For those who’re like most buyers, you’re keen on the market’s long-term upside. You simply do not need to undergo its occasional (and typically painful) setbacks. Downside? You do not know when crashes are coming. The perfect you possibly can hope for is minimizing their distress as soon as they arrive. And one of the best ways to try this is by being correctly positioned earlier than massive pullbacks take form.

With that because the backdrop, there’s one title particularly I would take into account proudly owning now simply in case a market crash is looming. That is Annaly Capital Administration (NYSE: NLY).

By no means heard of it? Do not sweat it. You are not alone. It is not precisely a family title, and with a market cap of solely $10 billion, it isn’t prefer it garners a substantial amount of the monetary media’s consideration.

It does its job for buyers extremely nicely, although.

What’s Annaly Capital Administration?

Annaly Capital Administration is an actual property funding belief (REIT). Simply because the title suggests, REITs are actual estate-focused organizations. REITs personal properties starting from inns and workplace buildings to strip malls, condominium buildings, and extra. Their main objective, nevertheless, is similar in all circumstances: producing dependable, recurring revenue for shareholders.

Annaly is exclusive even by REIT requirements, although. Relatively than holding rent-bearing or revenue-bearing actual property, this firm’s enterprise is a mix of managing mortgage mortgage service rights, shopping for and promoting mortgage-backed securities issued by authorities companies, like Fannie Mae or Freddie Mac, and what’s primarily participating in rate of interest arbitrage between its personal borrowing prices and the yields on the mortgage-based securities it holds.

It sounds loopy, and in some methods it’s. The enterprise mannequin is 100% tethered to the US mortgage market, which ebbs and flows in relation to ever-changing rates of interest. Generally, this enterprise is predictable. Different instances, it is not. And typically, even when it’s predictable, that does not essentially imply there’s a simple approach for a mortgage REIT to defend itself towards looming setbacks.

On the finish of the day, although, Annaly Capital Administration makes it work. Since its inception in 1996, this REIT’s whole return has stored up with the S&P 500‘s achieve for a similar timeframe, with most of Annaly’s internet good points coming within the type of what’s normally an outsized dividend that continues being paid, even when the broad market is on the ropes.

An advantageous disconnect

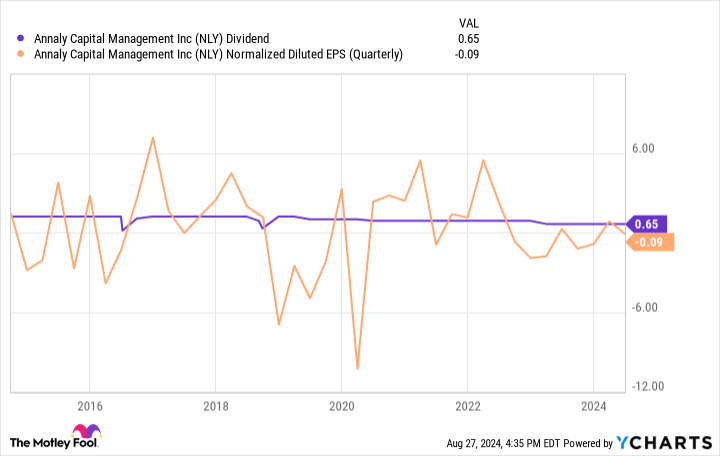

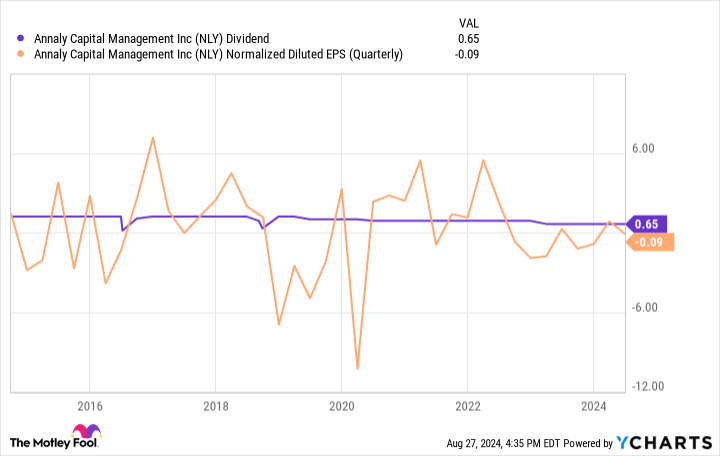

Do not misinterpret the message. For anybody needing constant, predictable funding revenue, Annaly Capital Administration could be a relatively powerful ticker to rely on. The payout does not essentially develop in line with inflation, if it grows in any respect. Generally, it shrinks, reflecting the continued adjustments within the underlying mortgage mortgage market inside which this REIT solely operates. This ticker’s value adjustments — usually being lowered — to make its yield extra precisely mirror the prevailing, risk-adjusted yields at any given time.

The REIT’s underlying earnings (referred to as earnings out there for distribution) are additionally impacted by adjustments in rates of interest themselves, which might drive the group to regulate its dividend funds every so often.

Annaly Capital Administration remains to be a terrific defensive choice within the occasion of market crashes, although, for a few completely different however associated causes: (1) This enterprise does not essentially rise and fall with the inventory market’s ebb and circulation, and (2) the dividend behind Annaly’s present yield of 13% goes to be paid whatever the market’s efficiency within the foreseeable future.

That is higher than the S&P 500’s common annual achieve, by the best way.

To be clear, proudly owning a stake on this REIT does not assure you may be higher off than not ought to shares undergo a large pullback. There are not any ensures on this enterprise, in any case. Something can and can finally occur.

However that is not the purpose. Essentially the most you are able to do is give your self the most effective likelihood of heading off the complete brunt of a sweeping sell-off. Annaly a minimum of affords you an affordable likelihood of doing that. Within the meantime, it is dispensing a very good amount of money in an surroundings the place development shares will not be logging a substantial amount of good points for some time.

Preserve it in perspective

The defensive advantages listed below are apparent, besides, buyers ought to hold issues in perspective. Annaly is not nicely suited to function a serious, foundational holding in a long-term portfolio. And in case your present objective is simply to outlive a market crash, it is best to take into consideration choosing up other forms of defensive trades, like gold or bonds.

However, Annaly Capital Administration is a prime prospect for a minimum of a small sliver of your portfolio proper now, if solely as a result of it is so far faraway from the mainstream inventory market but nonetheless able to producing inventory market-like internet returns.

Must you make investments $1,000 in Annaly Capital Administration proper now?

Before you purchase inventory in Annaly Capital Administration, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Annaly Capital Administration wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $731,449!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 26, 2024

James Brumley has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

Is the Inventory Market Going to Crash? Who Is aware of? That is Why I would Personal This Excessive-Yield Dividend Inventory. was initially revealed by The Motley Idiot