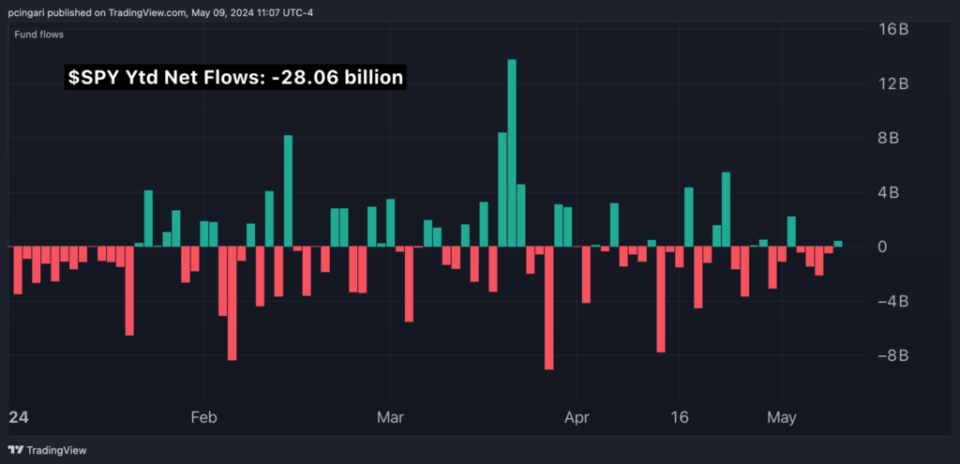

Outflows From SPY ETF On The Rise

The SPDR S&P 500 ETF Belief witnessed outflows totaling $28 billion because the 12 months’s begin, in accordance with knowledge from Vettafi.

This shift is notable as a result of it happens towards a backdrop the place the U.S. inventory market has been on the rise, indicating that the efficiency of the underlying investments isn’t the reason for the outflows.

The first driver behind this shift seemed to be the associated fee related to managing these funds, fairly than their efficiency.

SPY has an expense ratio of 0.09%, considerably increased than a few of its direct rivals. Even a number of foundation factors could make a substantial distinction in investor returns over time, particularly for institutional or very giant particular person traders.

