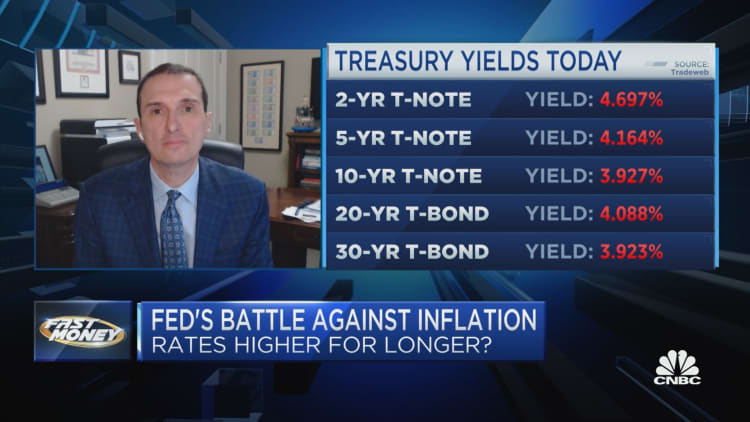

Conventional financial savings accounts are going up in opposition to shares.

And, the winner could also be your neighborhood financial institution for the primary time in years, in response to Wall Road forecaster Jim Bianco.

He contends rising rates of interest are giving buyers safer methods to generate revenue.

“Money is not trash. That was a two-decade outdated meme that does not apply,” the Bianco Analysis president instructed CNBC’s “Quick Cash” on Wednesday. “Money may really be considerably of an alternate the place it was only a waste of time all through the 2010s. It is not that anymore.”

He makes use of the 6-month Treasury Word, which is yielding above 5% proper now, for instance. Bianco believes it would quickly rise to six%.

‘Suck cash away from the inventory market’

“You’re going to get two-thirds of the long-term appreciation of the inventory market with no threat in any respect,” added Bianco. “That’s going to supply heavy competitors for the inventory market. That might suck cash away from the inventory market.”

His newest feedback observe the Fed minutes launch from the final assembly. The Fed indicated “ongoing” fee hikes are essential to curtail inflation.

The Dow and S&P 500 closed decrease following the minutes whereas the tech-heavy Nasdaq eked out a small achieve. The S&P 500 is now on a four-day shedding streak, and the Dow is adverse for the yr.

“Buyers are going to have to begin occupied with the concept that we’ve got a 5% or 6% world,” famous Bianco.

He believes inflation is unlikely to meaningfully budge within the coming months.

“Lots of people are beginning to suppose… the Fed simply will not be going to go one further fee hike, however they’ll go many further fee hikes,” Bianco mentioned. “That is why I believe you are beginning to see the inventory market get up to it.”

Disclaimer