Dow Jones futures tilted larger in a single day, together with S&P 500 futures and Nasdaq futures. The inventory market rally had one other weak session, with Apple (AAPL) and Exxon Mobil (XOM) breaking under key ranges whereas Amazon.com (AMZN) and Tesla (TSLA) are beginning to transfer towards bear market lows.

X

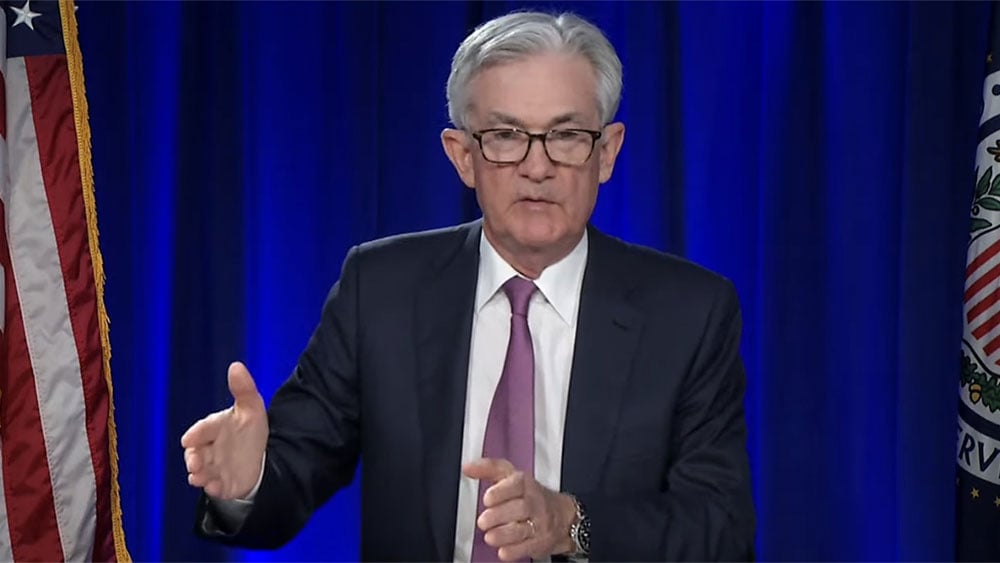

The S&P 500 and different key indexes had been testing or undercutting key ranges, round-tripping final Wednesday’s large achieve following Fed chief Jerome Powell’s speech.

This inventory market rally has had a number of large one-day good points adopted by pullbacks. That is made it troublesome for shares flashing purchase alerts to make headway. It isn’t a great time to be including publicity, however buyers ought to be searching for shares organising.

United Leases (URI), UnitedHealth Group (UNH) and United Airways (UAL) are all buying and selling close to purchase factors.

UAL inventory is on IBD Leaderboard, whereas URI inventory is on the Leaderboard watchlist. United Airways, Charles Schwab and UNH inventory are on the IBD 50. United Leases was Tuesday’s IBD Inventory Of The Day.

Dow Jones Futures As we speak

Dow Jones futures had been 0.1% above honest worth. S&P 500 futures climbed 0.1% and Nasdaq 100 futures rose 0.2%.

The ten-year Treasury yield superior 3 foundation factors to three.54%.

Do not forget that in a single day motion in Dow futures and elsewhere would not essentially translate into precise buying and selling within the subsequent common inventory market session.

Be part of IBD specialists as they analyze actionable shares within the inventory market rally on IBD Dwell

Inventory Market Rally

The inventory market rally rapidly retreated after Tuesday’s open and continued to pattern decrease throughout the day earlier than barely paring losses close to the shut.

The Dow Jones Industrial Common fell 1% in Tuesday’s inventory market buying and selling. The S&P 500 index gave up 1.4%. The Nasdaq composite tumbled 2%. The small-cap Russell 2000 retreated 1.5%

Apple inventory, a member of the Dow Jones, S&P 500 and Nasdaq composite, slid 2.5% to 142.91, again under its 50-day line. XOM inventory sank 2.8%, additionally under its 50-day line in addition to beneath a purchase level. Exxon inventory is struggling as oil, gasoline and pure fuel costs all hunch.

Amazon inventory slumped 3% to 88.25, closing in on its Nov. 9 bear low of 85.87. Tesla inventory fell 1.4% to 179.82, off intraday lows, however after tumbling 6.4% on Monday. TSLA is shifting towards 52-week lows however nonetheless has far to go earlier than it drops to that 166.19 mark.

U.S. crude oil costs slumped 3.5% to $74.25 a barrel.

The ten-year Treasury yield fell 9 foundation factors to three.51%, again close to the bottom ranges since Sept. 20.

The inventory market’s inverse relationship with Treasury yields could also be breaking down. A decrease 10-year Treasury yield more and more could mirror rising recession dangers vs. declining inflation pressures. The yield curve, which retains inverting additional, additionally signifies recession issues.

