Uncertainty is the phrase of the day, in reference to the near-term financial future. Sentiment will hinge on the inflation numbers due out subsequent week. March’s determine rose to three.5%, and April’s job numbers confirmed a marked slowing within the labor market; that mixture has stoked fears of stagflation.

However – company earnings from Q1 are beating expectations, and the inventory market has taken a flip for the higher with the S&P 500 closing slightly below 5,200 yesterday. Financial strategists are nonetheless optimistic that the Federal Reserve will transfer to chop rates of interest later this 12 months.

So, there are instances to be made for each the bears and the bulls proper now, making the atmosphere one tailor-made for astute inventory choosing.

With this in thoughts, the Morgan Stanley analysts are pounding the desk on two shares specifically, arguing they’re well-positioned to ship good-looking returns within the 12 months forward – in a single case, as a lot as 110%.

Utilizing the TipRanks platform, we’ve seemed up the big-picture view on each of those picks and it appears like the remainder of the Avenue agrees with the MS take – each are rated Robust Buys by the analyst consensus. Listed below are the small print, with feedback from the Morgan Stanley analysts.

Auna S.A. (AUNA)

We’ll begin within the healthcare sector, the place Auna is a number one supplier of healthcare providers in lots of the Spanish-speaking international locations in Latin America. Auna’s presence is especially sturdy in Mexico, Colombia, and Peru, and the corporate has constructed up one among Latin America’s largest – and most fashionable – healthcare networks.

By the numbers, Auna is spectacular. The corporate operates 31 healthcare services with a complete of two,308 in-patient beds and employs roughly 14,900 folks throughout its community. Auna can boast of 1.3 million plan memberships, a powerful buyer base, and brings in roughly $1 billion in annual income. The corporate makes use of a patient-centric mannequin that incentivizes preventative care and concentrates its assets within the remedy of ‘high-complexity ailments.’

This firm went public on the New York Inventory Trade in March of this 12 months, by means of an IPO that noticed 30 million class A shares go in the marketplace at $12 every. The providing introduced in $360 million in gross proceeds. In monetary releases related to the general public providing, Auna reported that 2023 revenues totaled US$1.05 billion, whereas adjusted EBITDA got here in at US$223 million. These totals had been up strongly year-over-year, by 58% and 90% respectively. Auna is the primary Latin American healthcare providers supplier to go public on Wall Avenue.

Protecting this newly public inventory for Morgan Stanley, Mauricio Cepeda sees a number of paths towards enlargement. He writes of Auna, “We see Auna increasing earnings in 2024 from 3 fundamental fronts: (i) the ramp-up of its hospital occupancy in Monterrey, from 42% to 47%, increasing the entire firm EBITDA by 11% (+PEN 88mn) given the relevance of the Mexican operation; (ii) further maturation of the enterprise in Peru and Colombia, and (iii) a deleveraging have an effect on from its sturdy OCF with little CAPEX want (natural section). In addition to, we see development avenues within the years forward to justify sturdy multiples, notably the chance to introduce well being plans in Mexico (mimicking the success in Peru) and the likelihood to proceed the ramp-up in Monterrey (which can have nearshoring upside).”

