Every quarter, the S&P 500 index rebalances. This implies new firms are added to the index, changing present members which might be not eligible.

One firm that has been eligible for S&P 500 inclusion for fairly a while however is but to be added to the index is Palantir Applied sciences (NYSE: PLTR). With the subsequent rebalance scheduled for Sept. 20, is now the time to load up on Palantir inventory?

How do firms develop into eligible for the S&P 500?

Eligibility standards for S&P 500 inclusion varies amongst elements equivalent to market cap, profitability, inventory float, and company construction. On this article, I’ll primarily concentrate on the profitability standards. To develop into eligible for the S&P 500, an organization should be worthwhile over the earlier 4 quarters whereas particularly producing a revenue in the latest quarter.

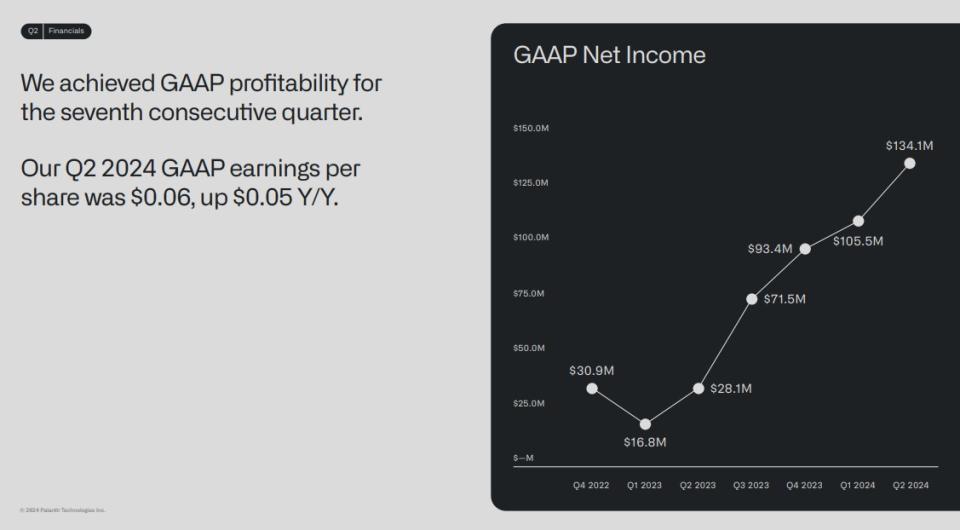

To be clear, this implies your enterprise might burn money for 3 straight quarters however then generate a revenue within the fourth quarter that is huge sufficient to make the online sum during the last 12 months a optimistic determine. The chart beneath illustrates Palantir’s profitability during the last a number of quarters.

Palantir has generated optimistic web revenue on a usually accepted accounting ideas (GAAP) foundation for seven consecutive quarters. The corporate has clearly demonstrated a capability to function in a persistently worthwhile manner. Nevertheless, there could also be a few huge explanation why Palantir hasn’t been chosen for the S&P 500 regardless of its rising revenue ranges.

Why hasn’t Palantir been added to the S&P 500 but?

Simply to be upfront, I can’t definitively say why Palantir hasn’t been chosen for the S&P 500 but. Nevertheless, my fellow Idiot Jake Lerch made an astute remark again in March as to what could be the driving choice.

It is no secret that synthetic intelligence (AI) has served as a giant catalyst for the expertise sector during the last two years. Palantir’s enterprise software program platforms focus on huge information analytics and have witnessed hovering demand because of hefty investments in AI.

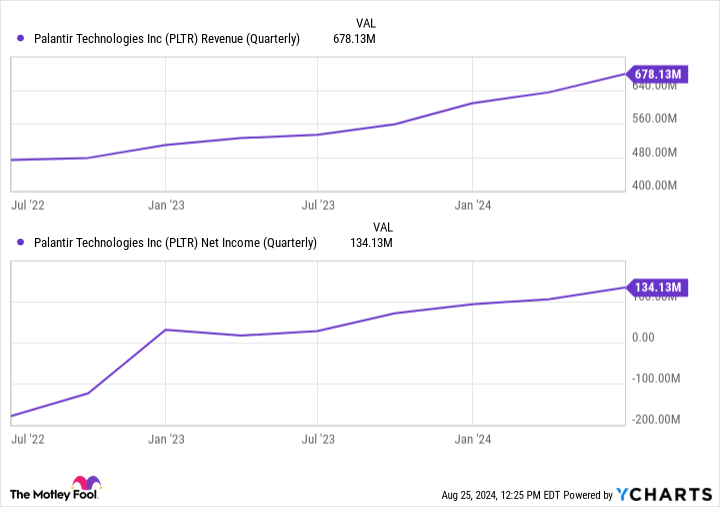

Because the charts beneath clearly illustrate, Palantir’s income actually began to kick into gear during the last two years. Furthermore, this newfound AI-driven development helped gasoline sustained profitability.

One other concern could possibly be that Palantir depends closely on massive authorities contracts. Typically talking, authorities offers will be lumpy and unpredictable. These dynamics make it difficult to evaluate what an organization’s future development could appear to be.

On the finish of the day, there may be an argument to be made that Palantir’s present development is fleeting and that the corporate is simply benefiting from the AI hype. Whereas I perceive that thesis, I feel it is shortsighted.

Do you have to purchase Palantir earlier than Sept. 20?

Earlier this yr, IT structure specialist Tremendous Micro Pc was added to the S&P 500. Similar to Palantir, Supermicro has entered a brand new part of development largely pushed by hefty investments in AI infrastructure, equivalent to information facilities.

But, not like Palantir, Supermicro’s gross margin and revenue ranges are very a lot inconsistent — and but, the corporate nonetheless earned a spot within the S&P 500 earlier than Palantir. Moreover, investments in capital expenditures (capex) ought to proceed to rise, in response to administration at mega-cap tech stalwarts equivalent to Amazon, Alphabet, and Microsoft.

To me, considerations over the long-run sustainability of Palantir’s development are overblown and ought to be put to relaxation. Whether or not you need to spend money on Palantir earlier than the subsequent S&P 500 rebalancing boils all the way down to your danger urge for food. Candidly, I might not be shocked to see shares of Palantir witness a little bit of momentum as Sept. 20 attracts nearer.

Nevertheless, investing in momentum shares generally is a actual danger and go away you as a bag holder if you happen to’re not cautious. It is necessary to remember the fact that Palantir is a development inventory and experiences outsize volatility in comparison with blue chip alternatives. Moreover, Palantir inventory is way from a discount, contemplating its ahead price-to-earnings (P/E) ratio of 89.5.

Ought to Palantir lastly earn its spot within the S&P 500, you very properly may even see some beneficial properties in your portfolio. Nevertheless, I feel a extra prudent technique is to spend money on Palantir utilizing dollar-cost averaging over a long-term horizon — permitting you to purchase in at completely different value factors over time and mitigate timing dangers. Traders should not weigh an excessive amount of on particular dates when shopping for a inventory however fairly think about the long-term outlook.

And to me, Palantir’s future appears brilliant because the AI revolution continues to take form. I feel the corporate’s development is simply simply starting, and I see extra vital beneficial properties to come back.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Palantir Applied sciences wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $720,542!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 26, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Palantir Applied sciences. The Motley Idiot has positions in and recommends Alphabet, Amazon, Microsoft, and Palantir Applied sciences. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Is Palantir Inventory a Purchase Earlier than Sept. 20? was initially revealed by The Motley Idiot