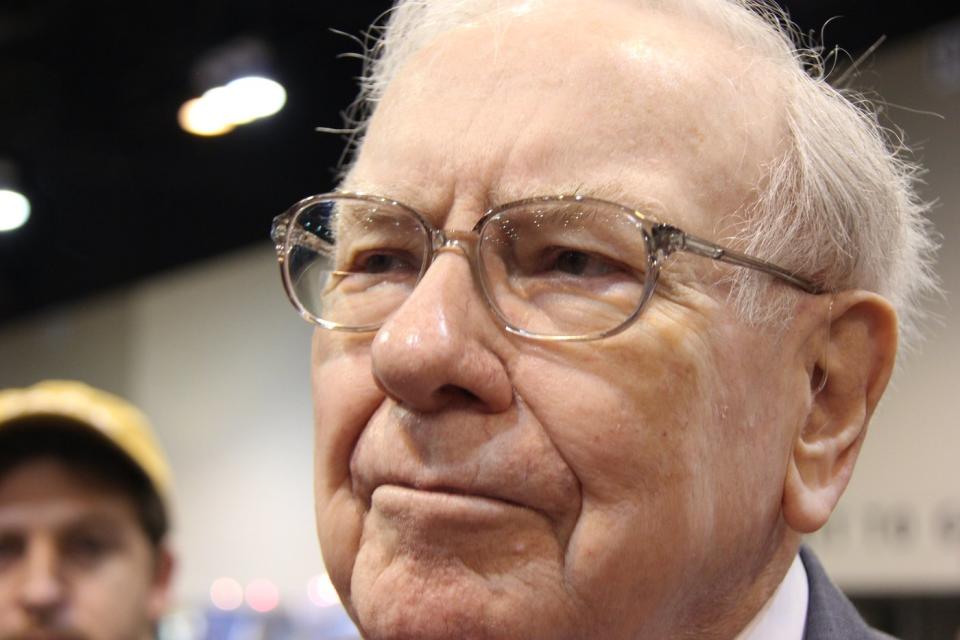

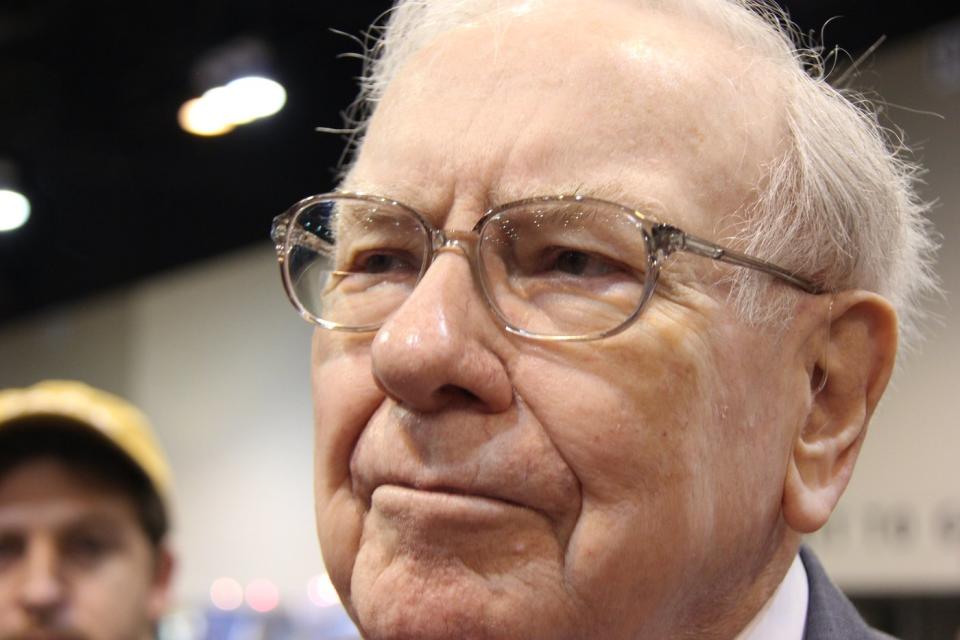

For practically six many years, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been dazzling Wall Avenue along with his investing prowess. Since changing into CEO within the mid-Nineteen Sixties, the Oracle of Omaha, as he is greatest identified, has overseen a higher than 4,450,000% mixture return in his firm’s Class A Shares (BRK.A), as of the closing bell on January 12.

Warren Buffett has a knack for selecting long-term winners, and buyers of all walks often wait on the sting of their respective seats to see what he and his funding workforce have been shopping for and promoting. The humorous factor is, Buffett’s mostly bought inventory is not the one you may initially assume it’s.

Buffett and his workforce have been including to a handful of brand-name shares with frequency

The excellent news for curious buyers is that Berkshire Hathaway is required to file Type 13F with the Securities and Alternate Fee no later than 45 days following the tip of every quarter. A 13F supplies an under-the-hood take a look at what Wall Avenue’s brightest minds bought and offered within the earlier quarter and is a required submitting for individuals and entities with at the very least $100 million in property below administration.

As of the closing bell on Jan. 12, Berkshire Hathaway’s funding portfolio had $361 billion of invested property unfold throughout roughly 50 shares. A few of these shares have been added to with frequency lately.

Power inventory Occidental Petroleum (NYSE: OXY) is the right instance of a now-core holding that is had the undivided consideration of the Oracle of Omaha and his “investing lieutenants,” Todd Combs and Ted Weschler, over the previous two years.

