The essential function that Nvidia (NASDAQ: NVDA) performs within the proliferation of synthetic intelligence (AI) expertise due to the large computing energy of its graphics processing items (GPUs) explains why the corporate witnessed an excellent surge in its income and earnings in current quarters.

In its just lately concluded fiscal 2024, income was up 126% to $60.9 billion. Within the present fiscal 12 months, analysts count on one other stellar income achieve of 96% to $110.6 billion. In the meantime, analysts count on the corporate’s backside line to double this 12 months, although it might outperform on that entrance, because it enjoys immense pricing energy within the AI GPU market.

All of this means that Nvidia ought to be capable of justify its costly valuations. It trades at 75 instances trailing earnings, however the ahead earnings a number of of 35 tells us simply how quickly its backside line is predicted to develop. What’s extra, Nvidia’s worth/earnings-to-growth ratio (PEG ratio) stands at simply 0.13. A PEG ratio of lower than 1 is considered as indicating {that a} inventory is undervalued with respect to the expansion it’s anticipated to ship.

Nonetheless, cautious traders who’ve doubts about Nvidia’s development story will not be comfy shopping for it at these valuations after the 225% surge that the inventory noticed prior to now 12 months. However for traders seeking to purchase a worth play within the AI house proper now, Dell Applied sciences (NYSE: DELL) seems to be like a super inventory decide.

Dell Applied sciences has a few strong AI-related catalysts

Dell’s enterprise consists of two segments. The primary is infrastructure options, by means of which the corporate sells storage and server options together with networking services. The second section is consumer options, which incorporates gross sales of workstations, private computer systems (PCs), and different peripherals.

The excellent news for Dell traders is that each these segments are on monitor to win huge from the rising adoption of AI.

The corporate’s infrastructure enterprise is getting a pleasant bump from gross sales of AI servers, that are used for mounting chips from Nvidia and others. Within the fourth quarter of Dell’s fiscal 2024 (which ended Feb. 2), its infrastructure options section delivered $9.3 billion in income. Although that was a drop of 6% 12 months over 12 months, it was a achieve of 6% sequentially due to the rising demand for AI-optimized servers.

Dell shipped $800 million price of AI servers in the course of the quarter, and that metric is prone to head larger as orders for AI servers elevated 40% sequentially final quarter, boosting Dell’s AI server backlog to $2.9 billion. Its AI server-related order ebook ought to preserve getting fatter — in keeping with a forecast from International Market Insights, the AI server market’s income will leap from $38 billion in 2023 to $177 billion in 2032.

The corporate is already witnessing a “sturdy curiosity in orders” for next-generation chips from Nvidia and Superior Micro Gadgets, which is one other indication that its AI-specific server orders are set to maneuver larger.

Equally, Dell expects the arrival of AI to drive a turnaround in its consumer options enterprise as properly, which has been underneath stress due to declining PC gross sales. Consumer options income was down 12% 12 months over 12 months within the fiscal fourth quarter to $11.7 billion. Nonetheless, the sequential decline was simply 5%.

“PCs will develop into much more important as most day-to-day work with AI shall be achieved on the PC,” Dell COO Jeffrey W. Clarke stated on the Feb. 29 earnings name. The corporate already introduced a brand new lineup of economic PCs with built-in AI functionalities to capitalize on this chance. It is a good factor to do, as shipments of AI-enabled PCs are anticipated to take off this 12 months.

Market analysis agency Canalys predicts that AI-enabled PC shipments will hit 48 million items in 2024, 100 million items in 2025, and 205 million items in 2028. Canalys additionally factors out that AI PCs are prone to carry worth premiums of 10% to fifteen% over conventional PCs. Provided that Dell is the third-largest PC authentic tools producer and managed simply over 15% of this market in 2023, it’s positioned to learn from this fast-growing area of interest.

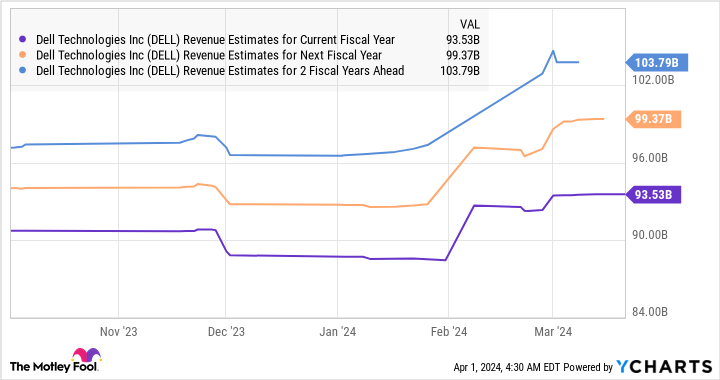

These AI-related catalysts clarify why analysts have been considerably elevating their income development expectations for Dell of late.

The valuation and the potential upside make this inventory an excellent purchase proper now

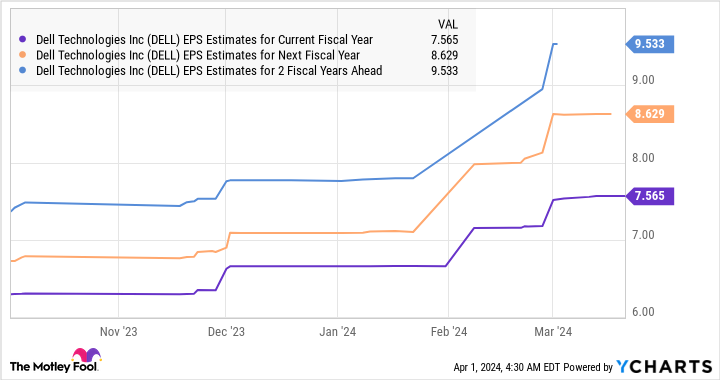

Dell’s top-line efficiency is anticipated to enhance over the subsequent three fiscal years, and that income development is predicted to filter right down to the underside line as properly.

Dell is at the moment buying and selling at slightly below 25 instances trailing earnings. Its ahead earnings a number of is even cheaper at 15.7. For comparability, the tech-heavy Nasdaq-100 index has a trailing earnings a number of of 31 and ahead earnings a number of of 27. Assuming the corporate does obtain $9.53 per share in earnings in fiscal 2027 and trades at 27 instances earnings at the moment (utilizing the Nasdaq-100’s ahead earnings a number of as a proxy for tech shares), its inventory worth might leap to $257 in three years.

That will be a 100% leap from present ranges. Dell has already gained 210% prior to now 12 months, however do not be shocked to see this tech inventory ship eye-popping positive factors sooner or later as properly due to its bettering AI credentials. That is why traders seeking to purchase a development inventory that is not ridiculously costly ought to take into account including Dell Applied sciences to their portfolios earlier than it surges larger.

Must you make investments $1,000 in Dell Applied sciences proper now?

Before you purchase inventory in Dell Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Dell Applied sciences wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of April 1, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets and Nvidia. The Motley Idiot has a disclosure coverage.

Missed Out on Nvidia’s Unimaginable Surge? This May Be the Subsequent Massive Synthetic Intelligence (AI) Inventory, With Potential Positive aspects of 100%, and It Is Extremely Low cost Proper Now was initially revealed by The Motley Idiot