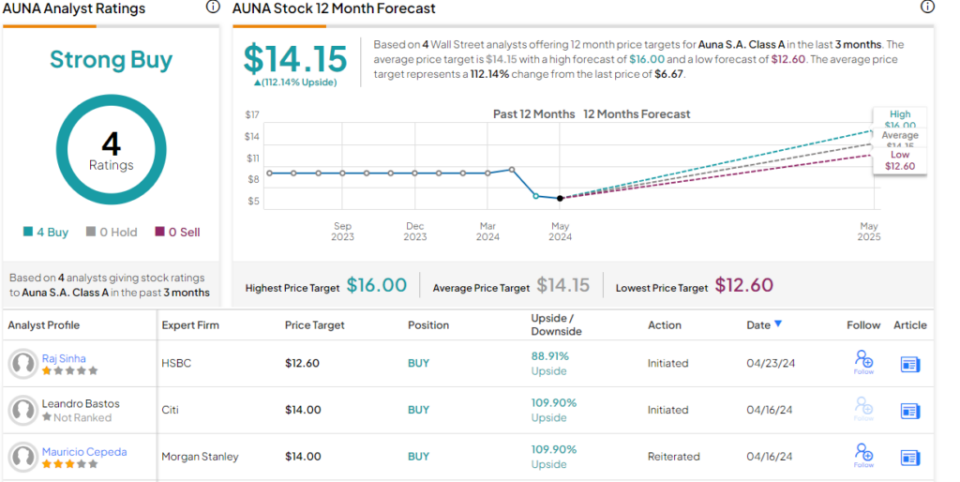

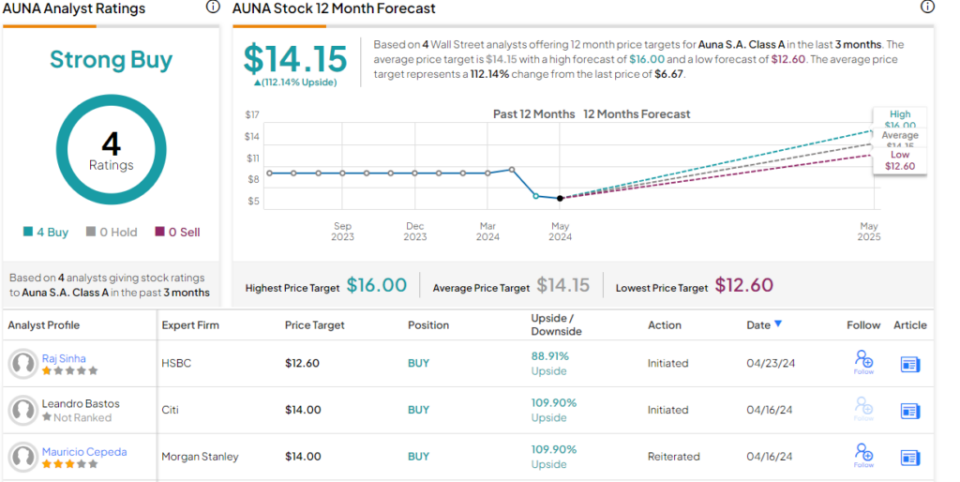

Cepeda’s views again up his Obese (Purchase) score on the inventory, and his $14 price-target factors towards a sturdy 110% upside potential for the following 12 months. (To observe Cepeda’s monitor report, click on right here)

General, it’s clear that Wall Avenue likes this new inventory; AUNA shares have picked up 4 latest analyst opinions of their quick time on the general public markets, and people opinions are all optimistic – for a unanimous Robust Purchase consensus score. The inventory is priced at $6.67, and its $14.15 common value goal is barely extra bullish than the MS take, suggesting a 112% achieve for the 12 months forward. (See AUNA inventory forecast)

Contineum Therapeutics (CTNM)

Subsequent up is Contineum Therapeutics, a San Diego-based biopharmaceutical agency engaged in clinical-stage analysis on neuroscience, irritation, and immunology indications. The corporate is working to develop novel small molecule therapeutic brokers to make use of as orally dosed remedies for neuroinflammatory ailments. This can be a class of illness circumstances with excessive unmet medical wants – that’s, present remedy choices will not be thought-about sufficiently efficient, and the sphere is extensive open for a biotech agency that may create new remedies.

At present, Contineum has two drug candidates in its analysis program, PIPE-791 and PIPE-307. The primary is an entirely owned asset, and the second is beneath improvement in collaboration with Johnson & Johnson. Every drug candidate confirmed promise in early testing, and every presently has two medical applications beneath manner or in preparation.

PIPE-791 is a small molecule antagonist of the lysophosphatidic acid 1 receptor (LPA1R), and is being developed as a possible remedy for 2 circumstances, idiopathic pulmonary fibrosis (IPF) in addition to progressive a number of sclerosis (MS). The drug is presently present process a Section 1 trial for the remedy of IPF; outcomes of this trial, which is on wholesome volunteers, shall be used to assist Section 1b trials in each IPF and progressive MS.

On the PIPE-307 monitor, the Section 1 trials on wholesome volunteers have been accomplished and the corporate has initiated a Section 2 trial within the remedy of RRMS. This drug candidate, like -791 above, additionally has potential in a second indication, this one within the remedy of melancholy. PIPE-307 is one other small molecule compound, and is a selective inhibitor of the muscarinic sort 1 M1 receptor (M1R).

Transferring drug candidates out of the early medical testing section into extra superior research doesn’t come low cost, and Contineum held an IPO in April of this 12 months to lift funds. The corporate put 6.9 million shares in the marketplace at an preliminary value of $16 every; this was a downgrade from the unique submitting, which known as for 8.8 million shares to go on sale priced within the vary of $16 to $18. Within the occasion, Contineum raised $110 million in gross proceeds.

