Regardless of the mushy financial backdrop, 2022 has nonetheless offered a number of large-scale takeovers. Microsoft’s acquisition of Activision Blizzard ($68.7 billion – anticipated to shut subsequent 12 months), Broadcom’s of VMWare (~$61 billion – by the tip of subsequent 12 months, too) and Oracle’s of Cerner ($28.3 billion), are all notable offers that readily come to thoughts.

For corporations, numerous the time, bigger is preferable; smaller companies can reap the benefits of cost-savings that bigger organizations have, whereas larger entities get entry to further expertise that permits them to advertise revolutionary concepts and facilitates additional progress. It’s a win-win state of affairs, as long as the acquirer and goal are the best match.

So, with 2023 hovering into view, which corporations could possibly be the following takeover targets? Wall Avenue’s analysts have pinpointed two names that might probably be subsequent in line for some acquisitive motion. We’ve opened the TipRanks database to get a fuller image of those corporations’ prospects. Let’s see what makes these names red-hot takeover candidates proper now.

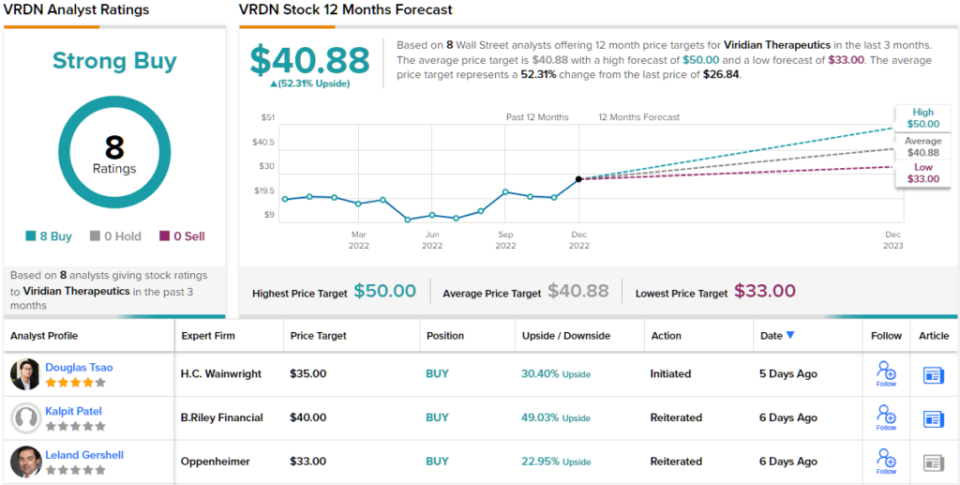

Viridian Therapeutics (VRDN)

We’ll begin with Viridian Therapeutics, a biotech firm creating therapies for sufferers affected by TED (thyroid eye illness). The corporate has three applications in varied phases of growth, essentially the most superior of those is for VRDN-001, an anti-insulin-like progress factor-1 receptor (IGF-1R) monoclonal antibody.

Halfway by means of final month, the corporate introduced constructive top-line scientific knowledge from the primary two cohorts within the ongoing Section 1/2 scientific research of VRDN-001, which confirmed most sufferers exhibited important enhancements in proptosis and scientific exercise rating, and full decision of diplopia following simply two infusions of VRDN-001. The preliminary knowledge additionally implies a lengthened period of profit. Outcomes from the third cohort ought to see the sunshine of day in early January 2023.

The corporate has additionally initiated a worldwide Section 3 research (THRIVE) of VRDN-001, with the primary affected person anticipated to be enrolled in December, and a knowledge readout anticipated by mid-2024.

So, the place does the takeover chat come from? Effectively, there appears to be a lot of curiosity not too long ago in Horizon Therapeutics, an organization whose which lead product Tepezza is already accredited for thyroid eye illness (TED) and is on track to clock gross sales of ~$2 billion in 2022.

Whereas like Tepezza, VRDN-001 is run intravenously, Oppenheimer analyst Leland Gershell believes the drug has proven potential for “extra speedy scientific enchancment, shorter infusions, and an accelerated remedy course.”

Gershell additionally believes the curiosity proven in Horizon “indicators the attractiveness of (and trade conviction in) the TED market’s progress prospects, and should carry VRDN nearer to a possible takeout—whether or not by one of many suitors in discussions with HZNP (AMGN, SNY) or one other firm.”

What’s extra, provides the analyst, VRDN shares nonetheless commerce at a “small fraction of HZNP’s valuation.”

