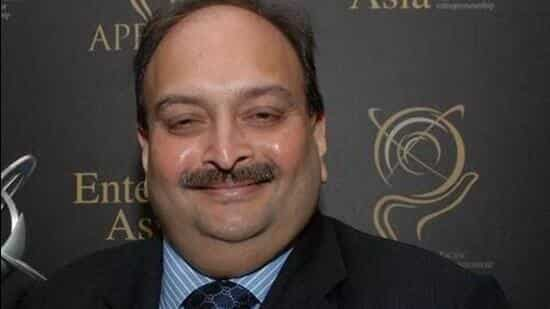

Fugitive businessman Mehul Choksi pledged overvalued, low high quality laboratory ready diamonds and gem stones to get a mortgage from Industrial Finance Company of India (IFCI) Ltd, a authorities entity, in 2016, the Central Bureau of Investigation (CBI) has mentioned in its newest cost sheet towards the diamantaire.

The studded jewelry, which had been pledged to get this mortgage, was already below pledge for one more company mortgage availed by one among Choksi’s firms earlier, CBI added.

The federal company plans to make use of the contemporary cost sheet, filed final month earlier than a Mumbai courtroom and reviewed by HT, to persuade the Interpol that Choksi is a ordinary offender in addition to, within the ongoing extradition proceedings in Antigua and Barbuda, individuals acquainted with the developments mentioned.

Interpol withdrew its purple discover – a world arrest warrant – towards Choksi after he alleged that Indian brokers kidnapped him from Antigua and Barbuda in Could 2021.

The Indian authorities “vehemently contested” the deletion of Choksi’s identify from Interpol’s needed listing however the international police physique wasn’t satisfied, and prime facie discovered credence in his allegations that Indian businesses tried to abduct him, HT had reported on March 21.

Additionally Learn: ‘Extradition request unaffected’: CBI after Interpol removes purple discover towards Mehul Choksi

The businessman is needed by India within the $2 billion Punjab Nationwide Financial institution (PNB) fraud case.

The most recent case towards Choksi, taken up by CBI on April 30 final 12 months, pertains to a mortgage of ₹25 crore taken from IFCI Ltd, by pledging his firm’s shares in addition to gold and diamond jewelry.

Apart from him, his firm Gitanjali Gems Ltd and valuers Surajmal Lallu Bhai and Co, Narendra Jhaveri, Pradip C Shah and Shrenik Shah have been named within the case.

CBI has alleged that 4 totally different valuers, in connivance with Choksi, submitted inflated valuations – starting from ₹34 crore to ₹45 crore – primarily based on which IFCI disbursed the mortgage of ₹25 crore into the account of Gitanjali Gems Ltd on September 30, 2016.

On the identical day, the whole mortgage quantity was “diverted to Premier Intertrade, a partnership agency managed by Choksi”, the cost sheet mentioned.

After Gitanjali Gems didn’t repay the mortgage, IFCI bought a contemporary valuation of the 896 items of jewelry executed by way of two valuers, who reported the worth of jewelry at ₹2.03 crore and ₹70.33 lakh, respectively, roughly 98% lower than what was declared by Choksi.

The valuers, CBI mentioned, “have said that the discount in worth of the studded jewelry is as a result of inferior high quality of diamond and ruby (color stones).”

“The valuers additionally noticed that the diamonds are of low-quality lab ready chemical vapour diamonds and different inferior color stones and never actual gem stones,” CBI added.

The company additionally bought an impartial valuation of the pledged jewelry executed by way of two government-approved valuers within the presence of impartial witnesses.

The 2 valuers revealed the worth of 896 items of jewelry to be ₹69 lakh and ₹76 lakh, respectively. Additionally they confirmed that the jewels had been of inferior high quality, in line with the cost sheet.

“Investigation, thus, revealed that the accused individuals in conspiracy with one another, induced the financial institution in sanctioning the mortgage quantity by submitting extremely inflated and false valuation studies of the pledged jewelry,” the cost sheet mentioned.

Dismissing the allegations, Choksi’s lawyer Vijay Aggarwal mentioned, “All these circumstances are baseless and would ultimately die within the courts. Earlier cost sheets haven’t proceeded an inch in courts for the final 5 years.”