Elon Musk touched upon many themes on Tesla’s latest earnings name, one among which was the shortage of lithium refining choices. Given lithium is a vital part in EV batteries, there’s an unmet want for refined lithium within the EV trade.

In the course of the name, Musk stated: “Can different individuals please do that work? That might be nice. We’re begging you. We don’t wish to do it. Can somebody please? As an alternative of constructing a picture-sharing app, strive lithium mining and refining, heavy trade, come on.”

In brief, Musk was attempting to attract consideration to the chance at play for lithium producers.

Protecting this trade for Deutsche Financial institution, analyst Corinne Blanchard agrees and has an concept about which corporations may additionally symbolize a possibility for traders.

“Our basic view of Lithium has not modified within the medium to long-term, as we consider Provide will stay in need of Demand. We anticipate market tightness over the approaching years, adopted by a rising deficit thereafter,” Blanchard wrote. “Now we have a choice for essentially the most established Lithium producers, as we consider they will supply higher execution with a decrease threat profile, and they’re nicely positioned for rising volumes in key jurisdictions.”

Towards this backdrop, we’ve opened the TipRanks database and pulled up the small print on two of Blanchard’s suggestions. Each are Purchase-rated shares, with double-digit upside potential for the approaching 12 months. Let’s take a more in-depth look.

Lithium Americas (LAC)

We’ll begin with Lithium Americas, a lithium mining and refining firm with huge progress potential forward. Whereas nonetheless a pre-revenue concern, LAC totally owns the Thacker Go Mine, which is located in northern Nevada, and is its crowning asset provided that it boasts the best lithium reserves within the US. That makes the mine a useful useful resource for the nation’s creating EV trade, which wants first-rate Li-ion batteries. Moreover, LAC additionally holds full possession and three way partnership offers for prime purity lithium mines in Argentina.

Though Thacker Go is an thrilling venture, manufacturing remains to be some time away and slated for 2026. The corporate introduced the beginning of development actions in early March.

Nonetheless, on the latest This fall earnings name, the corporate introduced that development on the Argentine Cauchari-Olaroz mine was “considerably full,” with manufacturing anticipated to kick off earlier than the conclusion of the primary half of 2023. To attain manufacturing and constructive money circulate, the corporate stated it requires lower than $50 million in additional capital prices. LAC anticipates reaching the total manufacturing fee of 40,000 tpa (tonnes every year) of lithium carbonate by the primary quarter of subsequent 12 months.

Assessing the corporate’s prospects, it’s the long-term potential of the Thacker Go Mine that’s core to Blanchard’s constructive thesis.

“We stay Purchase rated on LAC,” stated the Deutsche Financial institution analyst, “given its asset portfolio and strategic geographic publicity to Argentina and the US… We’re constructive on administration’s skill to develop the Thacker Go, though we acknowledge the inherent challenges to the asset being a clay-based deposit. That being stated, Thacker Go is a ~80ktpa hydroxide venture, within the US, which ought to be extremely useful to the US home Lithium market.”

That Purchase score is supported by a $26 value goal, and will or not it’s met, will symbolize one-year share appreciation of 36%. (To view Blanchard’s monitor report, click on right here)

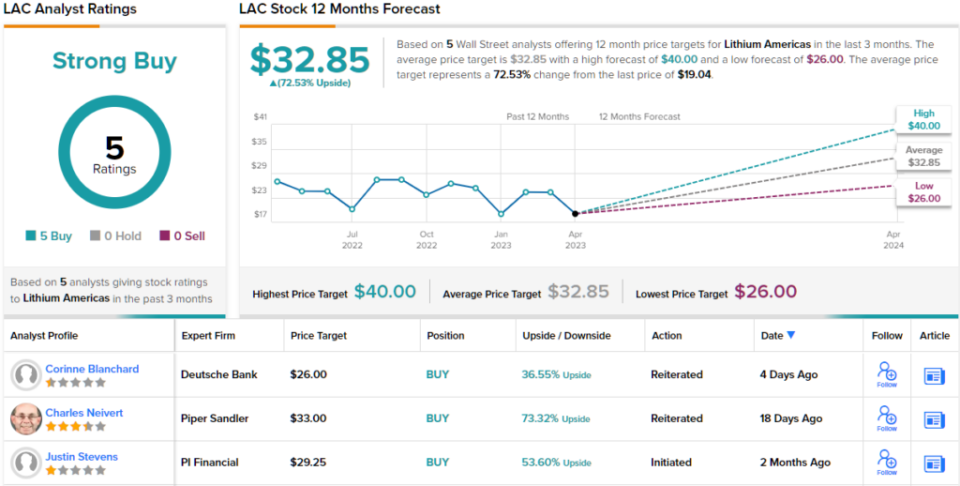

Blanchard isn’t alone in her constructive take for this potential lithium producer. LAC has garnered 5 analyst evaluations over the previous 3 months, and all are constructive, naturally making the consensus view right here a Robust Purchase. Within the 12 months forward, the analysts see the inventory surging 73.5%, contemplating the typical goal stands at $32.85. (See LAC inventory forecast)

