They are saying the larger they arrive, the tougher they fall. That reckoning all the time comes finally for meme shares — and Trump Media & Expertise Group seems to be no exception.

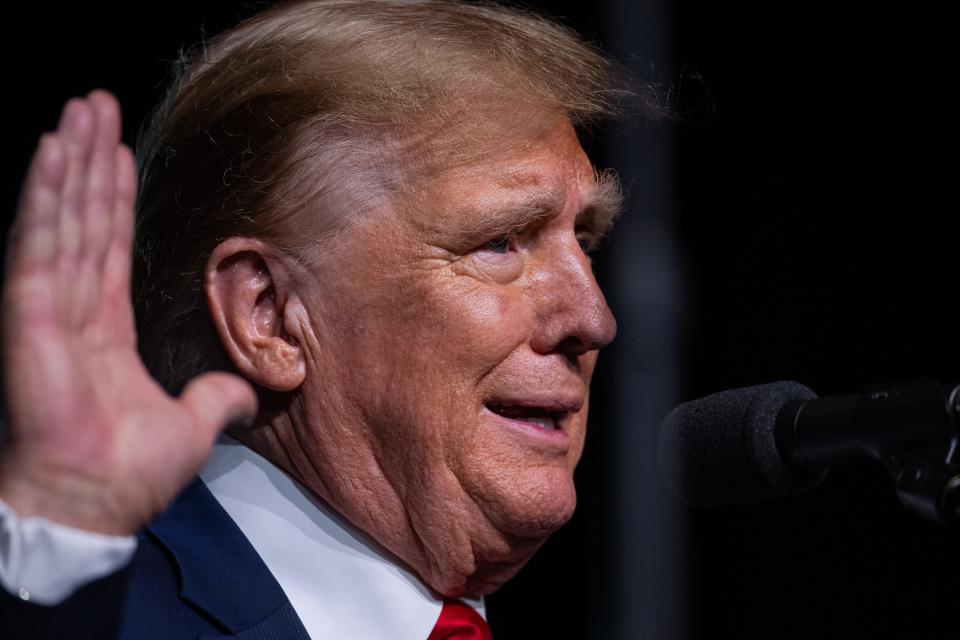

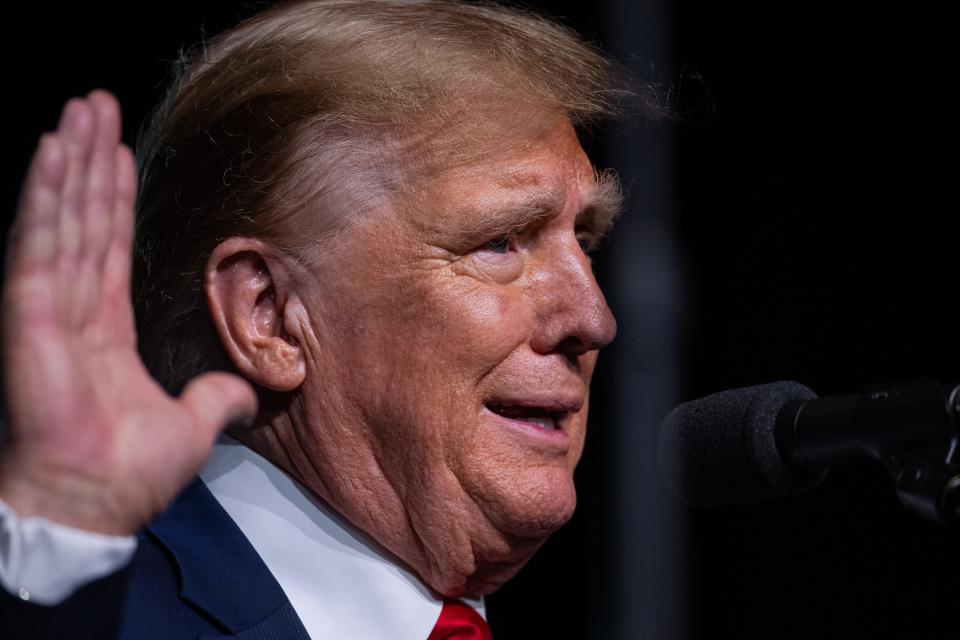

Donald Trump’s namesake social media firm burst out of the gate on its first day of buying and selling Tuesday, opening at $70.90 and hovering as excessive as $79.38 as Trump followers and opportunistic merchants purchased up shares. However the value pale late within the session and has bounced alongside at decrease ranges ever since, ending Thursday down $4.26 at $61.96.

Its market valuation, simply over $8 billion, remains to be gorgeous for a social media fledgling with an unproven enterprise mannequin that has struggled to draw customers and advertisers, burned by way of money and wracked up losses.

“The valuation of the corporate ought to be a number of hundred million, not the billions it’s at the moment valued at,” College of Florida professor Jay Ritter stated.

Thursday’s slide into the crimson could possibly be only the start, market observers say. Ritter predicts the self-importance inventory ticker DJT will backside out round $2 a share – or worse.

“The inventory will proceed to be very risky, with sharp strikes up and down. However the long-term pattern can be down,” he stated. “The corporate has about $2 in money per share, however it should in all probability burn by way of that cash and the most definitely final result is eventual chapter.”

Trump additionally used a conceit ticker for his Atlantic Metropolis on line casino enterprise, Trump Lodges and On line casino Resorts, when it went public in 1995. The corporate by no means turned a revenue and ended up bankrupt in 2004.

Trump Media buying and selling like meme shares

Trump Media’s buying and selling has mimicked meme shares like GameStop and AMC Leisure, which rose to unbelievable heights in 2021 after particular person buyers organized on social media platform Reddit to drive up the inventory value. These buyers aimed to strike again in opposition to hedge funds that had wager in opposition to the corporate and shorted the inventory.

“It has all of the substances to be a risky inventory,” stated Jonathan Brogaard, a finance professor on the College of Utah who has researched meme shares.

What’s tough is predicting when a meme inventory will collapse, stated Derek Horstmeyer, a finance professor at George Mason College in Virginia, who focuses on company finance. The one hard-and-fast rule? “Ultimately, it does,” Horstmeyer stated.

Inventory value remains to be excessive: Is Trump Media overvalued?

Like typical meme shares, Trump Media is overvalued in contrast with different social media corporations, at the very least by standard Wall Road requirements. It recorded $3.3 million in income within the first 9 months of 2023 and a lack of $49 million, however its market worth is greater than 2,000 occasions its estimated annual income in comparison with Reddit at 10 occasions, Meta at 7 and Snap at 6.

“The one strategy to get to that quantity is to think about some form of immense progress within the platform,” stated Brent Goldfarb, a professor on the College of Maryland’s enterprise faculty and co-author of “Bubbles and Crashes,” a e-book on monetary market bubbles.

However Goldfarb sees “no path to profitability” for Reality Social.

“Except you consider that Reality Social is the subsequent Fb or TikTok, I don’t see a motive (for it to be valued this excessive),” he stated.

Reality Social trades on Trump model, following

Trump Media’s flagship product, Reality Social, trades on Trump’s persona and model and, whereas highly effective, that comes with dangers. Simply ask Trump Media.

Along with Trump’s “demise, incarceration or incapacity,” there’s his checkered enterprise historical past that features the chapter of the Trump Taj Mahal in 1991 and the Trump Lodges and Casinos Resorts chapter, in accordance with the chance components listed in a Trump Media regulatory submitting.

“A lot of corporations that had been related to President Trump have filed for chapter,” the submitting states.

Trump’s Reality Social has far fewer customers than Fb, TikTok

And, in contrast to different social media and tech corporations that commerce on the expectation of progress, the variety of customers of Reality Social has declined.

Trump Media was fashioned in 2021 after the previous president was barred from main social media platforms after the Jan. 6 assault on the Capitol. Reality Social debuted in 2022 as an alternative choice to Twitter, now often called X, and serves as Trump’s most well-liked bullhorn.

Final month, Reality Social had 5 million desktop and cell guests, in accordance with Similarweb, a knowledge and analytics firm. Fb, however, has 3 billion month-to-month energetic customers. Reality Social doesn’t launch person figures.

“The inventory is a strategy to put money into Trump. The ticker DJT just isn’t a coincidence in any means,” Goldfarb stated. “It’s a wonderfully above-board strategy to push cash into his pockets.”

Trump supporters are propping up inventory value

Trump supporters banded collectively on social media to carry the inventory even earlier than Trump Media accomplished the merger with Digital World Acquisition Corp., a particular goal acquisition firm, or SPAC, on Monday. It began buying and selling on Tuesday.

Teri Lynn Roberson, couldn’t care much less in regards to the enterprise fundamentals.

Roberson, 52, from the Dallas-Fort Value metroplex in Texas, stated she bought 5 shares of Trump Media at about $72 a pop, proper across the inventory value’s Monday peak, to indicate her help for the previous president.

“It’s primarily to help Trump and his authorized battles,” she stated.

Horstmeyer expects Reality Social’s inventory value to swing 10% or extra every day within the coming months. However as a result of the inventory’s value relies on sentiment, not exhausting metrics like income and money circulation, the sample is tough to anticipate.

“It might both go right down to $10 or as much as $150,” he stated. “The one factor I can predict is volatility.”

How a lot is Donald Trump price with DJT inventory positive factors?

Trump Media’s Nasdaq debut padded Trump’s wealth by about $5 billion – although solely on paper.

And cashing out gained’t be straightforward. Trump Media has restrictions that forestall insiders from promoting shares or utilizing shares as collateral for loans for at the very least six months.

The board which is stacked with Trump allies might waive these restrictions. It might additionally maintain a secondary providing to permit insiders an earlier alternative to promote.

The chance for Trump Media: If Trump sells shares, it might deflate the inventory value.

“Donald Trump has substantial paper wealth within the inventory, however the capability to show it into money is proscribed,” Ritter stated. “By the point that he can promote shares, the value is more likely to be within the single digits. And the extra shares that he sells, the decrease would be the value.”

This text initially appeared on USA TODAY: Reality Social slips into the crimson as Trump Media inventory hits turbulence