Many revenue buyers focus primarily on an organization’s monitor document for making and elevating dividend funds, and the dividend yield. However for those who’ve been questioning which corporations pay essentially the most dividends, you’ve got come to the appropriate place.

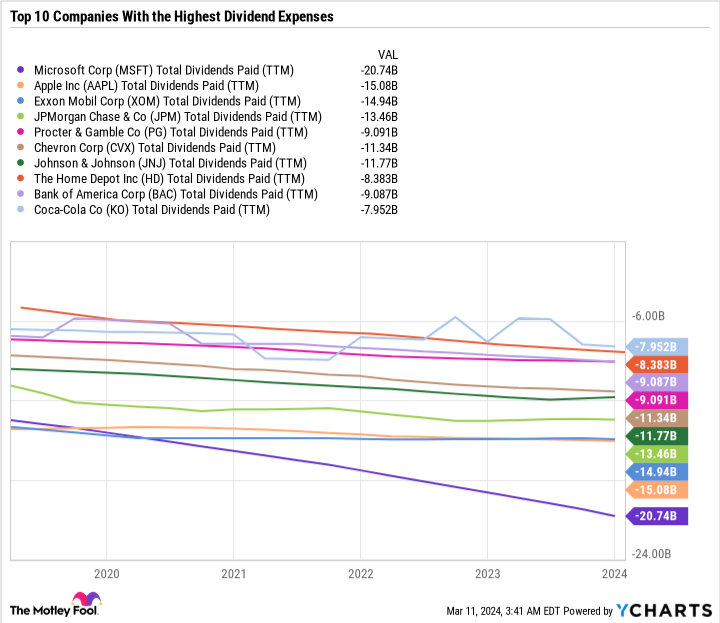

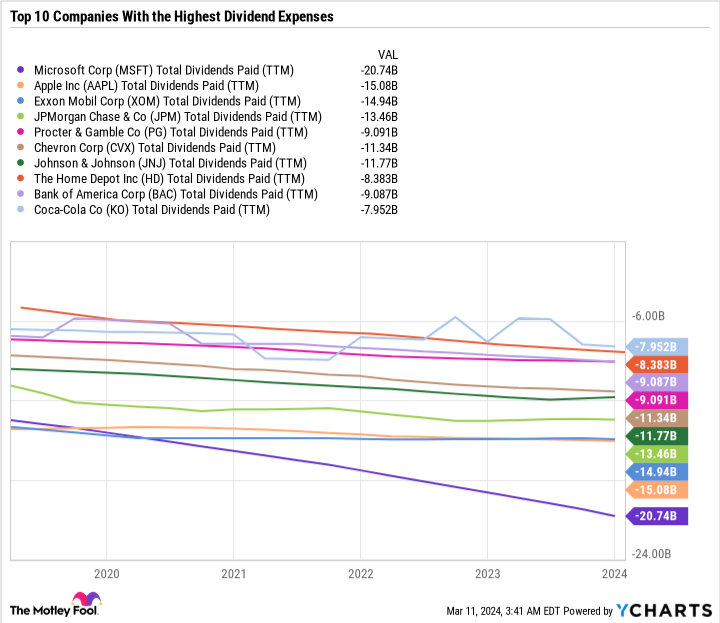

The highest candidates could be giant corporations with excessive yields, however the two corporations with the best dividend bills are literally Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL) — each “Magnificent Seven” shares.

This is a take a look at the ten U.S.-based corporations with the most important dividend bills, why Microsoft leads the group, and why Microsoft is value shopping for now.

Microsoft’s multibillion-dollar annual dividend hikes

Apart from ExxonMobil and Financial institution of America, the ten U.S. corporations with the most important dividend bills are all within the Dow Jones Industrial Common, which is understood for having industry-leading corporations as its parts.

In case you comply with the purple line within the chart, you will see that Microsoft’s dividend fee has elevated considerably, particularly lately. In truth, it has almost doubled during the last six years. For fiscal 2024, Microsoft elevated its dividend by greater than 10%. As a result of it’s such a big firm, every 5% improve within the dividend interprets to round $1 billion extra in dividend bills.

