NEW YORK, April 21 (Reuters) – JPMorgan Chase & Co (JPM.N) bankers continued to have conferences with the intercourse offender Jeffrey Epstein even after the financial institution determined to shut his accounts in 2013, the Wall Avenue Journal reported on Friday, citing folks conversant in the matter.

The banker Justin Nelson had a few half-dozen conferences at Epstein’s townhouse between 2014 and 2017, the newspaper stated.

Financial institution staff additionally met with Epstein after his accounts had been closed to debate different shoppers and introductions he might make to potential shoppers, the newspaper stated, citing folks conversant in the conferences.

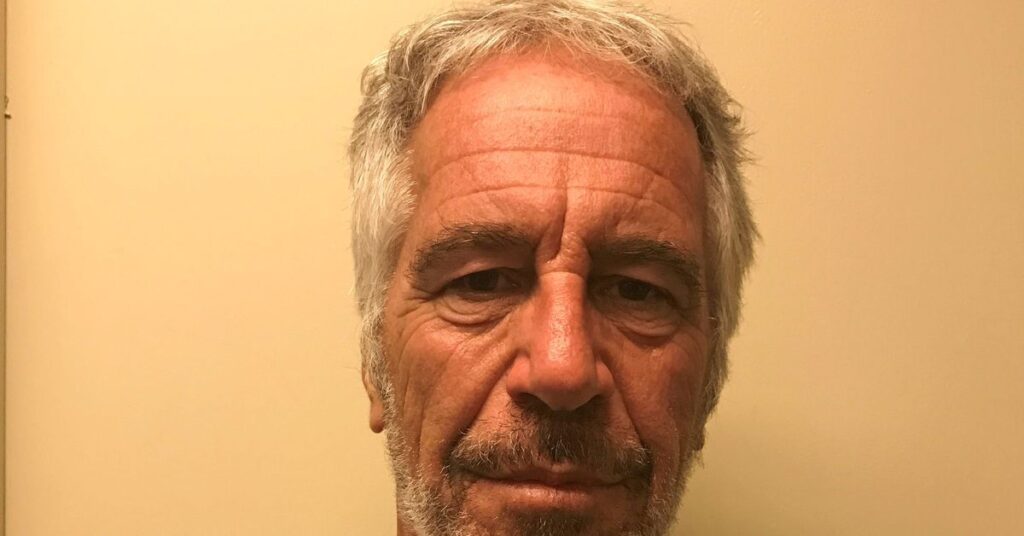

Epstein, a well-connected cash supervisor dogged for years by allegations that he sexually abused women and younger girls, killed himself in a Manhattan jail cell in August 2019 whereas awaiting trial on intercourse trafficking costs.

Whereas nonetheless a shopper of JPMorgan, Epstein met in 2011 and 2013 with Mary Erdoes, who’s now CEO of the financial institution’s asset and wealth administration unit, and in 2013 with John Duffy, who ran JPMorgan’s U.S. non-public financial institution, the newspaper stated.

JPMorgan has denied information of Epstein’s crimes and is suing former govt Jes Staley for deceptive it about Epstein’s conduct.

The interplay with Epstein was typical for a shopper of the non-public financial institution, a JPMorgan spokesman stated after the article was printed.

Erdoes’ first assembly with Epstein concerned settling a lawsuit he had filed towards Bear Stearns, and any of the financial institution’s conferences with Epstein after 2013 had been requested by shoppers who used Epstein as an adviser, the spokesman stated. JPMorgan purchased Bear throughout the 2008 monetary disaster.

Nelson declined to remark through the spokesman. Duffy and Staley’s attorneys didn’t reply instantly to separate requests for remark.

JPMorgan is being sued in Manhattan federal court docket by girls who stated Epstein sexually abused them, and by the federal government of the U.S. Virgin Islands, the place Epstein owned a non-public island.

JPMorgan did enterprise with Epstein as early as 1998, and managed about 55 Epstein-related accounts value a whole lot of thousands and thousands of {dollars}.

Based on court docket papers, compliance employees and executives on a number of events flagged the dangers of retaining Epstein as a shopper, together with his alleged use of money to pay for ladies and younger girls to go to his houses.

Epstein was a shopper for about 5 years after he pleaded responsible in 2008 to a Florida state prostitution cost.

Reporting by Tatiana Bautzer in New York; Modifying by Lananh Nguyen and Rosalba O’Brien

: .