When examined over lengthy durations, no asset class has extra persistently delivered for traders than the inventory market. When in comparison with gold, oil, housing, and even Treasury bonds, the typical annual return of shares over the very long run handily outpaces these different asset courses.

Nevertheless, issues grow to be much less sure when the lens is narrowed. Over the earlier 4 years, the ageless Dow Jones Industrial Common (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-powered Nasdaq Composite (NASDAQINDEX: ^IXIC) have traded off bear and bull markets in successive years.

Reality be informed, there isn’t any foolproof technique for precisely predicting short-term directional strikes or crashes in Wall Avenue’s three main inventory indexes — however that does not cease traders from attempting to realize a bonus.

Although there isn’t any concrete solution to precisely forecast the place the Dow Jones, S&P 500, and Nasdaq Composite will head subsequent, there are a comparatively small variety of metrics and predictive indicators which have strongly correlated with directional strikes within the inventory market’s main indexes. One in every of these predictive instruments suggests hassle could also be brewing in paradise, which has the potential to ship Wall Avenue over the proverbial edge.

Are shares about to fall off a cliff?

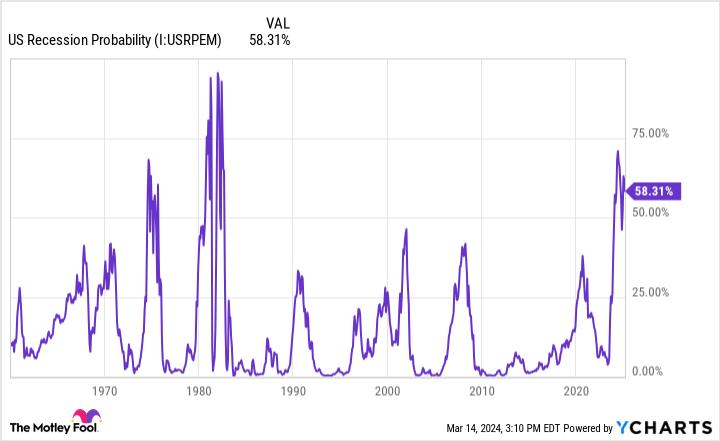

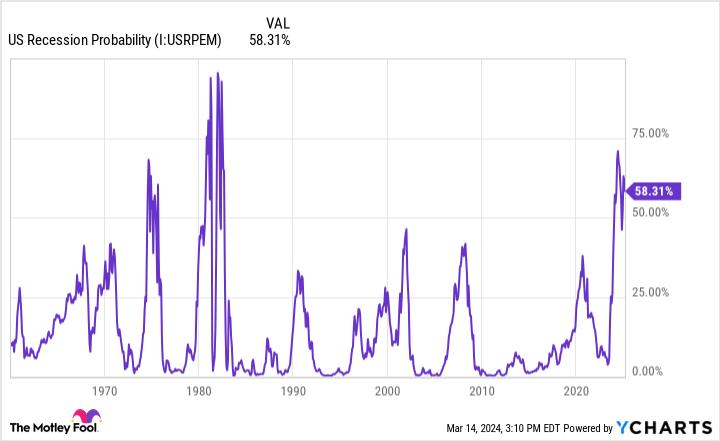

The forecasting device in query that is piquing the curiosity of Wall Avenue skeptics is the Federal Reserve Financial institution of New York’s recession likelihood indicator.

Each month for greater than six many years, the NY Fed’s recession likelihood device has analyzed the unfold (distinction in yield) between the 10-year Treasury bond and three-month Treasury invoice (T-bill) to find out how seemingly it’s {that a} U.S. recession will crop up over the approaching 12 months.

The overwhelming majority of the time, the Treasury yield curve slopes up and to the precise. In different phrases, Treasury bonds that are not set to mature for 30 years will supply greater yields than T-bills which are set to mature in, say, a month or a 12 months. Yields ought to improve the longer your cash is invested in an interest-bearing asset.

However because the 10-year/three-month yield unfold has proven over the previous 65 years, the yield curve does not all the time behave as deliberate. Sometimes, the yield curve inverts, which represents an occasion the place T-bills sport greater yields than Treasury bonds maturing a very long time from now. When the yield curve inverts, it is sometimes an indication that traders are apprehensive concerning the near-term outlook for the U.S. economic system.

