The “Magnificent Seven” was coined by Financial institution of America analyst Michael Hartnett to explain seven giant, tech-focused corporations. As a result of a mix of their dimension, underlying fundamentals, and development, these corporations led the market rally in 2023. They’ve additionally contributed the majority of the S&P 500’s positive factors in 2024.

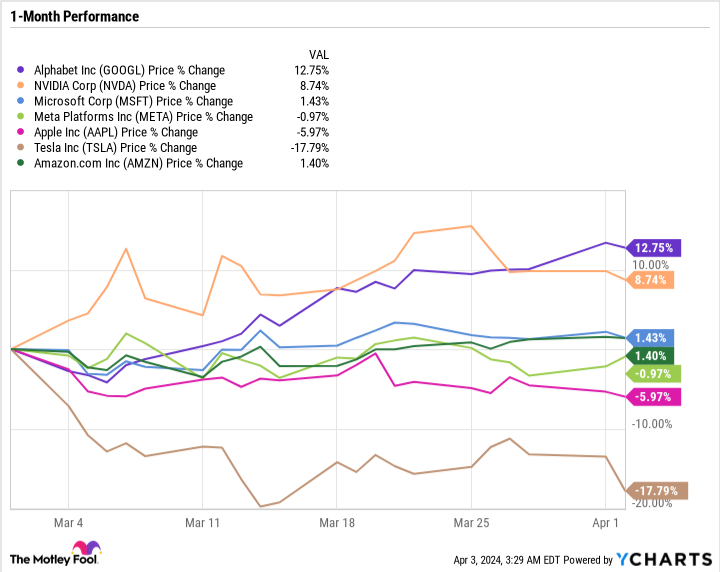

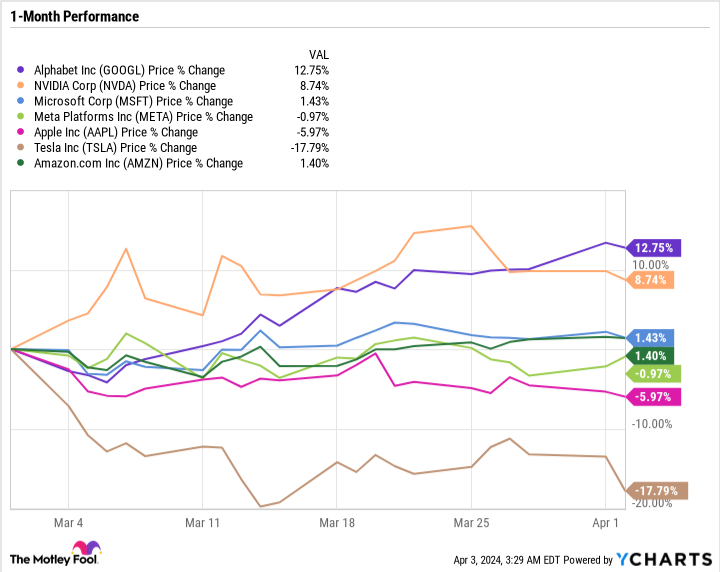

Nevertheless, one thing has modified during the last month. One of many three Magnificent Seven shares that had been down 12 months thus far is immediately up — loads — during the last month.

This is why Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has immediately turn out to be the most well liked Magnificent Seven inventory and why it stays a fantastic worth though it’s hovering round a 52-week excessive.

Out and in of favor

It has been a wild experience for Alphabet inventory in 2024. In late January, it was across the identical worth it’s in the present day — above $150 a share. However in early March, it fell to the low $130 per-share vary resulting from investor pessimism concerning its synthetic intelligence (AI) investments — particularly, Google Gemini AI and its inaccuracies.

However then, in mid-March, information surfaced that Alphabet was in talks with Apple to license Gemini AI in iPhones, placing a much-needed stamp of approval on Alphabet’s AI endeavors. The inventory rose as a lot as 7.7% on March 18, which contributed to its over 12% acquire previously month.

