(Bloomberg) — When banks led by Morgan Stanley agreed in April to assist finance Elon Musk’s buy of Twitter Inc., they have been keen to assist an vital consumer, the richest individual on the earth. Now neither Musk nor the banks have an apparent technique to wriggle out of it.

Most Learn from Bloomberg

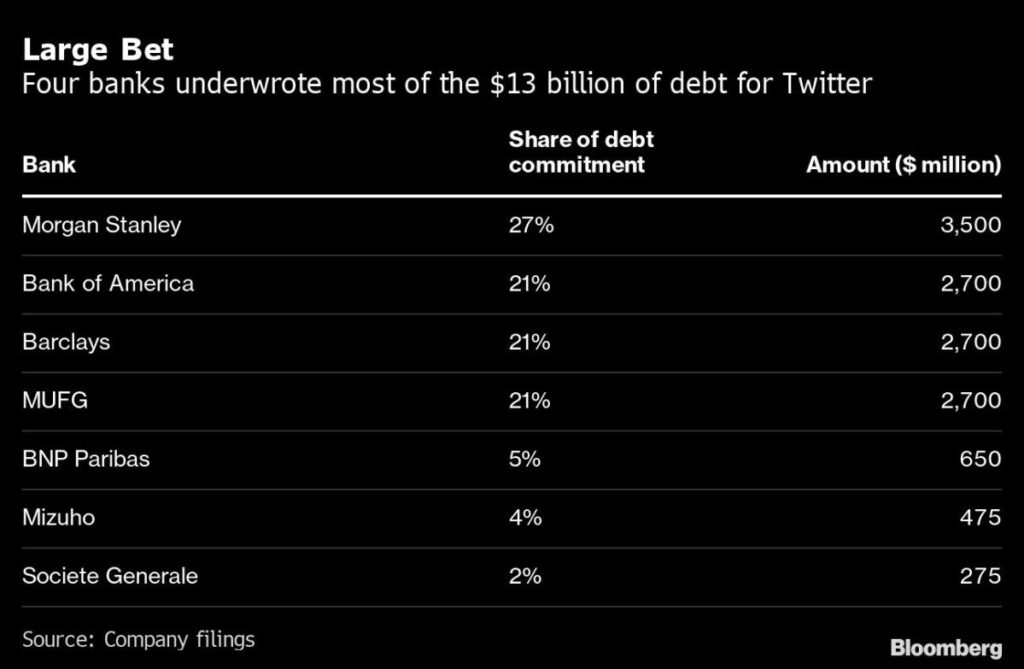

Lenders that additionally embrace Financial institution of America Corp., Barclays Plc and Mitsubishi UFJ Monetary Group Inc. dedicated to supply $13 billion of debt financing for the deal. Their losses would quantity to $500 million or extra if the debt have been to be bought now, in response to Bloomberg calculations. They agreed to fund the acquisition whether or not or not they have been in a position to offload the debt to exterior buyers, in response to public paperwork and attorneys who’ve checked out them.

“I feel that these banks wish to get out of it, I feel the deal makes much less sense for them now, and that the debt can be more durable to syndicate to buyers,” stated Howard Fischer, accomplice at regulation agency Moses Singer. However Fischer, a former senior trial counsel on the Securities and Change Fee who isn’t concerned in Twitter, stated there’s no authorized foundation for them to again out.

Junk bond and leveraged mortgage yields have surged since April, that means that banks will lose cash from having agreed to supply financing at decrease yields than the market will settle for now. Any ache the banks bear from this deal comes as lenders have already sustained billions of {dollars} of writedowns and losses this 12 months after central banks worldwide have began mountain climbing charges to tame inflation.

Even when the banks may discover consumers for Twitter debt out there now, which is much from sure, promoting bonds and loans tied to the deal most likely wouldn’t be doable earlier than the buyout closes.

Banks have a pipeline of round $50 billion of debt financings they’ve dedicated to supply within the coming months, in response to Deutsche Financial institution AG estimates. Whereas often banks would promote bonds and loans to fund these offers, buyers are much less keen to purchase now than they have been towards the start of the 12 months, and offloading this debt can be exhausting.

That’s forcing banks to supply the financing themselves on plenty of offers, a pressure on their earnings and capital necessities. For instance, lenders together with Financial institution of America and Barclays anticipate to should fund $8.35 billion of debt for the leveraged buyout of Nielsen Holdings subsequent week, Bloomberg reported on Tuesday.

Representatives for Morgan Stanley, Financial institution of America, Barclays, MUFG and Twitter declined to remark. A consultant for Musk didn’t instantly reply to a request for remark.

Means Out?

Banks could not have the ability to again out of the Twitter deal, however Musk has been making an attempt to. Twitter stated on Thursday that it’s doubtful of the billionaire’s guarantees to shut on the transaction. The corporate stated {that a} banker concerned within the debt financing testified earlier Thursday that Musk had but to ship them a borrowing discover, and had in any other case not communicated to them that he meant to shut the deal.

The shortage of a borrowing discover by itself isn’t essentially an issue. Often that doc comes towards the top of the method of closing on a purchase order, stated David Wicklund, a accomplice at Vinson & Elkins who focuses on complicated acquisition and leveraged financings. It’s usually submitted to banks two or three days earlier than closing, making it one of many final gadgets to be completed.

However main as much as the closing of a giant acquisition sometimes includes a blizzard of paperwork that needs to be negotiated between each events. There could also be 50 to 80 paperwork that get mentioned, Wicklund stated.

A Delaware decide stated on Thursday that if the transaction isn’t performed by October 28, she’s going to set new dates in November for the lawsuit between Twitter and Musk. That date comes from a submitting from Musk’s group that stated the banks wanted till then to supply the debt funding.

On Monday, Musk despatched Twitter a letter saying he would undergo along with his acquisition “pending receipt of the proceeds of the debt financing.” That made it appear to be there was some doubt as as to whether the banks would offer their promised financing, which grew to become a sticking level in negotiations between the corporate and the billionaire.

However in a courtroom doc on Thursday, Musk’s group stated that counsel for the banks “has suggested that every of their shoppers is ready to honor its obligations.”

Bonds, Loans

The banking group initially deliberate to promote $6.5 billion of leveraged loans to buyers, together with $6 billion of junk bonds cut up evenly between secured and unsecured notes. They’re additionally offering $500 million of a kind of mortgage known as a revolving credit score facility that they’d sometimes plan to carry themselves.

Of the greater than $500 million of losses that the banks are estimated to have on the Twitter debt, as much as about $400 million stems from the riskiest portion, the unsecured bonds, which have a most rate of interest for the corporate of about 11.75%, Bloomberg reported earlier this 12 months. The losses exclude charges the banks would often earn on the transaction.

The remainder of the losses are estimated primarily based on the place the utmost rates of interest would have been decided for the mortgage and secured bond when in comparison with the unsecured portion. The anticipated loss may in the end be greater or decrease.

The banking group is predicted to offer the money to Twitter and grow to be a lender to the soon-to-be extremely indebted social media big.

Morgan Stanley would maintain onto essentially the most at about $3.5 billion of debt, primarily based on the debt dedication letter:

The banks must mark down the debt primarily based on the place it could commerce within the secondary market, which might seemingly be at steep reductions to face worth, particularly for the riskiest parts. BNP Paribas, Mizuho and Societe Generale SA declined to remark. The banks can then wait till higher market situations and attempt to promote the debt to buyers at a later date, seemingly at a reduction to face worth.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.