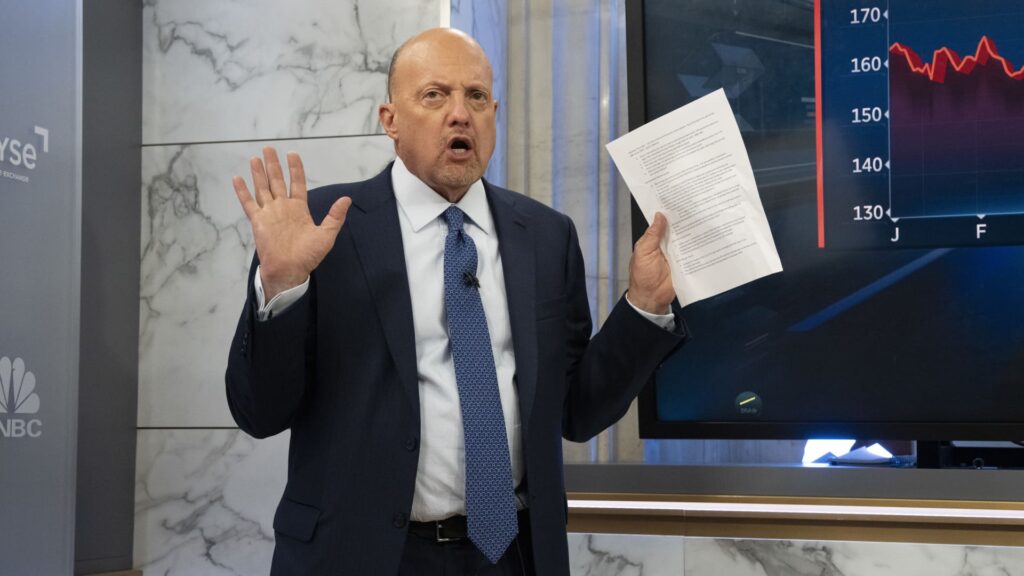

Each weekday the CNBC Investing Membership with Jim Cramer holds a “Morning Assembly” livestream at 10:20 a.m. ET. This is a recap of Friday’s key moments. Look to trim in an overbought market Do not promote Wells Fargo Maintain onto Estee Lauder 1. Look to trim in an overbought market Shares had been largely down Friday, pressured by a decline in financials after a number of main banks reported fourth-quarter outcomes. The S & P 500 fell 0.42% in midmorning buying and selling. It is probably that the overbought nature of the market – our trusted S & P 500 Quick Vary Oscillator is at 9.46% – is contributing to the loses. Regardless of the Oscillator’s excessive studying, we have now to date held off on making any gross sales because of the sheer breadth of shares which have gained previously week. Nevertheless, that does not imply we have now dominated out promoting solely, and we’re looking out for gentle trimming alternatives. 2. Do not promote Wells Fargo Shares of Wells Fargo (WFC) had been down 0.63% on midmorning buying and selling Friday after the financial institution reported lowering income in its newest quarter, damage by bills from a $3.7 billion settlement and an effort to construct up its reserves. Nevertheless, we urge traders to not promote their shares of WFC, given the basics of its enterprise are robust. The corporate forecasted about $50.2 billion in bills for 2023, decrease than the roughly $51.58 billion analysts predicted. And with the financial institution showing to be making headway on its expensive regulatory troubles, the bills that weighed down its steadiness sheet will probably be a factor of the previous sooner fairly than later. 3. Maintain onto Estee Lauder JPMorgan Chase on Friday raised its worth goal for Estee Lauder (EL) to $285 from $274, citing potential upside from abating overseas trade headwinds. We proceed to love this inventory, particularly as China — a vital marketplace for the cosmetics big — reopens its economic system and welcomes again vacationers . We count on EL shares to climb increased, and haven’t any plans to promote extra shares proper now. (Jim Cramer’s Charitable Belief is lengthy EL, WFC. See right here for a full listing of the shares.) As a subscriber to the CNBC Investing Membership with Jim Cramer, you’ll obtain a commerce alert earlier than Jim makes a commerce. Jim waits 45 minutes after sending a commerce alert earlier than shopping for or promoting a inventory in his charitable belief’s portfolio. If Jim has talked a few inventory on CNBC TV, he waits 72 hours after issuing the commerce alert earlier than executing the commerce. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

2 Comments

Hello jhb.news Owner, exact same in this article: Link Text

Hello jhb.news Owner, identical right here: Link Text