This firm has attracted the eye of Morgan Stanley analyst Jeffrey Hung. The 5-star biotech professional sees -791 as the important thing level for traders to look at, however can be optimistic on PIPE-307. He writes of CTNM, “PIPE-791 has the potential to be best-in-class… Though Contineum’s information are comparatively early, we’re inspired by the corporate’s preclinical information suggesting PIPE-791 is ~30x stronger at decreasing LPA-induced collagen manufacturing than BMS-986278. We expect PIPE-791’s elevated receptor publicity with low dosing resulting from excessive oral bioavailability and low plasma protein binding may assist enhance its security profile… For PIPE-307, M1R antagonism is clinically validated in each melancholy and RRMS, and the partnership with JNJ additional validates Contineum’s strategy.”

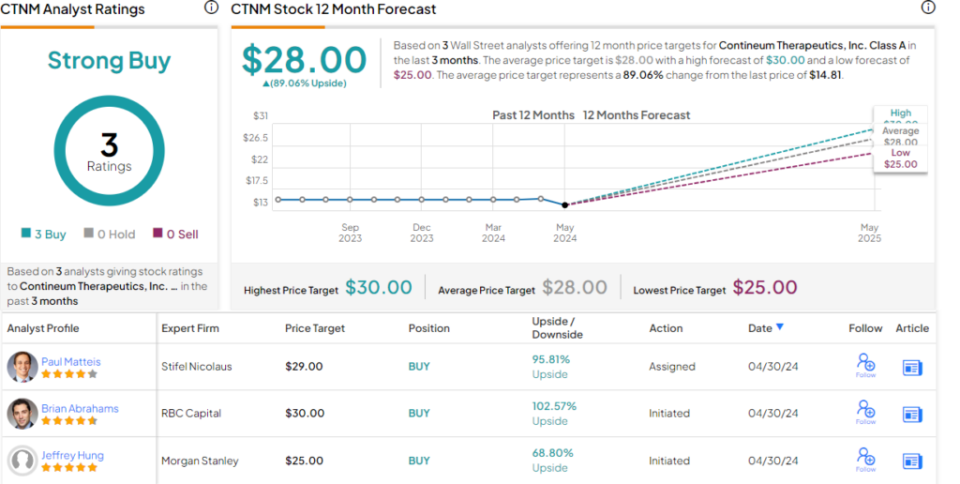

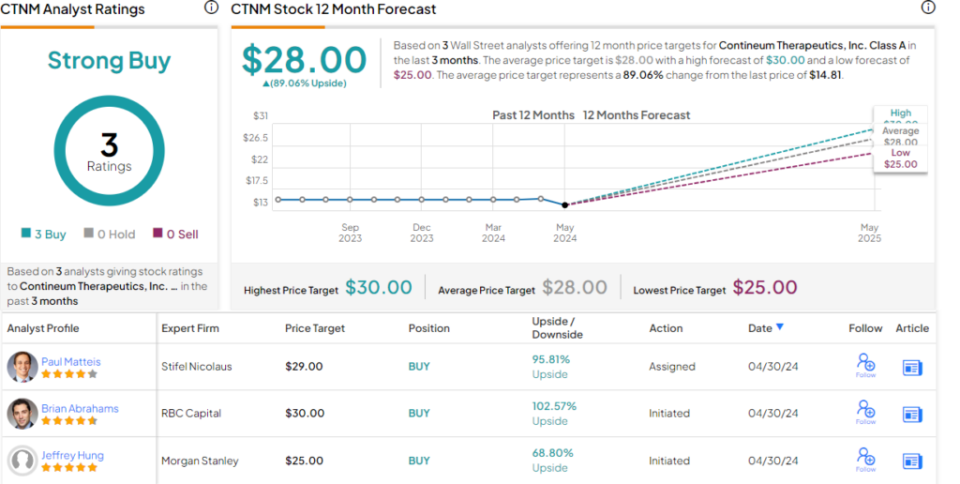

Hung goes on to place an Obese (Purchase) score on this inventory, and he enhances that with a $25 value goal, suggesting the shares have a 69% upside potential on the one-year horizon. (To observe Hung’s monitor report, click on right here)

That is one other inventory with a unanimous Robust Purchase consensus score, primarily based on 3 latest optimistic analyst opinions. Contineum’s shares are priced at $14.81 and have a mean goal value of $28, implying a powerful upside potential of 89%. (See CTNM inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally vital to do your personal evaluation earlier than making any funding.