Enthusiasm round synthetic intelligence (AI) has performed an enormous position in pushing the markets increased to date this yr. Though huge tech shares equivalent to Nvidia and Microsoft have witnessed outsize shopping for exercise, many traders have been much less apparent selections in hopes of figuring out the following huge AI alternative.

One such firm that has skilled its share of hype is Tremendous Micro Pc (NASDAQ: SMCI). Shares of the AI darling are up 234% during the last yr, and 218% simply in 2024.

Whereas Supermicro has been carefully affiliated with Nvidia, the underlying enterprise is definitely fairly completely different — and in my view, I feel it’s miles much less profitable.

Let’s dig into the funding prospects of Supermicro and discover if the inventory deserves a spot in your portfolio.

Supermicro’s enterprise is hovering, however…

Maybe the most popular pocket of the AI realm is semiconductors. Demand is hovering for graphics processing items (GPUs) as generative AI purposes proceed to evolve.

For now, Nvidia, AMD, Intel, and another chip designers have emerged as the most important names within the GPU market. Whereas Supermicro is works with many chip firms, it isn’t a semiconductor firm itself.

Quite, Supermicro makes a speciality of IT infrastructure. Basically, the corporate designs structure options equivalent to storage clusters for high-performance GPUs.

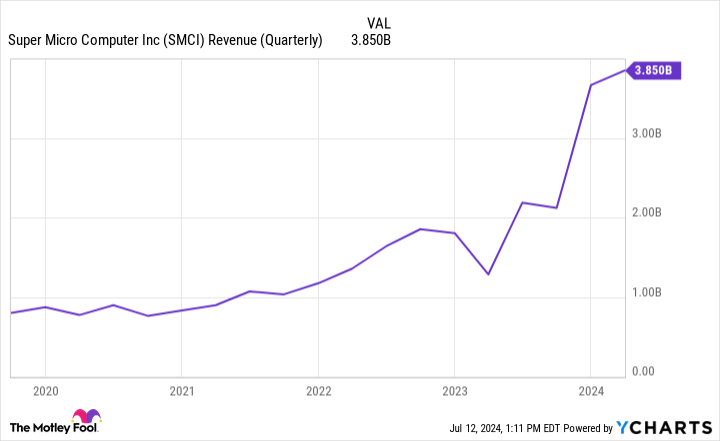

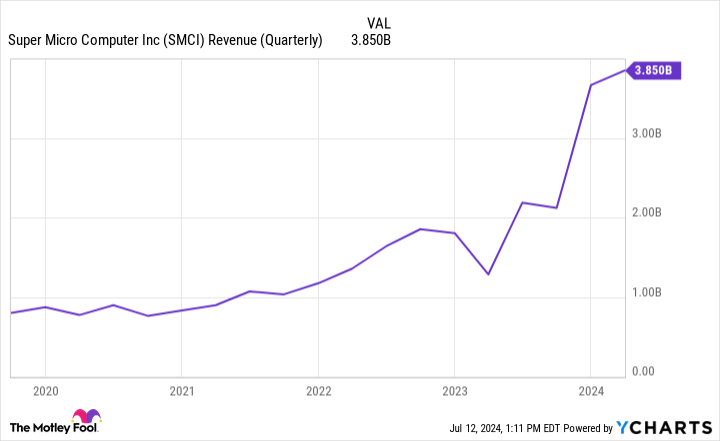

The income tendencies seen under illustrate how the heightened demand and shopping for exercise surrounding chips has served as a bellwether for Supermicro’s providers during the last couple of years.

Whereas the newfound income development is encouraging, there are some lowlights traders ought to concentrate on in terms of Supermicro.

