Dow Jones futures fell barely in prolonged buying and selling, together with S&P 500 futures and Nasdaq futures. Lululemon, Costco and Broadcom reported earnings after the shut.

X

The inventory market rally rebounded modestly on Thursday, however solely regained a small portion of the losses suffered within the final a number of days. Buyers ought to nonetheless be cautious amid uneven market motion. The S&P 500 stays beneath its 200-day line with most indexes additionally hitting resistance at their 21-day shifting averages.

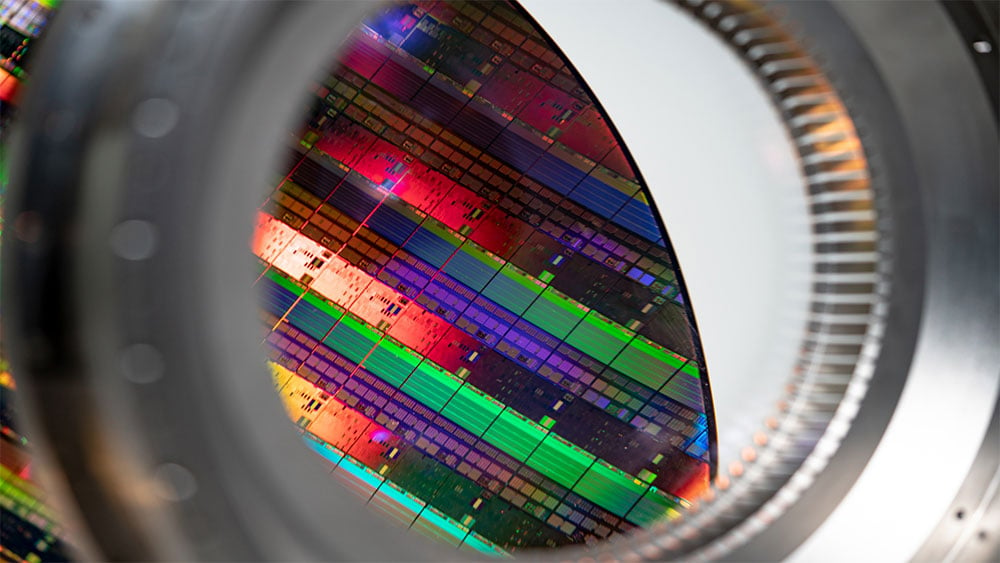

Semiconductor shares did nicely, with chipmaker Nvidia (NVDA) among the many S&P 500’s prime performers Thursday. However chip-equipment makers are typically in higher form, with KLA Corp. (KLAC), Axcelis Applied sciences (ACLS) and Extremely Clear Holdings (UCTT) flashing purchase indicators Thursday. ASML (ASML) and Utilized Supplies (AMAT) are amongst these close to purchase factors.

Key Earnings

Costco Wholesale (COST), Lululemon Athletica (LULU) and Broadcom (AVGO) reported late Thursday.

COST inventory had been little modified in a single day after Costco earnings and gross sales simply missed views. Costco inventory misplaced a fraction in Thursday’s common session however is down practically 11% up to now this month.

LULU inventory tumbled in prolonged commerce after the yoga attire retailer guided barely decrease for the vital vacation quarter. Lululemon earnings topped Q3 views barely. Lululemon inventory edged up 0.6% to 374.11 Thursday, closing in vary of a 370.56 cup-with-handle purchase level. But it surely’s set to fall out of that purchase space.

AVGO inventory rose modestly after-hours as Broadcom earnings and steerage topped views, with the chip-and-software large additionally mountain climbing its dividend. Broadcom inventory closed up 2.4% to 531.08, just under the 200-day line. Final week’s excessive of 552.42 may provide some type of entry.

LULU inventory is on IBD Leaderboard as an earnings choices play. KLAC inventory is on IBD Lengthy-Time period Leaders.

Dow Jones Futures As we speak

Dow Jones futures fell 0.1% vs. truthful worth. S&P 500 futures and Nasdaq 100 futures declined 0.1%.

Crude oil futures rose barely.

Do not forget that in a single day motion in Dow futures and elsewhere would not essentially translate into precise buying and selling within the subsequent common inventory market session.

Be part of IBD consultants as they analyze actionable shares within the inventory market rally on IBD Stay

Inventory Market Rally

The inventory market rally had a strong session, with the indexes largely going sideways after the primary hour of buying and selling.

The Dow Jones Industrial Common climbed 0.55% in Thursday’s inventory market buying and selling. The S&P 500 index rose 0.75%. The Nasdaq composite rallied 1.1%. The small-cap Russell 2000 superior 0.7%.

U.S. crude oil costs dipped 0.8% to $71.46 a barrel, with some large intraday swings. Crude futures are actually at ranges that the Biden administration signaled would set off refilling the Strategic Petroleum Reserve, which has been drained to long-term lows this 12 months to scale back power prices.

The ten-year Treasury yield popped 8 foundation factors to three.49%, nevertheless it was an inside day after tumbling to three.41% on Wednesday.

ETFs

Amongst development ETFs, the iShares Expanded Tech-Software program Sector ETF (IGV) rallied 1.8%. The VanEck Vectors Semiconductor ETF (SMH) popped 2.55%. Nvidia inventory, ASML, KLA and AMAT are all SMH holdings. Reflecting more-speculative story shares, ARK Innovation ETF (ARKK) gained 2.4% and ARK Genomics ETF (ARKG) 2.2%.

