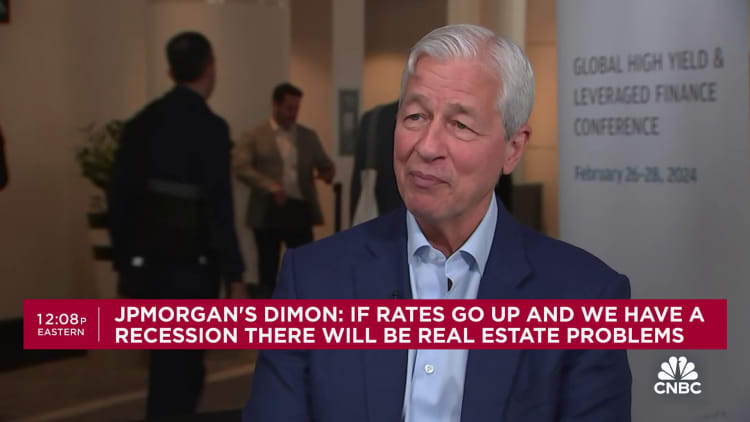

JPMorgan Chase CEO Jamie Dimon is not nervous concerning the added competitors from a bulked-up Capital One if its $35.3 billion takeover of Uncover Monetary will get accredited.

“My view is, allow them to compete,” Dimon stated. “Allow them to attempt, and if we predict it is unfair, we’ll complain about that.”

Dimon, chatting with CNBC’s Leslie Picker at a Miami convention, acknowledged that if regulators approve the Capital One-Uncover deal, his financial institution shall be eclipsed because the nation’s greatest bank card lender.

However that did not cease him from praising Capital One CEO Richard Fairbank, who he credited with shaking up the cardboard business in a approach that finally led Dimon to changing into CEO of a predecessor agency to JPMorgan greater than 20 years in the past.

“Richard is why I am right here,” Dimon stated.

Concerning the transaction, he added, “I am not nervous about it actually, however we do monitor every little thing he does.”

Final week, Capital One introduced the largest proposed merger of the yr, one that would remodel the trillion-dollar bank card business. By buying Uncover, Fairbank is each bulking up as a lender and boosting the smallest of the funds networks after Visa, Mastercard and American Specific.

“The bank card enterprise … they’re going to be greater and [have] extra scale,” Dimon stated. “They’re superb at it. I’ve monumental respect for Richard Fairbank and Capital One.”

It is unclear if Capital One can create a real various to the dominant card networks with this deal, Dimon stated.

He added that Capital One can have an “unfair benefit versus us” in debit funds, owing to the truth that laws generally known as the Durbin Modification caps debit charges for giant banks, however not Uncover or American Specific.

“After all, I’ve an issue with that,” Dimon stated. “, like why ought to they be allowed to cost debit totally different than we worth debit simply due to a legislation that was handed?”

Extra broadly, Dimon stated he additionally favored permitting small banks to merge. A wave of business consolidation has been anticipated after the tumult of final yr’s regional banking disaster, however solely a trickle of smaller offers have occurred as far as executives are uncertain if they will go regulatory muster.

The largest query remaining concerning the Capital One deal is whether or not regulators will approve it. Greater than a dozen Democrat lawmakers together with Sen. Elizabeth Warren, D-Mass., signed a letter to the Federal Reserve and the Workplace of the Comptroller of the Foreign money on Sunday urging them to dam the settlement.

“To guard customers and monetary stability, we urge you to dam this merger and strengthen your proposed coverage assertion to forestall dangerous offers sooner or later,” they wrote.

Do not miss these tales from CNBC PRO: