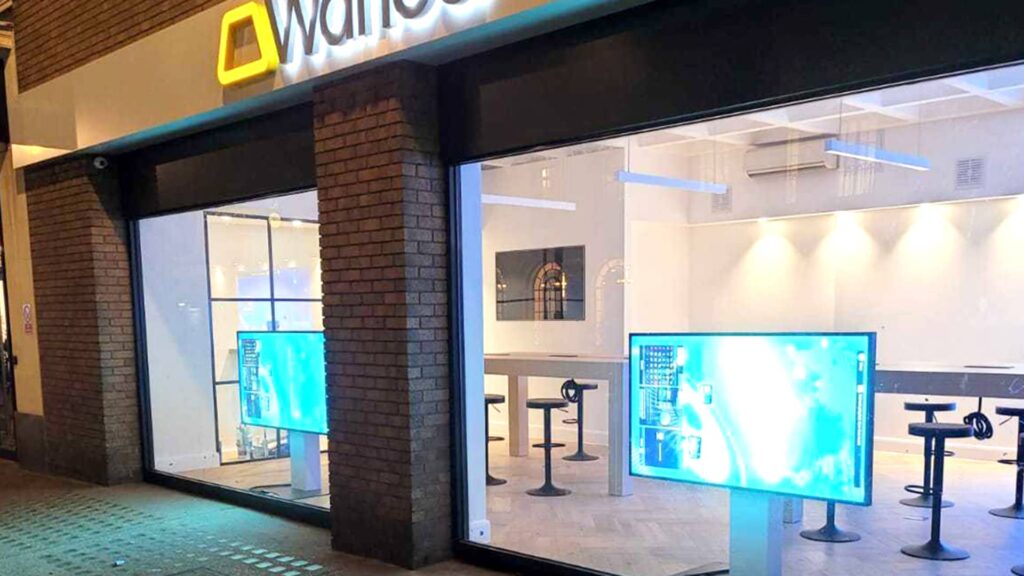

Islamic fintech startup Wahed has opened its first bodily department on Baker Road in London. The shiny retail location is designed to appear to be an Apple retailer.

Wahed

An investing platform backed by the likes of oil large Saudi Aramco and French soccer participant Paul Pogba is launching a novel proposition within the U.Ok.: a bodily department and financial institution accounts backed by gold.

New York-based Wahed, which describes itself as a “halal investing platform,” has opened a department within the U.Ok. in a bid to focus on the nation’s 3.9 million Muslims with a sharia-compliant funding administration and recommendation service.

The shiny retail location has an analogous design to an Apple retailer, with digital shows inside and a vivid signal displaying its brand exterior. It’s situated on Baker Road in central London, simply reverse a department of U.Ok. banking large HSBC.

Khabib Nurmagomedov, the Russian former skilled combined martial artist, is a promoter of the agency and can be amongst these attending the department opening Tuesday.

Wahed can also be debuting a debit card that lets customers deposit funds with an exchange-traded commodity that tracks the value of gold, which means they’ll successfully pay for on a regular basis items by way of gold.

Traders will be capable to redeem the gold of their accounts for bodily bars. Junaid Wahedna, CEO and Co-founder of Wahed, mentioned it is a approach for Muslim — in addition to non-Muslim — shoppers to beat foreign money fluctuations and the rising value of residing.

“[Muslims are] an underserved neighborhood as an entire,” Wahedna mentioned in an interview with CNBC, referring to the market alternative for digital Islamic finance. “It is a minority neighborhood, there is a lack of economic literacy.”

Banking startups equivalent to Monzo and Revolut have flourished within the U.Ok. with out bodily financial institution branches, providing smartphone apps that assist customers handle all their funds. However Wahedna cautioned that this dangers abandoning Muslim shoppers.

“In the UK, [the Muslim community is] truly one of many lowest socio-economic segments of the nation,” Wahed’s boss mentioned, with “low incomes or monetary literacy.”

“They’ve belief points,” he added. “And they also need to see a bodily presence earlier than they belief you with cash.”

Wahed’s service goals to assist purchasers adhere to the Islamic religion’s strict doctrines on monetary companies: sharia legislation forbids its followers from charging or incomes curiosity on loans, or investing in corporations that make most of their cash from the sale of issues equivalent to alcohol and playing.

Wahed prohibits investments in firms that make cash from lending, playing, alcohol and tobacco. An account with Wahed additionally would not supply curiosity on financial savings, nor does it tout wild returns on dangerous crypto tokens. As an alternative, the worth of customers’ deposits tracks the worth of gold, with the valuable steel fluctuating in worth relying on provide and demand.

“I feel it actually suits with the Muslim neighborhood and what their wants are,” Wahedna mentioned. “As a result of in any other case, what occurs is the Muslim neighborhood, as a result of they’re underserved, they hold their cash in money below their mattress, or in one thing that is very unsafe, and so they lose their cash each few years as a result of there is a rip-off locally or somebody takes benefit of them. And that poverty cycle simply continues.”

CEO slams lending-focused fintechs

Junaid slammed the state of recent fintech firms, suggesting that the trade is simply too targeted on client lending with the rise of Klarna and different hyped “purchase now, pay later” companies.

“All of their enterprise plans are constructed round lending income, proper? Even digital banks, it is like, okay, I am going to begin off being a brand new financial institution, however then ultimately, I am gonna get a banking license,” mentioned Wahedna.

Wahed is debuting a debit card linked to a gold-backed spending account. The startup is backed by French soccer star Paul Pogba.

Wahed

He mentioned Wahed is concentrated on earning money by charging wealth administration charges, which cost customers a proportion of their total asset holdings. The startup, which was based in 2017, stays lossmaking, however has hit working breakeven in Malaysia and the U.S., he added.

“I really feel that fintech, like a lot of the finance trade, could be very closely geared in the direction of lending,” Wahedna mentioned. “The truth is, I might say, it is making the price of residing disaster, a debt disaster, worse with a number of the merchandise.”

“If you happen to take a look at the purchase, now pay later firms, individuals are struggling — that is the worst sort of innovation, you make it simpler to get folks into debt,” he added.

Wahedna burdened that the corporate will not be just for Muslims and goals to serve followers of different Abrahamic faiths as nicely, together with Judaism and Christianity.

Employees at its London department will assist prospects open accounts, make investments and provides steering on wills and property planning.

The agency is focusing on high-net-worth people in addition to much less well-off shoppers, Wahedna mentioned.

Wahed has raised $75 million of complete funding to this point from traders together with Saudi Aramco Entrepreneurship Capital, the enterprise capital arm of Saudi state-backed oil agency Saudi Aramco, in addition to French footballer Paul Pogba, who’s a training Muslim.

Islamic finance has achieved important development over the previous decade and is anticipated to succeed in $4.9 trillion in worth by 2025, based on Refinitiv’s Islamic Finance Improvement Indicator. A variety of different fintech gamers are looking for to faucet into the halal cash area, together with Zoya and Niyah.