Tech shares on show on the Nasdaq.

Peter Kramer | CNBC

The market’s affinity for Huge Tech shares this 12 months is “shortsighted,” in line with portfolio supervisor Freddie Lait, who mentioned the subsequent bull market part will broaden out to different sectors providing larger worth.

Shares of America’s tech behemoths have been buoyant to this point in 2023. Apple closed Wednesday’s commerce up nearly 33% year-to-date, whereas Google dad or mum Alphabet has risen 37%, Amazon is 37.5% increased and Microsoft is up 31%. Fb dad or mum Meta has seen its inventory soar greater than 101% because the flip of the 12 months.

This small pool of corporations is diverging starkly from the broader market, with the Dow Jones Industrial Common lower than 1% increased in 2023.

The gulf between Huge Tech and the broader market widened after earnings season, with 75% of tech companies beating expectations, in comparison with a reasonably combined image throughout different sectors and broadly downbeat financial knowledge.

Traders are additionally betting on additional rallies as central banks start to sluggish and ultimately reverse the aggressive financial coverage tightening that has characterised recent occasions. Huge Tech outperformed for years throughout the interval of low rates of interest, after which obtained a significant enhance from the Covid-19 pandemic.

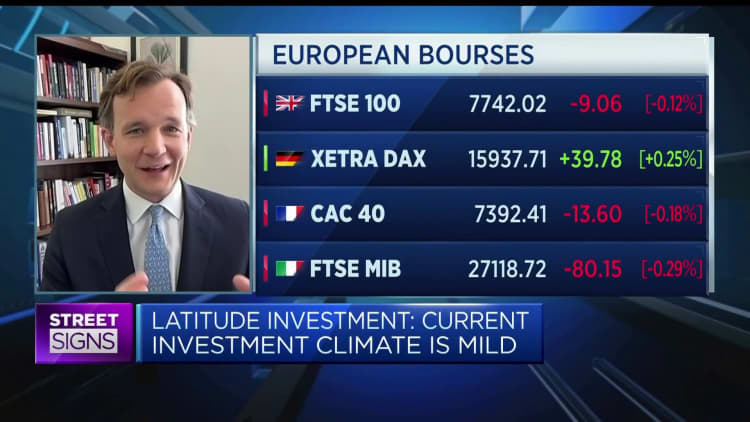

Nevertheless Lait, managing accomplice at Latitude Funding Administration, advised CNBC’s “Avenue Indicators Europe” on Wednesday that though the market’s positioning was “rational” within the circumstances, it was additionally “very shortsighted.”

“I believe we’re getting into a really totally different cycle for the subsequent two-to-five years, and whereas we might have a difficult interval this 12 months, and other people could also be hiding again out in Huge Tech as rates of interest roll over, I believe the subsequent leg of the bull market — at any time when it does come — can be broader than the final one which we noticed, which was actually simply form of tech and healthcare led,” Lait mentioned.

“You have to begin doing the work in a few of these extra Dow Jones sort shares — industrials or outdated economic system shares, to a level — with a purpose to discover that deep worth that you’ll find in in any other case nice development companies, simply exterior in numerous sectors.”

Lait predicted that as market contributors uncover worth throughout sectors past tech over the subsequent six-to-12 months, the increasing valuation hole between tech and the remainder of the market will start to shut.

Nevertheless, given the robust earnings trajectory demonstrated by Silicon Valley within the first quarter, he believes it’s price holding some tech shares as a part of a extra diversified portfolio.

“We personal a few of these know-how shares as effectively, however I believe a portfolio completely uncovered to them does run a focus of threat,” he defined.

“Extra apparently, it misses out on an enormous variety of alternatives which might be on the market within the broader market: different companies which might be compounding development charges at comparable ranges to the know-how shares, buying and selling at half or a 3rd of the valuation, providing you with extra diversification, extra publicity if the cycle is totally different this time.”

He subsequently suggested traders to not be roundly skeptical of tech shares, however to consider the broadening out of the rally and the “narrowing of the differential between valuations,” and to “decide their moments to get publicity.”