…there may be greater than meets the attention

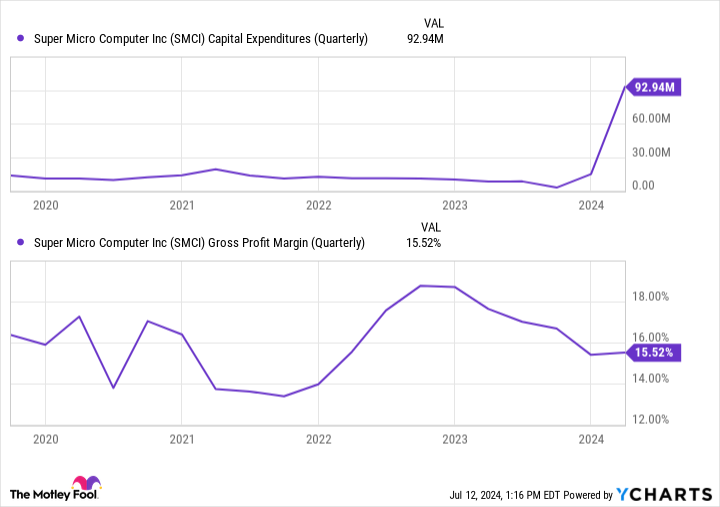

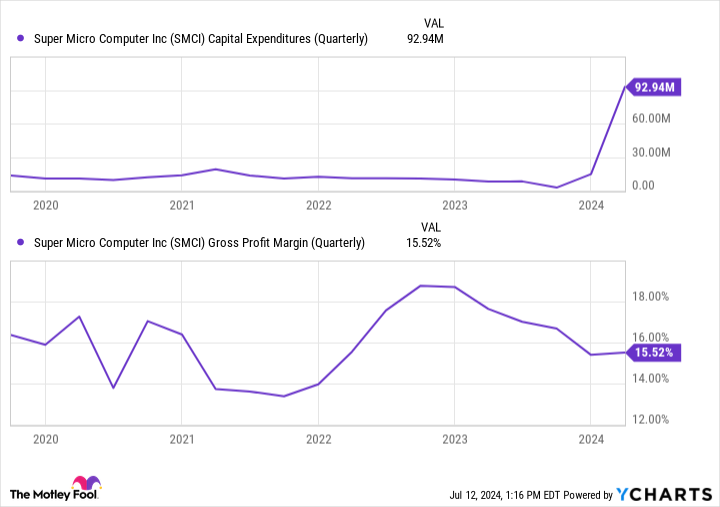

Whereas rising demand could be thought-about a great factor for Supermicro, remember the fact that constructing IT infrastructure is an costly enterprise.

Check out the dynamics within the charts under. In more moderen quarters, Supermicro’s capital expenditures (capex) have ballooned. The concept I am attempting to convey right here is that whereas the corporate’s income is surging, bills are additionally rising considerably.

This dynamic is immediately impacting Supermicro’s margin profile. As noticed under, Supermicro’s gross margin is definitely plateauing in the mean time.

Admittedly, the financials analyzed above aren’t essentially a motive to run for the hills. Nonetheless, there are a few different potential points to discover as they relate to Supermicro.

Remember the fact that the semiconductor area is a cyclical trade. Proper now, chip companies are having fun with a little bit of a renaissance fueled by AI euphoria. However like another kind of enterprise, ultimately provide and demand tendencies will normalize.

That would spell bother for Supermicro in the long term. It is fairly tough to forecast demand for any product, not to mention cutting-edge chips which are used for breakthrough purposes in AI. These themes have me involved that Supermicro’s enterprise might witness a deceleration. This might additional affect the corporate’s profitability profile, which might be an unwelcome shock given the already low-margin nature of the enterprise.

Is now a great time to purchase Supermicro inventory?

Whereas many traders have undoubtedly made some huge cash proudly owning Supermicro inventory, I am skeptical that the returns have been for the correct causes. I’m suspicious that many traders see Supermicro as analogous to Nvidia and have poured into the inventory accordingly. Due to this fact, when Nvidia and different chip shares start buying and selling upwards, shares of Supermicro have adopted.

