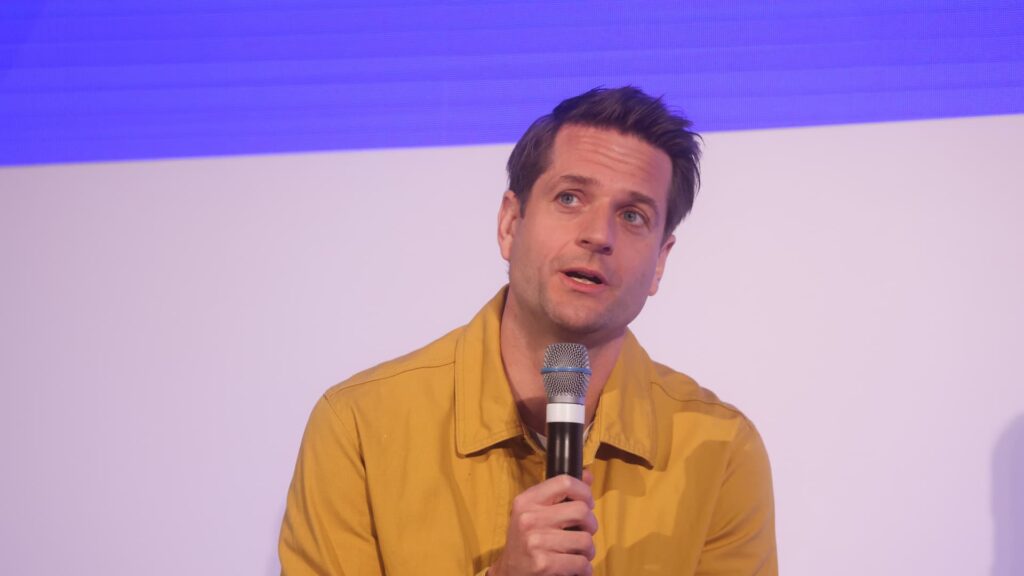

Sebastian Siemiatkowski, CEO of Klarna, talking at a fintech occasion in London on Monday, April 4, 2022.

Chris Ratcliffe | Bloomberg through Getty Photographs

Klarna noticed its losses leap within the first quarter as the favored purchase now, pay later agency applies the brakes on a hotly anticipated U.S. preliminary public providing.

The Swedish funds startup mentioned its internet loss for the primary three months of 2025 totaled $99 million — considerably worse than the $47 million loss it reported a 12 months in the past. Klarna mentioned this was resulting from a number of one-off prices associated to depreciation, share-based funds and restructuring.

Revenues on the agency elevated 13% year-over-year to $701 million. Klarna mentioned it now has 100 million lively customers and 724,00 service provider companions globally.

It comes as Klarna stays in pause mode relating to a extremely anticipated U.S. IPO that was at one stage set to worth the SoftBank-backed firm at over $15 billion.

Klarna put its IPO plans on maintain final month resulting from market turbulence attributable to President Donald Trump’s sweeping tariff plans. On-line ticketing platform StubHub additionally put its IPO plans on ice.

Previous to the IPO delay, Klarna had been on a advertising and marketing blitz touting itself as a man-made intelligence-powered fintech. The corporate partnered up with ChatGPT maker OpenAI in 2023. A 12 months later, Klarna used OpenAI know-how to create an AI customer support assistant.

Final week, Klarna CEO Sebastian Siemiatkowski mentioned the corporate was in a position to shrink its headcount by about 40%, partly resulting from investments in AI.