ETFs

Amongst key tech ETFs, the iShares Expanded Tech-Software program Sector ETF (IGV) gave up 1.7%. The VanEck Vectors Semiconductor ETF (SMH) slumped 2.2%.

SPDR S&P Metals & Mining ETF (XME) edged up 0.25% and the World X U.S. Infrastructure Improvement ETF (PAVE) edged down 0.3%. U.S. World Jets ETF (JETS) held altitude. SPDR S&P Homebuilders ETF (XHB) fell 1.4%. The Power Choose SPDR ETF (XLE) slumped 2.6% and the Monetary Choose SPDR ETF (XLF) 0.9%. The Well being Care Choose Sector SPDR Fund (XLV) declined 0.8%.

Reflecting more-speculative story shares, ARK Innovation ETF (ARKK) fell 4% and ARK Genomics ETF (ARKG) 3%. Tesla inventory is a significant holding throughout Ark Make investments’s ETFs.

5 Finest Chinese language Shares To Watch Now

Shares Close to Purchase Factors

United Leases inventory rose 0.5% to 347.29, simply above the 21-day line. URI inventory has a 368.04 deal with purchase level from a consolidation going again to November 2021. Breaking the downtrend of the deal with may supply an early entry. A number of heavy-equipment performs, together with Deere (DE), Caterpillar (CAT) and Titan Equipment (TITN), are also wanting sturdy.

UNH inventory edged up 0.8% to 539.32. The Dow Jones large has a 558.20 purchase level from a flat base subsequent to a cup-with-handle consolidation.

UAL inventory climbed 2% to 45.92, simply above the 45.67 cup-with-handle purchase level, in keeping with MarketSmith evaluation. Another airline and journey shares are wanting sturdy.

Why This IBD Software Simplifies The Search For High Shares

Market Rally Evaluation

The inventory market rally continues a irritating pattern of leaping forward 4 steps, then giving that again over the following few days.

The most important indexes have fallen solidly for 2 straight periods, wiping out or undercutting the large good points on Fed chief Jerome Powell’s speech final Wednesday.

The S&P 500 index, which fell again under the 200-day line Monday, prolonged losses Tuesday to undercut the 21-day line. The Russell 2000, which dropped under the 200-day and 21-day strains, slid to the bottom shut since Nov. 9, with the 50-day line coming again in play.

The S&P MidCap 400 closed under its 21-day line for the primary time since Oct. 20 and retreated to check its 200-day.

The Dow Jones, which has led the market rally, fell under its 21-day line for the primary time since Oct. 14, however is effectively above its 200-day.

The laggard Nasdaq undercut its 21-day line and is as soon as once more approaching its 50-day line, simply above the 11,000 stage.

All of those indexes closed at their worst ranges since Oct. 9, simply earlier than the Oct. 10 gap-up on the October CPI inflation report.

Final Wednesday’s large market good points had been puzzling on the time, as a result of Fed chief Powell did not say something particularly totally different or dovish. The most important indexes holding up Friday, with Treasury yields in the end closing decrease, regardless of the recent jobs report was much more puzzling.

However the technical image is acquainted.

Because the inventory market rally started on Oct. 13, The most important indexes have had a number of large one-day good points — akin to Oct. 28 and Nov. 30. However then they’ve quickly fallen again, wiping out most, all or greater than all of that large achieve.

So proper as the main indexes hit larger highs and main shares flash purchase alerts, the market rally begins to fade once more.

Time The Market With IBD’s ETF Market Technique

What To Do Now

Up to now, the market rally has ultimately rebounded every time, setting larger highs alongside the best way. However that does not imply it’s going to occur this time. Extra importantly, it does not imply that your shares will rebound.

Till the S&P 500 strikes decisively above the 200-day line, buyers ought to be cautious of including publicity. The Nasdaq and Russell 2000 falling under their 50-day strains, and the S&P 500 testing its October highs, can be indicators to cut back publicity additional.

Additionally be aware that the November CPI inflation report comes out Dec. 13, with the year-end Fed fee hike and Powell information convention the next day. These large occasions may present the catalyst for a market rally break larger or decrease.

So buyers ought to be able to act. Meaning having watchlists prepared, but it surely additionally means staying engaged and versatile.

Learn The Large Image day by day to remain in sync with the market course and main shares and sectors.

Please comply with Ed Carson on Twitter at @IBD_ECarson for inventory market updates and extra.

YOU MAY ALSO LIKE:

Need To Get Fast Income And Keep away from Large Losses? Attempt SwingTrader

Finest Development Shares To Purchase And Watch

IBD Digital: Unlock IBD’s Premium Inventory Lists, Instruments And Evaluation

Tesla Vs. BYD: Which EV Big Is The Higher Purchase?