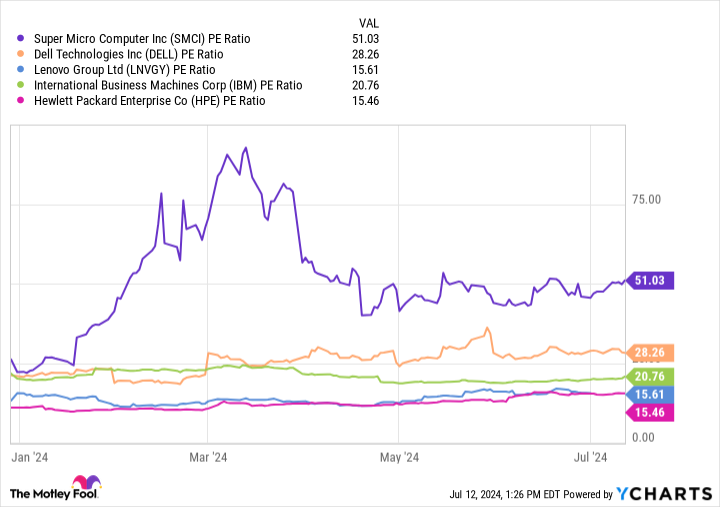

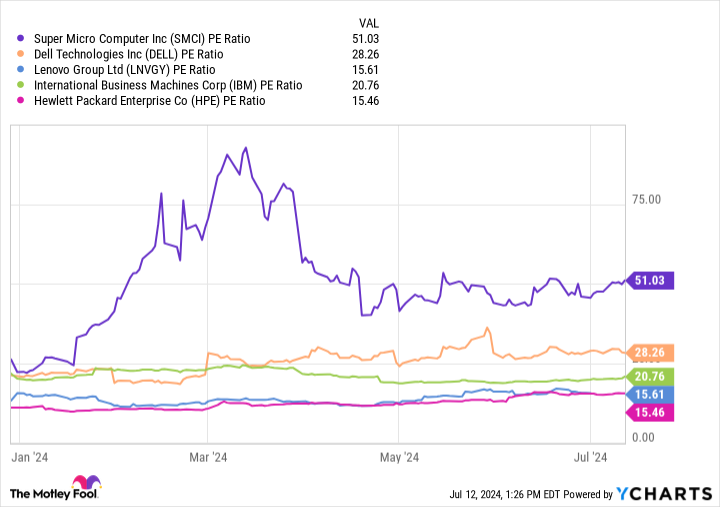

The chart above benchmarks Supermicro in opposition to a peer set on a price-to-earnings (P/E) foundation. The plain takeaway from the valuation tendencies above is that Supermicro is valued at a big premium to its friends.

Nonetheless, a extra refined argument is that companies equivalent to Dell Applied sciences and Worldwide Enterprise Machines particularly aren’t solely a lot bigger than Supermicro, however they’re way more diversified in terms of services. And but Supermicro’s P/E is greater than double that of IBM and meaningfully increased than Dell’s.

Contemplating the extent of competitors and the cyclicality of the chip area extra broadly, combined with the excessive capex and low-margin nature of Supermicro’s enterprise, I am unable to assist however assume the inventory is overvalued.

I feel traders with a long-term horizon have higher alternatives within the chip area and the AI area typically. Whereas scooping up Supermicro inventory seems to be tempting, I see the corporate as extra of commerce and fewer of an funding.

Do you have to make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Tremendous Micro Pc wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $791,929!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 8, 2024

Adam Spatacco has positions in Microsoft and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units, Microsoft, and Nvidia. The Motley Idiot recommends Intel and Worldwide Enterprise Machines and recommends the next choices: lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, quick August 2024 $35 calls on Intel, and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Is Tremendous Micro Pc Inventory a Good Purchase Proper Now? was initially revealed by The Motley Idiot