Not everybody can be completely happy when the Federal Reserve begins reducing rates of interest after it declares victory over inflation.

Bear in mind, there’s a massive however low-profile flock of parents with cash who wish to revenue in a really old school means – financial savings accounts.

For nearly two years, these buyers loved the best charges on these zero-risk bets for the reason that flip of the century. However now it appears the “bull market” for no-brainer financial savings could also be coming to an finish.

So for followers of those less-than-sexy investments, it could be time to get busy locking in some longer-term offers with certificates of deposit. And I want I may finish this column proper right here and inform you to easily go to your neighborhood banking establishment and cargo up on enticing CD charges.

However sadly, discovering first rate offers isn’t quite simple. So let me stroll you thru the CD maze.

First a historical past lesson

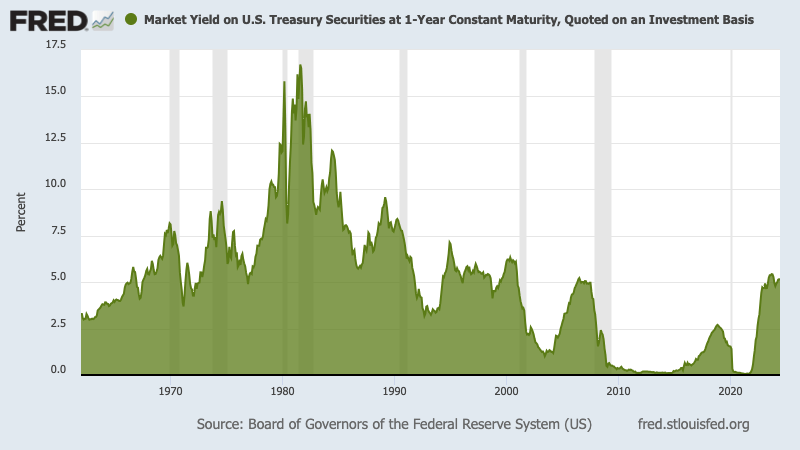

Earlier than the Fed’s battle on inflation started in 2022 with rising charges, the post-Nice Recession period was painful for savers. Yields crumbled to close zilch because the Fed used low-cost cash to ease the monetary woes. Then they repeated the tactic to assuage the pandemic’s enterprise challenges.

Take into consideration charges on 1-year Treasury payments – a benchmark for typical financial savings charges. Within the final 38 years of the twentieth century, 1-year yields averaged virtually 7%. However they paid barely 1% on common for the reason that world monetary disaster erupted in 2008 – till 2023.

So final yr’s 5% charges – the best 1-year yields since 2000 – made savers euphoric.

What’s your stash?

First, determine how a lot cash you possibly can put away for a yr or extra. This sum may be break up into buckets by years, and you may match any financial savings must the maturity size of the CD.

Please be real looking together with your liquidity wants. Most banks and credit score unions – however not all – cost important charges if it’s a must to exit your CD early.

The place to look

In the event you contact your financial institution or credit score union, it’s unlikely they’ve essentially the most thrilling charges.

Get on-line. A easy search will give you quite a few lists detailing “finest” CD charges. Sadly, you’ll should wade by means of a half-dozen private finance web sites to discover a CD or two that stands above the pack.

Remember that many CD rankings promote associate establishments. So highlighted charges will not be the most effective accessible. Nonetheless, establishments paying for this type of advertising and marketing typically supply first rate offers.

On-line pleasant?

You’ll enhance your odds for a worthy price in case you are keen to financial institution remotely.

Nonetheless, my fast survey of current high-rate CDs discovered a number of choices from establishments with California branches for anybody who nonetheless must do face-to-face enterprise.

One other geography issue is that sure must-have charges include geographic or different limits.

There are banks that solely do enterprise in sure states. And plenty of credit score unions have odd membership necessities, the place you reside being one in all them.

The caveats

There are also some too-good-to-be-true gives.

First, ensure you’re getting a certificates of deposit from a federally insured establishment. Some “finest price” checklist are sprinkled with annuities – an insurance coverage firm product that appears and feels so much like a CD.

Additionally, make sure that a beautiful account has a hard and fast price. Some establishments promote variable-rate CDs with yields that may definitely change as charges go down as forecast within the coming years.

Don’t neglect to examine what measurement deposit qualifies for a excessive price.

Some offers include high-balance necessities. And consider it or not, some “wow!” charges are good just for modest quantities. Financial savings above the maximums typically receives a commission mere pennies.

However there’s a however …

Permit me to notice two twists on CDs value contemplating — in case your head isn’t already spinning from all the small print required to get what’s supposedly a boring funding.

No-penalty CDs: Fastened charges for an prolonged time period with two catches: Savers can withdraw cash from the account early with out penalty, however charges run barely beneath related choices that include early withdrawal penalties.

Nonetheless, they supply consolation to the saver who’s anxious about tying up cash for an prolonged interval.

Brokered CDs: These are purchased on monetary markets – similar to shares and bonds. Curiously, a number of the large banks that provide subsequent to nothing on their department CDs can be very aggressive within the dealer CD world.

The “however” is that these may be complicated to accumulate.

For the do-it-yourself investor, on-line brokerage accounts don’t make it straightforward to search out or purchase these CDs.

And in the event you go to a monetary adviser together with your stash of money, you’ll possible get a pitch about different investments – most containing some degree of danger – that you could be not need to hearken to.

Backside line

Locking in two to 5 years of near-5% yields doesn’t make for “monetary genius” bragging rights.

However CDs are nice for incomes more money in your spare money – or people who must know financial gyrations or political hijinx received’t dent their nest egg.

And right this moment’s CD charges appear like a cut price that may evaporate quickly.

Jonathan Lansner is the enterprise columnist for the Southern California Information Group. He may be reached at jlansner@scng.com

Initially Printed: