E-commerce and cloud chief Amazon (NASDAQ: AMZN) is a bona fide inventory winner that retains compounding in worth. Shares commerce close to their all-time highs, and a mere $1,000 funding made at its preliminary public providing in Might 1997 has changed into over $1.9 million.

Naturally, new traders will ask whether or not they have missed the practice on this inventory. Does Amazon nonetheless have share appreciation juice to squeeze because it approaches a $2 trillion valuation? The reply to that query entails asking two different distinct questions:

-

Can Amazon nonetheless develop?

-

Does the inventory’s valuation go away room for extra?

After doing a little homework, I used to be shocked on the solutions I discovered. Here’s what you have to know.

Can Amazon nonetheless develop?

Naturally, development turns into more difficult if you’re an enormous company producing, in Amazon’s case, $574 billion in annual income. However borrowing a phrase from my youngsters, Amazon is constructed otherwise.

That is as a result of Amazon performs in three humungous markets with extra room for development and alternatives than most: e-commerce, cloud computing, and digital promoting. It’s America’s main e-commerce firm, with a 38% market share. In cloud computing, Amazon Net Providers (AWS) leads the market with a 31% share. Amazon is anticipated to account for 15.2% of all digital promoting spending within the U.S. in 2025.

That management helps Amazon compete as a result of it has the scale and scale most rivals cannot match. It might probably present a greater product for much less cash.

One of the best half is that these big-picture traits favor Amazon. At present, e-commerce nonetheless solely accounts for simply over 15% of complete retail in the USA. That is trillions of {dollars} of shopper spending but to maneuver on-line.

Cloud computing has develop into the inspiration of the web, and now synthetic intelligence (AI) has added a number of new rooms to construct up and stack on prime. Only in the near past, Amazon introduced $50 billion in new information heart investments for Virginia and Japan, underlining how a lot computing energy AI and an more and more digital world will command. Some consider in a bullish state of affairs during which public clouds like AWS might develop into a $10 trillion market over the approaching years.

Third, Amazon has amassed an enormous presence within the media panorama by leveraging its Prime subscription program, which has someplace round 200 million paying accounts. Prime members get entry to streaming content material and Amazon’s rights to Thursday Evening Soccer through the Nationwide Soccer League. Moreover, Amazon generates billions in promoting income by way of Prime and thru its affiliate gross sales program. The advert enterprise grew 27% yr over yr in This autumn, sooner than another a part of Amazon. Annualizing its This autumn advert income places the section at almost $60 billion. Amazon’s robust development price appears to indicate loads of room for the advert enterprise to develop transferring ahead.

General, Amazon appears to have loads of alternatives to proceed rising.

Does the valuation make sense?

Amazon founder Jeff Bezos as soon as mentioned that the corporate was “famously unprofitable.” He meant that you simply had to take a look at the enterprise’s money circulation as a result of it reinvested all its income again into the corporate. In different phrases, valuing the inventory on bottom-line earnings does not inform the entire story.

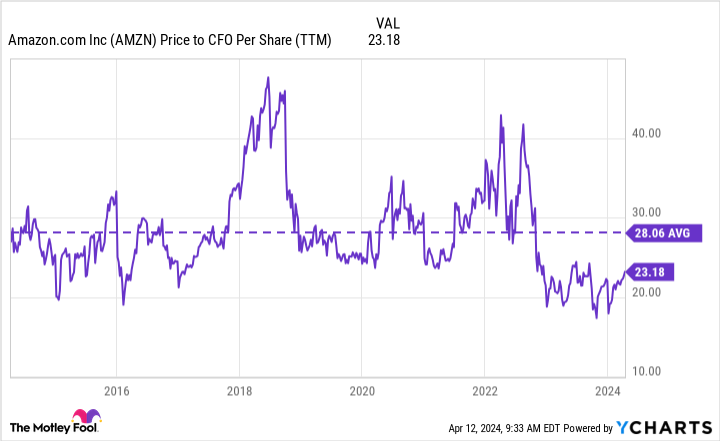

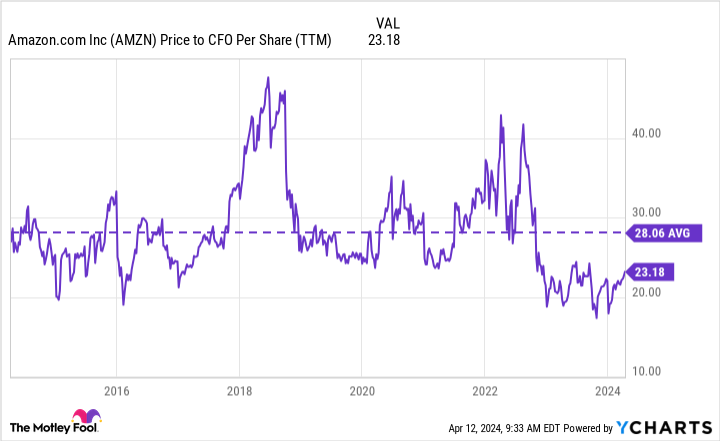

So I checked out Amazon’s ratio of value to money from operations (CFO) to see if it is nonetheless engaging as we speak. In any case, shares are buying and selling at all-time highs and have elevated 88% over the previous yr.

What jumps out is how low a valuation the inventory got here from by almost doubling in share value in only a yr. At lower than 20 occasions working money circulation, that discount does not come round usually. The excellent news is that shares are nonetheless notably beneath their common valuation over the previous decade.

So sure, shares nonetheless supply some worth as we speak.

Is it too late to purchase Amazon?

Whether or not to purchase any inventory will depend on what the corporate might do sooner or later and the worth you pay for that potential development. You will seemingly generate income over time for those who get these two issues proper.

Amazon has room to proceed rising its core e-commerce and cloud companies. And it has gotten additional into media and promoting, which provides the corporate a 3rd potential development avenue to discover.

As you noticed above, Amazon remains to be (at worst) fairly priced as we speak.

So to reply the query, long-term traders can nonetheless purchase the inventory as we speak. It isn’t too late, regardless of the robust run over the previous yr.

With that mentioned, shares might all the time dip, as any inventory may, so contemplate a dollar-cost averaging technique to slowly construct a place to keep away from being caught in a market correction with no cash left to speculate.

Do you have to make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Amazon wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of April 8, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon. The Motley Idiot has a disclosure coverage.

Is It Too Late to Purchase Amazon Inventory? was initially printed by The Motley Idiot