Now this is the quirk: A yield-curve inversion does not assure the U.S. economic system will dip right into a recession. Nevertheless (and this is the important thing “nonetheless’), each recession for the reason that finish of World Struggle II in September 1945 has been preceded by a yield-curve inversion. It represents one thing of a warning to traders that the U.S. economic system and inventory market might be teetering on catastrophe.

As you possibly can see from the info launched in current days by the NY Fed, there is a 58.31% likelihood of a recession taking form by or earlier than February 2025. Though this is not the very best current studying from this predictive device, it stays one of many highest recession-probability forecasts over the previous 42 years.

There are two issues price mentioning from the 65 years of reported yield-curve knowledge from the NY Fed. To start out with, this predictive device can be flawed. In October 1966, the probability of a U.S. recession taking form surpassed 40% and not using a downturn within the U.S. economic system materializing. It is not an infallible forecasting device.

However, it is solely been flawed one time spanning 65 years and has an ideal monitor report over the past 58 years. Since October 1966, a recession likelihood of 32% or above has, with out fail, finally forecast a U.S. recession.

Despite the fact that the inventory market does not mirror the efficiency of the U.S. economic system, company earnings do ebb and circulation primarily based on the well being of the economic system. Traditionally, two-thirds of the S&P 500’s drawdowns have occurred after, not previous to, a recession being declared by the Nationwide Bureau of Financial Analysis. Put one other means, a recession would, certainly, be anticipated to decisively knock the Dow Jones Industrial Common, S&P 500, and Nasdaq Composite off their respective perches. Whereas a speedy crash could not happen, significant draw back can be the expectation.

Endurance has an ideal monitor report on Wall Avenue

Reality be informed, the NY Fed’s trusted recession likelihood device is only one of a few metrics that seems to spell hassle for the U.S. economic system and inventory market. Particularly, M2 cash provide is meaningfully contracting for under the fifth time since 1870, and the Convention Board Main Financial Index (LEI) is engaged on one among its longest consecutive declines courting again greater than 60 years. All indicators seem to level to a large downturn for the Dow Jones, S&P 500, and Nasdaq Composite.

Whereas this is probably not the rosiest of near-term forecasts, endurance has a means of righting the ship relating to investing on Wall Avenue.

For instance, within the 78 years since World Struggle II ended, the U.S. economic system has navigated its means by means of a dozen recessions. Solely three of those 12 downturns reached 12 months in size, and none surpassed 18 months. Based mostly on what historical past tells us, recessions are short-lived occasions.

Conversely, durations of financial progress have a tendency to stay round for a number of years. Whereas there are a couple of situations of short-lived expansions, there are two durations of progress since 1945 that lasted a minimum of a decade. Statistically talking, it is a significantly smarter transfer to wager on the American economic system (and its underlying companies) to develop over time.

It is a related story on Wall Avenue. Based on analysts at Bespoke Funding Group, there is a marked disparity between bear and bull markets within the S&P 500.

Final June, Bespoke printed a dataset that exposed the size of each bear and bull market within the S&P 500 courting again to the beginning of the Nice Melancholy in September 1929. The 27 S&P 500 bear markets have lasted a mean of simply 286 calendar days (about 9.5 months), with the longest enduring 630 calendar days in 1973 to 1974.

By comparability, the typical S&P 500 bull market has lasted for 1,011 calendar days (roughly two years and 9 months), with 13 of the 27 bull markets since September 1929 sticking round for an extended variety of calendar days than the lengthiest S&P 500 bear market.

It doesn’t matter what the U.S. economic system or Wall Avenue has thrown traders’ means, endurance has all the time paid off. Ultimately, inventory market corrections and bear markets are cleared away by bull market rallies. Even when 2024 seems to be a tough 12 months for equities, it might characterize a blessing in disguise for opportunistic long-term traders.

The place to speculate $1,000 proper now

When our analyst crew has a inventory tip, it may possibly pay to pay attention. In any case, the e-newsletter they have run for over a decade, Motley Idiot Inventory Advisor, has practically tripled the market.*

They simply revealed what they imagine are the 10 greatest shares for traders to purchase proper now…

See the ten shares

*Inventory Advisor returns as of March 11, 2024

Sean Williams has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

Is Wall Avenue on the Verge of a Crash? The Fed’s Most-Trusted Recession Indicator Weighs In. was initially printed by The Motley Idiot