Sociedad Quimica Y Minera de Chile (SQM)

We’ll now shift to Chile, a rustic in possession of the world’s largest lithium reserves and the second-biggest producer on earth. As such, Sociedad Quimica Y Minera de Chile is likely one of the world’s largest producers of lithium, iodine, and potassium nitrate. The corporate produces lithium hydroxide and lithium carbonate from brine in Chile’s vastest salt flat, the Salar de Atacama.

The constructive value surroundings seen throughout 2022 helped the corporate ship sturdy ends in its most lately reported quarter – for 4Q22. Income climbed by 189.8% from the identical interval a 12 months in the past to $3.13 billion, whereas beating the consensus estimate by $110 million. Gross revenue hit $1.64 billion, means above the $542.8 million generated in 4Q21. That helped the corporate ship EPADR (Earnings per American Depositary Receipt) of $4.03, an enormous improve on the $1.13 delivered within the 12 months in the past quarter and nicely forward of the $3.77 forecast.

Nonetheless, extra lately, on final Friday, the shares took an enormous beating, crashing by 18.5% after Chilean President Gabriel Boric unveiled plans to nationalize the nation’s lithium trade and set up a state-owned firm that shall be concerned in lithium exploration.

Earlier than their contracts run out, the state-controlled Codelco is anticipated to barter an settlement with SQM (and peer Albemarle) to buy an curiosity of their operations.

With SQM’s contract to extract lithium in Chile’s Atacama salt flat coming to an finish in 2030, Deutsche Financial institution’s Blanchard notes that regardless of believing there received’t be any main adjustments to present contracts, given the continuing renewal course of, SQM may very well be affected.

Nonetheless, whether or not the Chilean authorities’s plan truly takes place stays to be seen, and within the meantime, Blanchard highlights SQM’s worth proposition and alternative for traders.

“As we’re more and more constructive on the basics of the market within the medium-term, we worth SQM’s upcoming quantity growth, with a spotlight in Chile on current operations, but in addition the upcoming 20kt of hydroxide capability in China and Mt Holland in Australia,” the analyst wrote. “We like SQM’s shareholder returns with a ~12% dividend yield anticipated this 12 months, based mostly on our numbers.”

All advised, regardless of the Chilean authorities’s actions, there’s no change to Blanchard’s Purchase score on SQM or to the worth goal, which stays at $90 and is ready to generate returns of ~42% over the approaching months

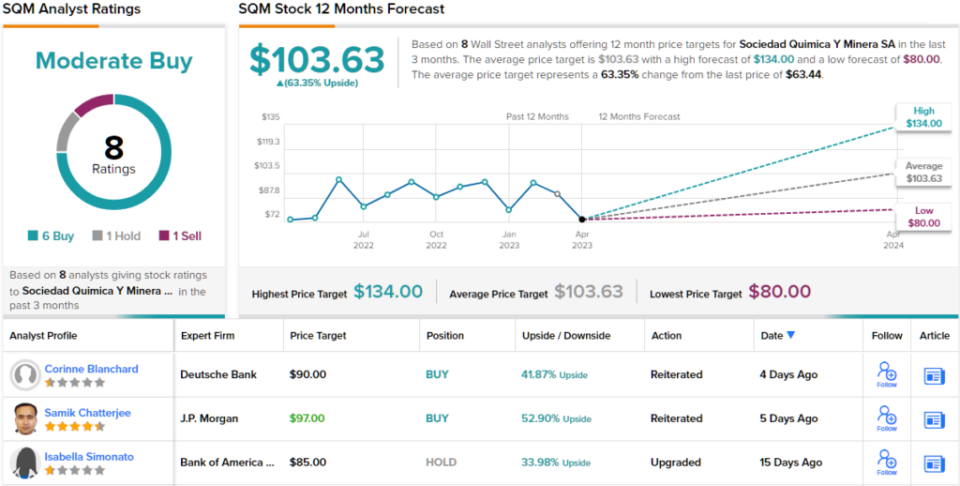

Trying on the consensus breakdown, with a complete of 6 Buys vs. 1 Maintain and Promote, every, the analyst consensus charges this inventory a Reasonable Purchase. At $103.63, the typical goal is extra bullish than Blanchard permits and will see traders pocket positive factors of 63% a 12 months from now. (See SQM inventory forecast)

To search out good concepts for lithium shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your individual evaluation earlier than making any funding.