Partnering with Apple could be an enormous deal for Alphabet. Regardless of proudly owning varied differentiated companies, like Google Search, YouTube, Google Cloud, and Android, Alphabet nonetheless is dependent upon advertisements for the overwhelming majority of its income. The extra it could possibly diversify its enterprise away from advertisements, the broader its moat and the extra levers it could possibly pull to unlock development.

A minimum of within the quick time period, Alphabet inventory has moved out and in of favor with Wall Avenue based mostly on its perceived AI aptitude and potential. In actuality, this can be a firm that has been monetizing AI for a while and has an enormous analysis and growth finances and money to spend money on innovation.

There is a goal on Alphabet’s again

With so many development narratives flooding the market, it may be straightforward to get caught up in implied-growth trajectories and overlook the businesses which have already completed a lot and are incomes a ton of revenue. In different phrases, outweighing the unknown and discounting confirmed winners.

Alphabet is a confirmed winner, however there are query marks surrounding the way it will keep a winner within the midst of a lot competitors.

Google Search and YouTube depend on advanced AI-driven algorithms. However platforms like TikTok and Meta Platforms‘ Instagram Reels have been cited as various search engines like google to Google by youthful generations like Gen Z.

In the meantime, Google Cloud is third behind Microsoft Azure and Amazon Internet Providers in cloud-infrastructure market share.

Android remains to be the dominant working system globally, however iOS is greater in core areas just like the U.S., and Apple has extra management over its {hardware} and software program integration than Alphabet.

Invert your pondering

The glass-half-empty outlook on Alphabet is that it’s a market chief throughout many various industries however that each one of its industries are ripe for disruption.

It has been the chief in seek for many years, however can it keep pole place within the face of mounting competitors from short-video platforms or new competitors stays to be seen?

Shoppers have extra leisure choices than ever, so will YouTube lose market share to different streaming websites?

Will Google Cloud have the ability to take market share towards its bigger friends?

These are all legitimate questions.

Whenever you like an organization, it is at all times good to think about the counterargument. Charlie Munger used to speak in regards to the inversion course of as a solution to broaden a line of pondering. Earlier than shopping for a inventory, we normally take into consideration the the reason why the corporate is an efficient funding. However inversion would contain interested by all of the the reason why people would wish to promote the inventory, why it might go decrease, underperform the market, and so on.

There’s normally a midway respectable counterargument to even the very best shares. However typically, even unhealthy counterarguments can turn out to be dominant market sentiment if the market is pessimistic on a inventory because it had been on Alphabet relative to the remainder of the Magnificent Seven.

Alphabet is an efficient worth

Alphabet has a longtime, cash-cow enterprise mannequin and loads of methods to monetize AI. It’s no stranger to competitors, as there are at all times different corporations that need a slice of a high-margin trade.

In Alphabet’s favor is its cheap valuation. It has a mere 26.7 price-to-earnings ratio, barely above Apple’s 26.3 for the second-lowest of the Magnificent Seven shares. It additionally has a 28.8 price-to-free-cash-flow (FCF) ratio, additionally second-lowest behind Apple within the Magnificent Seven.

Alphabet will not be essentially the most thrilling development inventory on the market proper now. However what it does have is a worthwhile enterprise and room to take dangers and unlock development. Alphabet’s deep pockets and monitor report of innovation are cause sufficient for the inventory to not commerce at a reduction to the S&P 500 (prefer it does in the present day).

Alphabet inventory ought to have by no means fallen as a lot because it did. And even now, it seems like an affordable long-term purchase for affected person buyers.

Must you make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Alphabet wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $539,230!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 4, 2024

Financial institution of America is an promoting accomplice of The Ascent, a Motley Idiot firm. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Daniel Foelber has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Financial institution of America, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Meet the Finest-Performing “Magnificent Seven” Inventory Over the Final Month (Trace: It is Not Nvidia) was initially revealed by The Motley Idiot