When 2022 started, Berkshire Hathaway held $10 billion in Occidental most well-liked inventory yielding 8% yearly. Nevertheless, it held no frequent shares. As of this previous week, Buffett’s firm owned slightly over 243.7 million shares of Occidental Petroleum frequent inventory, representing a higher than $14.1 billion stake.

The rationale Buffett and his investing aides have bought shares of Occidental with frequency over the previous two years possible has to do with the expectation that the spot worth for crude oil will stay elevated or head even greater. A number of years of capital underinvestment by international vitality majors throughout the pandemic, coupled with uncertainty tied to Russia’s ongoing warfare with Ukraine, has led to a good international provide of crude oil. Typically talking, when the provision of a key commodity is constrained, it is commonplace for the spot worth of that commodity to extend.

Occidental Petroleum is exclusive amongst built-in oil and gasoline operators in that it generates a disproportionate share of its income from its upstream (i.e., drilling) operations. If the worth of crude oil rises, Occidental will get pleasure from an outsized profit. After all, the alternative of this situation (a decline within the spot worth of crude oil) is true, as nicely.

Warren Buffett has additionally not been shy about rising his firm’s place in tech inventory Apple (NASDAQ: AAPL). Since Berkshire’s preliminary stake in Apple was opened throughout the first quarter of 2016, it is grown to virtually 915.6 million shares and accounts for 47.1% ($170.2 billion) of invested property.

Contemplating that Buffett referred to Apple as “a greater enterprise than any we personal” throughout Berkshire’s 2023 annual shareholder assembly, it should not shock anybody that he and his workforce have been constructing this place for years. Apple brings model energy and modern consistency to the desk that few different companies can match.

As an illustration, Apple has been completely dominant within the U.S. smartphone marketplace for nicely over a decade. Since introducing a 5G-capable iPhone within the fourth quarter of 2020, the corporate has persistently accounted for slightly over half of U.S. smartphone market share.

Apple can also be evolving right into a platforms firm. Inserting added emphasis on subscription companies is a technique to increase long-term margins, reduce gross sales fluctuations throughout main iPhone improve cycles, and preserve prospects loyal to its ecosystem of services.

There’s additionally nothing fairly like Apple’s capital-return program. Apple is returning $15 billion in dividends to its shareholders annually and has repurchased greater than $600 billion of its frequent inventory since kicking off its buyback program in 2013.

Warren Buffett has purchased shares of this inventory on a virtually month-to-month foundation for over 5 years

Berkshire Hathaway’s 13F is a useful device that helps buyers get a learn on what shares, industries, and developments are piquing the curiosity of Warren Buffett and his lieutenants. Nevertheless, it would not inform the complete story — at the very least with regard to Warren Buffett’s favourite inventory to purchase.

Although there are a few core holdings in Berkshire’s portfolio which were bought with frequency lately, there’s one other inventory you may discover listed towards the tip of Berkshire’s quarterly experiences that is been bought by Warren Buffett on an virtually month-to-month foundation, relationship again to July 2018. The rationale you are not going to search out this inventory listed on the corporate’s 13F is as a result of Buffett’s favourite inventory to purchase is his personal firm, Berkshire Hathaway.

As of the midpoint of 2018, Berkshire Hathaway’s share repurchase program required the corporate’s inventory to commerce at or under 120% of e book worth (i.e., not more than 20% above e book worth) for buybacks to happen. For a few years main as much as July 2018, Berkshire’s inventory by no means fell to this line-in-the-sand threshold — which meant not a cent was spent on repurchases.

The whole lot modified on July 17, 2018. The corporate’s board handed new measures that allowed Warren Buffett and his late right-hand man Charlie Munger extra freedom to drag the set off on buybacks once they noticed match. So long as Berkshire Hathaway had at the very least $30 billion in money, money equivalents, and Treasuries on its stability sheet, and Buffett and Munger agreed that their very own firm’s inventory was intrinsically low-cost, repurchases could possibly be performed with none cap.

Since Berkshire Hathaway’s board made this alteration — Berkshire hasn’t reported its fourth-quarter outcomes but, which is why I am stating this determine by means of Sept. 30, 2023 — Buffett and Munger OK’d share buybacks in all 21 quarters. In reality, there have solely been a handful of months over the previous five-plus years the place share repurchases did not happen. In mixture, Buffett and the late, nice Charlie Munger oversaw the repurchase of greater than $72 billion price of Berkshire Hathaway inventory since mid-2018.

Share buybacks are the direct approach Warren Buffett and his workforce reward long-term shareholders. Since Berkshire would not pay a dividend, frequently shopping for again inventory can steadily improve the possession stakes of longtime shareholders.

Moreover, corporations with regular or rising internet revenue, like Berkshire Hathaway (sans the popularity of unrealized funding features and losses), ought to see their earnings per share climb because the variety of excellent shares decline. This helps to make Berkshire’s inventory much more engaging to basically centered buyers.

In 2024, there is not any inventory I am extra assured we’ll see Warren Buffett purchase than his personal firm.

Do you have to make investments $1,000 in Berkshire Hathaway proper now?

Before you purchase inventory in Berkshire Hathaway, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Berkshire Hathaway wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 8, 2024

Sean Williams has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple and Berkshire Hathaway. The Motley Idiot recommends Occidental Petroleum. The Motley Idiot has a disclosure coverage.

Meet the Inventory Warren Buffett Has Bought Shares of Nearly Each Month for Extra Than 5 Years was initially revealed by The Motley Idiot