All instructed, then, Gershell charges VRDN shares an Outperform (i.e. Purchase), whereas his $33 worth goal makes room for one-year progress of 23%. (To look at Gershell’s observe report, click on right here)

Viridian will get the Avenue’s full backing; the inventory has garnered Buys solely – 8, in whole, which all coalesce to a Sturdy Purchase consensus score. The typical goal is extra bullish than Gershell will permit; at $40.88, the determine suggests shares will climb ~52% larger within the 12 months forward. (See VRDN inventory forecast on TipRanks)

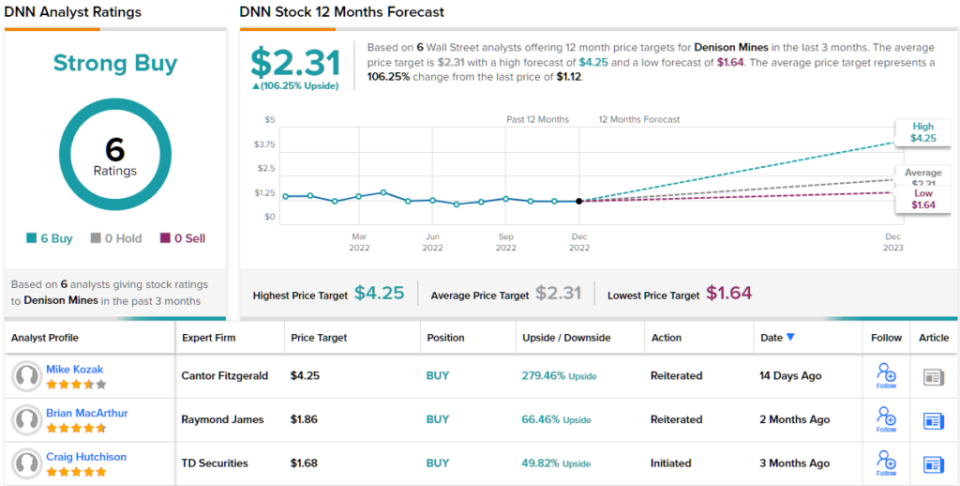

Denison Mines (DNN)

The subsequent M&A candidate we’ll take a look at is Denison Mines, a uranium exploration and growth firm. Its pursuits primarily lie within the Athabasca Basin area within the Canadian Prairie province of northern Saskatchewan.

Along with proudly owning a post-closure mine upkeep enterprise and a share within the McClean Lake Uranium Mill, one of many largest uranium processing services on the planet, the corporate additionally has a large assortment of properties, of which the bulk are nonetheless within the early phases of exploration.

Nevertheless, a lot of the firm’s value is primarily derived from simply two property. One is from the few million kilos of U3O8 Denison bought for considerably much less cash than what spot uranium is at present going for. The second is its Wheeler River Undertaking, which Denison is actively creating and the place it intends to use in situ restoration (“ISR”) methods to extract very inexpensive uranium.

The Wheeler River Uranium Undertaking, the biggest undeveloped uranium undertaking within the jap, extremely developed Athabasca Basin area of northern Saskatchewan, is owned by Denison with an efficient 95% stake. It’s this undertaking which Cantor analyst Mike Kozak imagine makes Denison a gorgeous takeover proposition, although that’s not the one purpose to get behind the corporate.

“Given the Tier One standing of the Wheeler River undertaking, its high spot on the checklist of potential takeover candidates within the uranium sector, and the Firm’s stability sheet which is totally cashed-up by means of to development, Denison must be a core holding for any/all institutional buyers with a uranium focus, power allocation, or Environmental, Social, and Governance (ESG) standards,” Kozak defined. “The Firm stays our most popular uranium developer.”

Kozak just isn’t messing about in his suggestion; together with a Purchase score, his Avenue-high worth goal of $4.25 suggests DNN shares are at present undervalued to the tune of 279%. (To look at Kozak’s observe report, click on right here)

Some shares make a roundly constructive impression on Wall Avenue’s analysts, and Denison is a type of. This uranium inventory has a unanimous Sturdy Purchase consensus score, based mostly on 6 latest constructive critiques. The shares are priced at $1.12 and the common worth goal of $2.31 provides the shares ~106% upside potential for the following 12 months. (See DNN inventory forecast on TipRanks)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is vitally essential to do your individual evaluation earlier than making any funding.