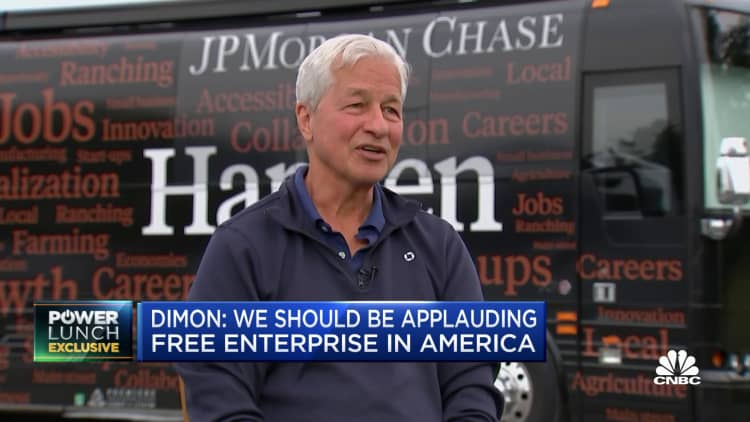

The Fitch Rankings downgrade of the USA’ long-term credit standing in the end does not matter, JPMorgan Chase CEO Jamie Dimon instructed CNBC on Wednesday.

“It does not actually matter that a lot” as a result of it is the market, not score businesses, that determines borrowing prices, Dimon instructed CNBC’s Leslie Picker.

Nonetheless, it is “ridiculous” that different nations have increased credit score rankings than the U.S. once they rely upon the soundness created by the U.S. and its army, Dimon added.

“To have them be triple-A and never America is sort of ridiculous,” Dimon mentioned. “It is nonetheless essentially the most affluent nation on the planet, it is essentially the most safe nation on the planet.”

Fitch downgraded the nation’s score to AA+ from AAA on Tuesday, pointing to “anticipated fiscal deterioration over the following three years,” an erosion of governance and a rising common debt burden.

The company put the U.S. score on watch in Could after members of Congress butted heads over elevating the debt ceiling and introduced the nation to near-default.

“We must always eliminate the debt ceiling,” Dimon mentioned. “It is utilized by each events” in ways in which sow uncertainty for markets, he mentioned.

Fed, A.I. and Ukraine

Within the wide-ranging interview, Dimon touched on subjects together with synthetic intelligence, the U.S. financial system, financial institution regulation and geopolitics.

He known as synthetic intelligence expertise similar to ChatGPT “a recreation changer” that may seemingly assist future generations reside longer, higher lives.

“It must be carried out proper,” Dimon added. “I do fear about it as a result of unhealthy guys are going to make use of it too.”

The U.S. financial system, he mentioned, is being supported by client and enterprise energy, low unemployment and wholesome steadiness sheets.

“It is fairly good, even when we go into recession,” Dimon mentioned. “The storm cloud half remains to be there,” he added, referring to a warning he gave final yr on the financial system.

What worries Dimon most are the geopolitical dangers created by the Ukraine battle and the Federal Reserve’s effort to rein in its steadiness sheet often called quantitative tightening, he mentioned.

Client impression

Dimon lambasted regulators’ efforts to tighten requirements on U.S. banks, saying the proposals unveiled final week have been “vastly disappointing.” At one level, he held up a chart exhibiting the net of regulators that banks cope with.

Banks will probably be compelled to carry extra capital as a cushion in opposition to quite a lot of dangers, which can have an effect on customers, as a result of the business will cede extra merchandise to nonbank gamers, Dimon warned. That is what occurred within the U.S. mortgage market, which is dominated by companies together with Rocket Mortgage.

A part of the adjustments contain banks ditching inner threat fashions for extra standardized variations from the Federal Reserve.

“If I used to be the Fed, I would watch out about saying their fashions are excellent,” Dimon mentioned. “Keep in mind, their fashions did not present inflation and did not present 5% rates of interest.”