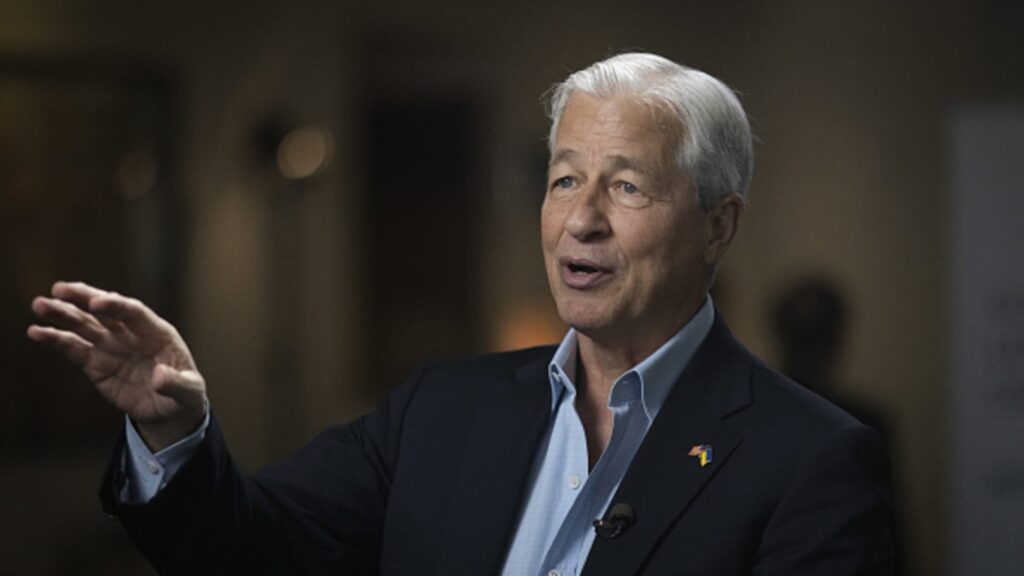

Jamie Dimon, chairman and chief govt officer of JPMorgan Chase & Co., throughout a Bloomberg Tv interview on the JPMorgan International Excessive Yield and Leveraged Finance Convention in Miami, Florida, US, on Monday, March 6, 2023.

Marco Bello | Bloomberg | Getty Pictures

JPMorgan Chase is scheduled to report first-quarter earnings earlier than the opening bell Friday.

This is what Wall Avenue expects:

- Earnings: $3.41 per share, 29.7% larger than a yr earlier, based on Refinitiv.

- Income: $36.24 billion, 14.7% larger than a yr earlier.

- Deposits: $2.31 trillion, based on StreetAccount.

- Provision for credit score losses: $2.27 billion.

- Buying and selling Income: Mounted earnings $5.29 billion, Equities $2.86 billion.

JPMorgan, the most important U.S. financial institution by belongings, shall be watched carefully for clues on how the trade fared after the collapse of two regional lenders final month.

Analysts count on a blended bag of conflicting traits. As an example, JPMorgan possible benefited from an inflow of deposits after Silicon Valley Financial institution and Signature Financial institution skilled deadly financial institution runs.

However the trade has been compelled to pay up for deposits as prospects shift holdings into higher-yielding devices like cash market funds. That may most likely curb banks’ positive aspects from rising rates of interest amid the Federal Reserve’s efforts to tame inflation.

The circulation of deposits by American monetary establishments is the highest concern of analysts and buyers this quarter. That is as a result of smaller banks confronted stress final month as prospects sought the perceived security of megabanks together with JPMorgan and Financial institution of America. However the greater image could also be that deposits are leaving the regulated banking system total as prospects notice they’ll earn larger yields exterior checking and saving accounts.

One other key query shall be whether or not JPMorgan and others are tightening lending requirements forward of an anticipated U.S. recession, which may constrict financial development this yr by making it tougher for shoppers and companies to borrow cash.

Banks have begun setting apart extra mortgage loss provisions on expectations for a slowing economic system later this yr, and that might weigh on outcomes. JPMorgan is predicted to publish a $2.27 billion provision for credit score losses, based on the StreetAccount estimate.

Wall Avenue might present little assist this quarter, with funding banking charges prone to stay subdued due to the still-shut IPO market. CFO Jeremy Barnum stated in February that funding banking income was headed for a 20% decline from a yr earlier, and that buying and selling was trending “a little bit bit worse” as nicely.

Lastly, analysts will need to hear what JPMorgan CEO Jamie Dimon has to say in regards to the economic system and his expectations for the way the regional banking disaster will develop. JPMorgan has performed a central function in propping up a shopper financial institution, First Republic, which teetered final month, partially by main efforts to inject it with $30 billion in deposits.

Shares of JPMorgan are down about 4% this yr, outperforming the 31% decline of the KBW Financial institution Index.

Wells Fargo and Citigroup are scheduled to launch outcomes later Friday, whereas Goldman Sachs and Financial institution of America report Tuesday and Morgan Stanley discloses outcomes Wednesday.

This story is growing. Please verify again for updates.