In the meantime, Apple has made naked minimal dividend raises of 1 cent per share per yr for the previous couple of years. Apple prefers to return cash to shareholders by way of inventory buybacks fairly than with dividends.

Do not underestimate Microsoft’s dividend

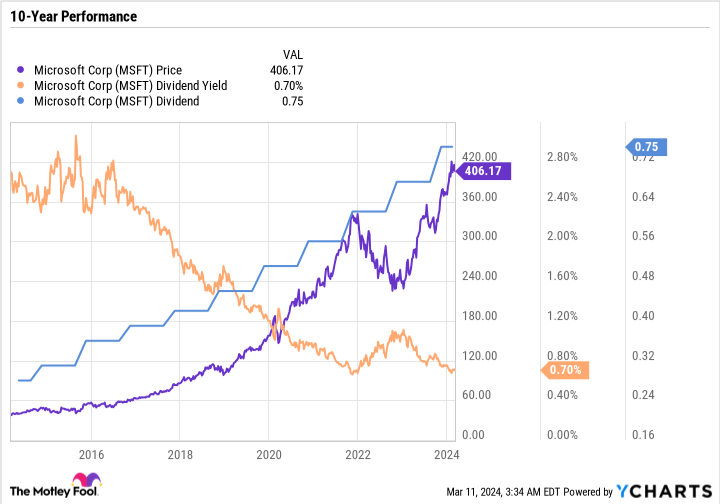

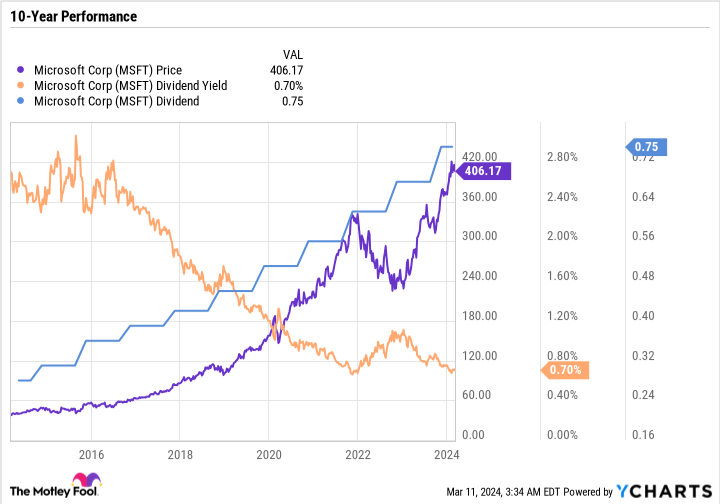

Microsoft has a below-average yield of simply 0.7% — however that is nonetheless essentially the most of any Magnificent Seven inventory, even when factoring in Meta Platforms‘ new dividend.

Microsoft has made sizable dividend hikes, however its inventory value development has nicely outpaced that dividend development charge, which has resulted in a shrinking yield over time. During the last decade, administration has almost tripled the dividend, but the yield has fallen from greater than 2.5% to 0.7% merely due to the inventory’s monster 900% achieve over that point.

In case you’re trying to construct passive revenue streams for the lengthy haul, then an organization’s potential and willingness to boost its dividend will show extra vital than its present yield. Microsoft stands out as a result of it will probably afford to boost its dividend commonly, purchase again inventory, fund its operations, put money into analysis and growth, and nonetheless preserve a stability sheet with extra cash than debt.

Basically, Microsoft can do all of it. It is higher to view its dividend as a cherry on high of its funding thesis as a substitute of taking a look at it in isolation.

Constructing an funding thesis

There are three primary methods an organization can reward its shareholders — capital good points, dividends, and inventory repurchases. When contemplating whether or not to put money into a inventory, it is vital to grasp which of these levers the corporate is most centered on pulling.