Chart: SPY ETF Witnesses $28 Billion In Outflows Yr-To-Date

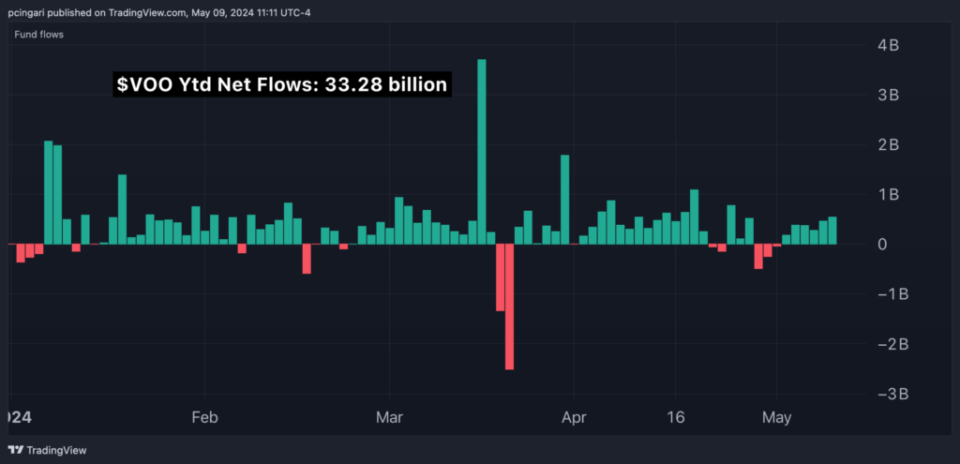

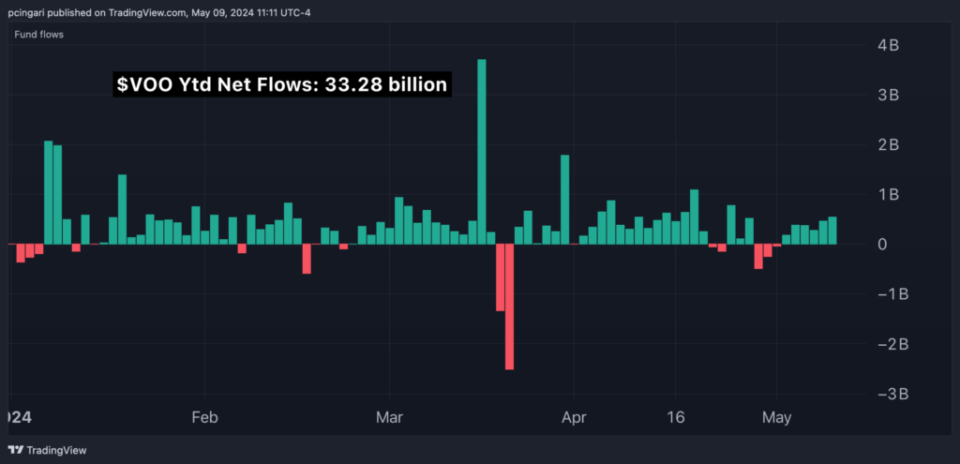

Inflows In Decrease-Value Friends

Whereas SPY has been seeing outflows, the Vanguard S&P 500 ETF welcomed inflows of $33 billion throughout the identical interval. One other competitor, iShares Core S&P 500 ETF (NYSE:IVV), attracted $14.53 billion.

These ETFs observe the identical index as SPY and have almost equivalent portfolios.

The distinguishing issue is their expense ratios: the Vanguard S&P 500 ETF and the iShares Core S&P 500 ETF cost simply 0.03%, in comparison with SPY’s 0.09%.

Chart: VOO ETF Sees Over $33 Billion In Inflows Yr-To-Date

Learn Additionally: 5 Issues You Want To Know About Vanguard ETFs: Why There’s No Bitcoin ETF In Their Lineup?

Ought to You Swap From SPY to VOO?

Though a distinction of 0.06% in expense ratios might sound negligible, it turns into important with bigger investments or over prolonged intervals.

For example, on a $10,000 funding, selecting VOO over SPY saves an investor $6 yearly. Nevertheless, for a $10 million funding, the annual financial savings soar to $6,000.

For instance the long-term impression, take into account an investor who begins with a $100,000 funding in an S&P 500 fund. Assuming a median annual return of seven%, after 20 years, this funding would develop to $384,803 with VOO, in comparison with $380,509 with SPY, because of the distinction in expense ratios.

Over time, these seemingly small variations may end up in substantial divergences in finish wealth, because of the impact of compounding returns.

Thus, for particular person traders, significantly these with substantial quantities or lengthy funding horizons, the associated fee financial savings from ETFs related to decrease expense ratios shouldn’t be missed.

If an individual was contemplating a change from SPY to VOO, it’s important to weigh these components together with any potential tax implications or transaction prices related to such a transfer.

For a lot of, the long-term financial savings on charges may justify the change, enhancing total returns whereas preserving the identical portfolio construction.

But, if an individual had important holdings within the SPY, they should take into account the tax prices related to promoting their shares. To keep away from these potential tax liabilities, keep the funding in SPY and begin diverting new funds right into a less expensive ETF, such because the VOO or the iShares Core S&P 500 ETF (IVV).

Desk Comparability: SPY vs. VOO vs. IVV

|

SPDR S&P 500 ETF Belief (SPY) |

Vanguard S&P 500 ETF (VOO) |

iShares Core S&P 500 ETF (IVV) |

|

|

Issuer |

State Road International Advisor |

Vanguard |

iShares – BlackRock Inc. (NYSE:BLK) |

|

Index tracked |

S&P 500 |

S&P 500 |

S&P 500 |

|

Asset |

$511.36 billion |

$440.59 billion |

$451.03 billion |

|

Internet flows (ytd) |

$-28.06 billion |

$33.28 billion |

$14.53 billion |

|

Expense ratio |

0.09% |

0.03% |

0.03% |

|

Annual dividend |

1.30% |

1.35% |

1.33% |

|

YTD Return |

9.15% |

9.19% |

9.18% |

|

3-year Return |

8.60% |

8.66% |

8.66% |

|

5-year Return |

14.25% |

14.30% |

14.34% |

Knowledge: Vettafi.com

Learn Now: Why Veteran Wall Road Investor Believes We’re Nonetheless In A Bull Market

Photograph: YO Alexandre by way of Shutterstock

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Recreation with the #1 “information & the whole lot else” buying and selling software: Benzinga Professional – Click on right here to start out Your 14-Day Trial Now!

Get the most recent inventory evaluation from Benzinga?

This text Traders Flock To Decrease-Value Vanguard S&P 500 ETF: Is It Time To Swap From SPY To VOO? initially appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.