Nvidia (NASDAQ: NVDA) has pulled off a historic rise over the past decade, with its share value up greater than 25,000% since 2014. The corporate has taken the chip market by storm, nearly singlehandedly constructing the buyer chip business into what it’s at this time.

Nvidia was one of many first firms to start promoting graphics processing items (GPUs) on to clients, who use these chips to construct high-performance PCs for actions like gaming and video enhancing.

The chipmaker’s direct-to-consumer enterprise stays profitable, with its gaming phase up 18% 12 months over 12 months within the first quarter of fiscal 2025. Nvidia’s success in desktop GPUs has given it the model energy and monetary sources to broaden to a number of different sectors, together with synthetic intelligence (AI), cloud computing, healthcare, authorities, robotics, and self-driving autos.

Nvidia’s inventory has climbed about 140% within the final 12 months however seems to solely simply be getting began. So, regardless of current development, Nvidia’s inventory stays a compelling choice price contemplating this 12 months.

The potential to attain a market cap above $3 trillion

Nvidia quickly achieved a market cap above $3 trillion earlier this 12 months, becoming a member of Microsoft and Apple within the elite membership of trillion-dollar firms. Nonetheless, its market cap is presently round $2.7 billion after a slight correction and pullback from tech business traders. But, Nvidia’s vital development potential suggests it will not be lengthy earlier than it rises above that $3 trillion milestone once more — and this time, for good.

AI has highlighted the essential function chips must play in the way forward for tech, equipping builders with the facility obligatory to construct the generative software program. In the meantime, AI is just one of many industries that require high-powered chips to maneuver ahead, representing many development catalysts for Nvidia.

Knowledge from JPMorgan Chase reveals that outstanding tech giants Microsoft, Amazon, Alphabet, and Meta Platforms will attain capital expenditures totaling $201 billion by Could 2025. That determine shall be up from about $140 billion in 2023, representing a 44% rise. A lot of that shall be spent on increasing their positions in AI, constructing knowledge facilities, and equipping them with GPUs.

In the meantime, Nvidia is well-positioned to take pleasure in large features from elevated AI spending, with its GPUs liable for about 90% of the market. The corporate posted income features of 262% 12 months over 12 months in Q1 2025, up 18% sequentially. The rise was primarily due to a 427% enhance in its knowledge heart phase, illustrating an increase in AI chip gross sales.

Nvidia has loved stellar development from AI, even whereas many markets have barely scratched the floor of what is potential with the expertise. Massive language fashions like OpenAI’s ChatGPT have confirmed the utility of language technology. Nonetheless, as Meta Chief Scientist Yann LeCun not too long ago identified, these platforms “do not actually perceive the bodily world. They do not actually have persistent reminiscence. They cannot actually cause, and so they actually cannot plan.”

One of the best and most effective use of AI has possible not even been considered but, with many years of understanding possible forward. And Nvidia is well-equipped to proceed fueling the market’s improvement. Elevated spending in AI will possible proceed to spice up earnings and lift its market cap to effectively above $3 trillion.

Nvidia is not buying and selling at a discount, however its inventory is a greater worth than you may assume

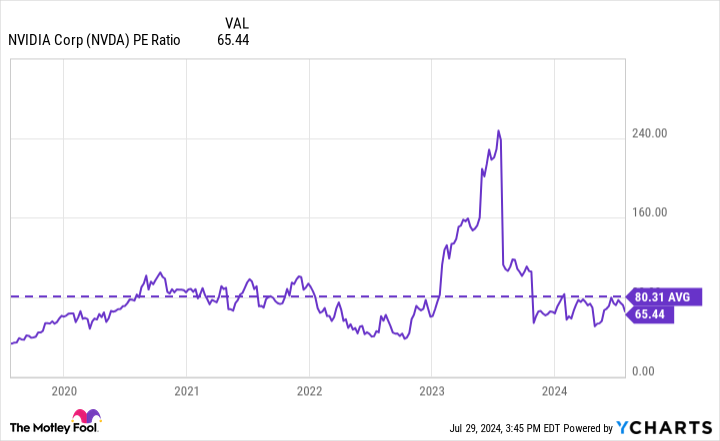

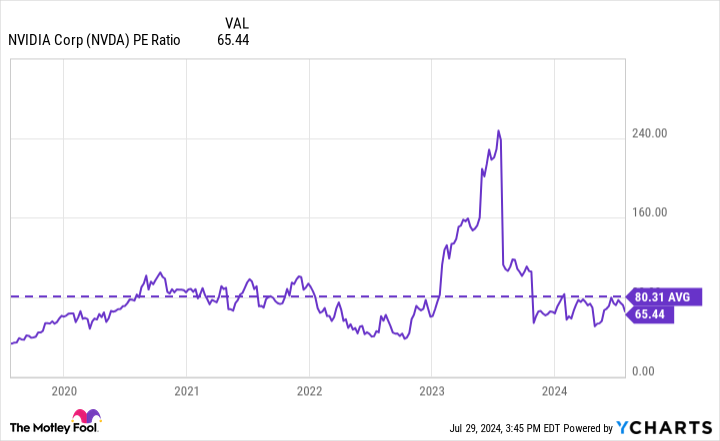

Nvidia’s inventory not too long ago was buying and selling at about 65 occasions its earnings. That determine beats its largest rival, Superior Micro Units, which has a price-to-earnings (P/E) ratio of an eye-watering 206. The information reveals that Nvidia is a greater worth than its competitor, however not precisely an enormous discount.

Nonetheless, this chart reveals that Nvidia’s present P/E is beneath its five-year common for the metric, throughout which the corporate’s inventory value skyrocketed by 2,450%. Consequently, a excessive P/E does not essentially imply the corporate’s inventory will fall quick in development.

Along with Nvidia’s monster potential in AI and tech generally, its inventory is simply too good to disregard for anybody in search of a long-term funding. The corporate will possible proceed cashing in on rising chip demand for years as increasingly markets require highly effective {hardware} to develop.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $669,193!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 29, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. JPMorgan Chase is an promoting accomplice of The Ascent, a Motley Idiot firm. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Dani Cook dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Amazon, Apple, JPMorgan Chase, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Is Nvidia Inventory a Purchase? was initially revealed by The Motley Idiot