For a lot of corporations, it is all about capital good points. Amazon and Tesla, for instance, slot in that class: They do not pay dividends and have giant stock-based compensation applications, which improve their excellent share counts and dilute their present shareholders.

For a stodgy dividend-payer like Procter & Gamble, dividends and buybacks are arguably a much bigger a part of the funding thesis than potential share value good points. Though P&G can nonetheless shock to the upside — the inventory is up by greater than 9% yr so far and is thrashing the S&P 500.

Then there are the uncommon corporations that each have loads of room to develop and in addition reward their shareholders with buybacks and dividends. Microsoft is on this elite class. During the last 5 years, the corporate has diminished its share rely by 3%, raised its dividend by 63%, and its inventory value is up by greater than 255%. It has delivered the trifecta for shareholders.

Leveraging AI throughout enterprise channels

Microsoft stands out as one of the well-rounded buys within the inventory market proper now as a result of it’s a comparatively low-risk however excessive potential-reward firm. With such excessive money move and a powerful stability sheet, Microsoft can afford to make errors, fund acquisitions, strive one thing new, and take dangers at occasions when many different corporations lack the capital or market place to take action. Microsoft additionally has a transparent path towards monetizing synthetic intelligence (AI). It has a number of high-margin enterprise models which can be associated however nonetheless diversified.

Microsoft Copilot is an AI assistant that works throughout a number of purposes, amongst them the Microsoft 365 applications and GitHub. On Microsoft’s fiscal 2024 second-quarter earnings name, administration went into element concerning the many ways in which Copilot helps its prospects save time and drive effectivity, and it is contributing to the underside line.

Even when Copilot hits a snag and its influence on development throughout all these merchandise seems to be restricted, it is not the corporate’s solely AI play. There’s additionally Azure AI for Microsoft’s Clever Cloud phase, which serves a totally completely different {industry} than Copilot targets.

In sum, Microsoft’s AI aspirations do not hinge on a single product or thought. AI is already boosting the corporate’s profitability and contributing to development, and there isn’t any motive to consider that development will decelerate anytime quickly.

Anticipate that to supply a snowball impact. Microsoft may select to speed up its share value development, return capital to shareholders via bigger buybacks, or elevate its dividend at a quicker charge. Buyers stand to learn regardless of which lever Microsoft chooses to drag.

Microsoft sports activities a premium valuation for good causes

The one difficulty with Microsoft is its valuation. It trades at a 36.8 price-to-earnings (P/E) ratio, which is nicely above its historic common and the S&P 500’s 27.8 common P/E ratio. The inventory is not low cost, which reveals that buyers have already got excessive expectations for Microsoft.

Do not anticipate Microsoft’s valuation enlargement to proceed. The good points should be pushed by earnings, which is not a foul factor. It simply means among the “straightforward cash” has already been made.

The excellent news is that Microsoft has a multidecade runway for rising earnings and rewarding its shareholders. Even with the inventory’s costly price ticket, Microsoft stands out as one of many safer methods to put money into AI and gather some passive revenue within the course of.

The place to take a position $1,000 proper now

When our analyst crew has a inventory tip, it will probably pay to pay attention. In spite of everything, the publication they’ve run for 20 years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They simply revealed what they consider are the 10 finest shares for buyers to purchase proper now… and Microsoft made the listing — however there are 9 different shares you might be overlooking.

See the ten shares

*Inventory Advisor returns as of March 11, 2024

JPMorgan Chase is an promoting accomplice of The Ascent, a Motley Idiot firm. Financial institution of America is an promoting accomplice of The Ascent, a Motley Idiot firm. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Daniel Foelber has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Apple, Financial institution of America, Chevron, Residence Depot, JPMorgan Chase, Microsoft, and Tesla. The Motley Idiot recommends Johnson & Johnson and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Meet the “Magnificent Seven” Inventory That Pays Extra Dividends Than Any Different U.S.-Based mostly Firm was initially revealed by The Motley Idiot