SPDR S&P Metals & Mining ETF (XME) edged up 0.3% and the World X U.S. Infrastructure Improvement ETF (PAVE) superior 0.8%. U.S. World Jets ETF (JETS) dipped 0.3%. SPDR S&P Homebuilders ETF (XHB) rose 0.6%. The Vitality Choose SPDR ETF (XLE) and the Monetary Choose SPDR ETF (XLF) nudged 0.1% greater. The Well being Care Choose Sector SPDR Fund (XLV) rose 0.9%.

5 Greatest Chinese language Shares To Watch Now

Chip Shares Close to Purchase Factors

A number of chip-gear makers are in or close to purchase zones. On the whole, semiconductor-equipment makers have some bleak forecasts for the 12 months forward, however chip-gear shares usually backside nicely earlier than enterprise turns round.

KLAC inventory rose 2% to 395.92, clearing some purchase factors between 392.60-396.02. Buying and selling was very gentle, however there have been various large good points in spiking quantity as KLA was rebounding from bear-market lows in October and November. The relative energy line is at a report excessive, even with shares nicely off their January peak. KLA inventory is a Lengthy-Time period Chief, however the time to purchase a inventory as an LTL is when it is nearer to the 200- or 50-day traces.

ACLS inventory popped 4.9% to 81.93, getting again above an 80.34 cup-with-handle purchase level, in keeping with MarketSmith evaluation. Axcelis is nicely prolonged from the 50-day line, however the 21-day line has been racing greater. The RS line for ACLS inventory is at a 15-year excessive.

UCTT inventory climbed 5.6% to 36.59, topping a 36.10 cup-with-handle purchase level and hitting its finest ranges since April. The bottom fashioned proper on the backside, with no prior uptrend. However the deal with largely fashioned above the 200-day line. The RS line for UCTT inventory is at an 8-month excessive.

ASML inventory edged up 0.9% to 606.89. Shares surged from its Oct. 13 bear market low till Nov. 15. Since then, the high-end Dutch semiconductor-equipment large has been consolidating comfortably above the 200-day line, at the perfect ranges since April. The 21-day line is near catching up. A break above latest highs may provide an early entry. Ideally, ASML would rebound off the 21-day line or forge a correct base.

AMAT inventory gained 2.4% to 108.61 on Thursday. Shares are barely above the 200-day line after its personal Oct. 13-Nov. 15 run. Utilized Supplies has a three-weeks-tight sample, providing a 112.22 purchase level. Buyers may use a brief trendline, maybe with Thursday’s excessive of 109.43 as a set off, as a barely earlier entry.

In the meantime, chip large Nvidia rallied 6.5% to 171.69, rebounding from its 21-day line. NVDA inventory is just under its 200-day line now. An aggressive dealer may use a decisive clearing of the 200-day line as a purchase sign. But it surely may be higher to attend for Nvidia inventory to clear the 200-day and type some type of consolidation, a la ASML or AMAT, to spy a safer entry.

Market Rally Evaluation

The inventory market rally snapped a latest shedding streak with modest-to-solid good points. But it surely did not basically change the technical image. The most important indexes are shifting sideways, discovering help at key ranges but in addition hitting resistance.

The S&P 500 index simply managed to shut again above its 21-day shifting common. The benchmark index must get again above its 200-day shifting common and its Dec. 1 excessive.

The Nasdaq composite held help at its 50-day shifting common, regaining the 11,000 stage however closing simply shy of its 21-day. The Russell 2000, which tumbled beneath its 200-day and 21-day line earlier this week, backed off from its 21-day intraday.

The Dow Jones, which closed simply above its 21-day common on Wednesday, bounced modestly on Thursday.

Markets might not make any decisive transfer with key information coming.

The November producer worth index is due out Friday morning. Wholesale inflation ought to present continued regular deceleration. However the actual concern is in service costs. The November CPI report is about for Dec. 13, with the year-end Fed assembly ending the subsequent day.

These occasions may very well be the catalyst for large market strikes up or down. In fact, over the previous month the indexes have had large strikes across the October CPI, Fed chief Powell’s speech and extra, however sideways, uneven motion continued.

Time The Market With IBD’s ETF Market Technique

What To Do Now

Some shares flashed purchase indicators Wednesday, together with KLAC, ACLS, United Leases (URI) and Dexcom (DXCM). Buyers may have nibbled on a few of these — or not.

Total publicity ought to stay low. The present market development is sideways and uneven. That is only a robust surroundings for making headway buying and selling shares. In the event you make new buys and get a good acquire, take into account taking partial earnings shortly. Too many promising shares have round-tripped 5%, 10% good points over the previous a number of weeks.

Various shares from a wide range of sectors are establishing. So preserve your watchlists updated and keep engaged.

Learn The Massive Image each day to remain in sync with the market path and main shares and sectors.

Please comply with Ed Carson on Twitter at @IBD_ECarson for inventory market updates and extra.

YOU MAY ALSO LIKE:

Need To Get Fast Earnings And Keep away from Massive Losses? Attempt SwingTrader

Greatest Progress Shares To Purchase And Watch

IBD Digital: Unlock IBD’s Premium Inventory Lists, Instruments And Evaluation As we speak

The 200-Day Common: The Final Line Of Assist?

Tesla Vs. BYD: Which EV Large Is The Higher Purchase?