Nvidia (NASDAQ: NVDA) has been one of many hottest shares available on the market in 2024, with shares of the chipmaker registering gorgeous positive factors of 70% thus far this yr as its synthetic intelligence (AI)-fueled development reveals no indicators of stopping.

Nvidia’s income and earnings are topping Wall Avenue expectations. Even higher, Nvidia is anticipated to maintain its spectacular development going ahead due to its 90%-plus share of the AI chip market and an aggressive product roadmap. The corporate is ready to launch even quicker AI graphics playing cards that may enable its clients to coach even larger giant language fashions (LLMs).

The inventory’s terrific surge additionally goes a way towards explaining why it’s now buying and selling at 74 instances trailing earnings. That is considerably greater than the Nasdaq-100‘s trailing earnings a number of of 30 (utilizing the index as a proxy for tech shares). Nonetheless, there’s a good likelihood that Nvidia will have the ability to justify its valuation due to the stable development alternatives it’s sitting on. The inventory appears to be like low-cost after we think about the projected development that it might ship.

Even then, value-oriented buyers are prone to search for alternate options to Nvidia in order that they will capitalize on the AI chip’s market development with out having to pay an costly valuation. That is the place Broadcom (NASDAQ: AVGO) is available in. Let’s examine why this chipmaker may develop into a stable Nvidia different for buyers seeking to profit from the AI increase.

Broadcom’s AI-related income is rising at a faster-than-expected tempo

Within the first quarter of fiscal 2024 (which ended on Feb. 4), Broadcom reported whole income of $11.9 billion, a rise of 34% from the year-ago interval. Excluding the income contribution from VMware, which Broadcom absolutely acquired in November 2023, the corporate’s income elevated 11% yr over yr on an natural foundation.

That factors towards an acceleration in Broadcom’s development, contemplating that it ended fiscal 2023 with natural income development of 8%. AI performed a key position in accelerating Broadcom’s development final quarter. The corporate bought $2.3 billion value of AI chips in Q1 of fiscal 2024, a 4x enhance over the prior-year interval. Broadcom’s AI income displayed a big bounce from $1.5 billion within the fourth quarter of fiscal 2023.

The corporate now forecasts a minimum of $10 billion in AI income in fiscal 2024, which might characterize 1 / 4 of its estimated income of $50 billion for the total yr. Analysts have been initially anticipating Broadcom to finish the yr with $8 billion in AI-related income this yr. Nevertheless, the corporate appears to be benefiting from an more and more robust demand for customized AI chips.

Main cloud computing firms are opting to make application-specific built-in circuits (ASICs) for powering their AI servers in a bid to cut back prices and increase effectivity. These firms are turning to Broadcom to make these customized chips. Meta Platforms and Alphabet are already its clients, and Broadcom not too long ago revealed that it has received a further buyer for its customized AI processors.

In response to Morgan Stanley, customized chips may make up for 30% of the general AI chip market by 2027 and produce an estimated $55 billion in annual income. This explains why Japanese funding financial institution Mizuho is forecasting Broadcom’s AI-related income to extend to $20 billion a yr by 2027. That will not be shocking as, in line with JPMorgan, Broadcom enjoys a 35% share of the high-end marketplace for ASICs.

Wholesome bottom-line development may ship the inventory greater

Broadcom inventory has jumped almost 19% in 2024. Nevertheless, buyers who have not purchased the inventory but ought to think about doing so quickly, because it appears constructed for extra upside contemplating the potential earnings development it may ship.

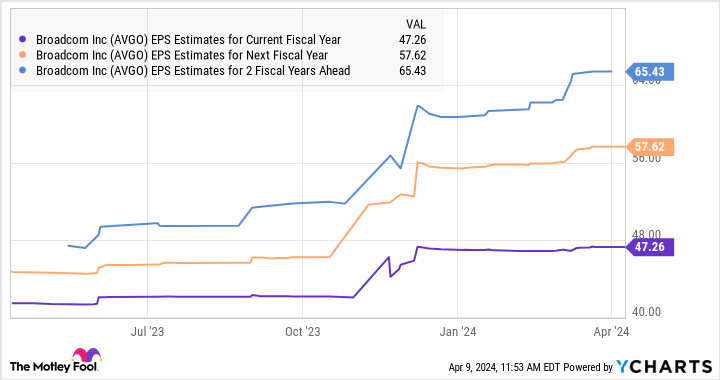

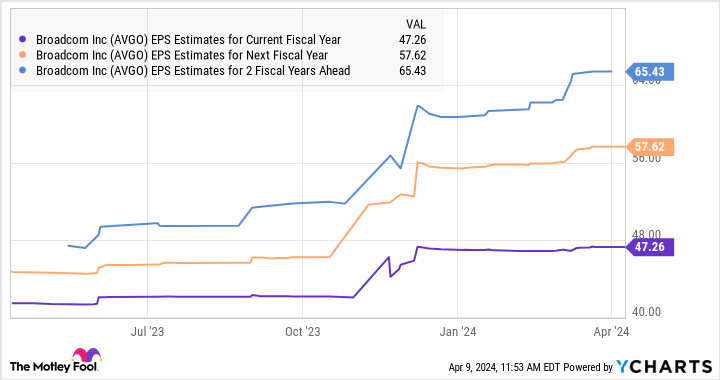

The chip inventory is at present buying and selling at 29 instances ahead earnings, which is decrease than the Nasdaq-100’s earnings a number of of 30. Assuming Broadcom trades at 30 instances earnings after three years and achieves $65.43 per share in earnings, because the chart signifies, its inventory worth may bounce to $1,963. That may be a 48% enhance from present ranges.

Nevertheless, Broadcom may ship even stronger positive factors, as its earnings may enhance at a quicker tempo due to the rising demand for customized AI chips. That is why buyers on the lookout for an attractively valued AI inventory that would ship wholesome appreciation ought to think about shopping for it earlier than it jumps greater.

Must you make investments $1,000 in Broadcom proper now?

Before you purchase inventory in Broadcom, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Broadcom wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of April 8, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. JPMorgan Chase is an promoting accomplice of The Ascent, a Motley Idiot firm. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, JPMorgan Chase, Meta Platforms, and Nvidia. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.

Missed Out on Nvidia? 1 Synthetic Intelligence (AI) Progress Inventory to Purchase Earlier than It Jumps 48%, at Least. was initially revealed by The Motley Idiot