(Bloomberg) — US shares are ripe for a selloff after prematurely pricing in a pause in Federal Reserve fee hikes, in response to Morgan Stanley strategists.

Most Learn from Bloomberg

“Whereas the current transfer greater in front-end charges is supportive of the notion that the Fed could stay restrictive for longer than appreciated, the fairness market is refusing to simply accept this actuality,” a group led by Michael Wilson wrote in a notice.

Wilson — the top-ranked strategist in final 12 months’s Institutional Investor survey — expects deteriorating fundamentals, together with Fed hikes which might be coming similtaneously an earnings recession, to drive equities to an final low this spring. “Worth is about as disconnected from actuality because it’s been throughout this bear market,” the strategists mentioned.

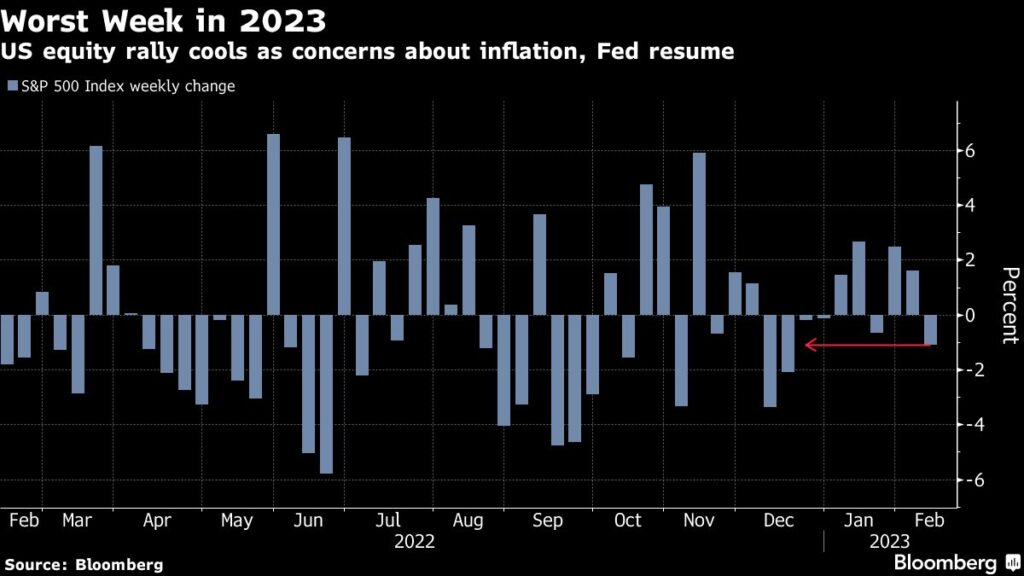

Final week, yields on US two-year notes exceeded 10-year yields by probably the most for the reason that early Nineteen Eighties, an indication of flagging confidence within the economic system’s potential to resist extra fee will increase. In the meantime, US equities have seen one of many strongest begins to a 12 months on file, although the rally has began to chill as Fed Chair Jerome Powell’s outlook for additional fee will increase weighed on sentiment.

US inflation knowledge might be a catalyst to deliver buyers again to actuality, and get shares in step with bonds once more, if costs rose greater than anticipated, Wilson mentioned, whereas noting that expectations for such a outcome have been rising. The information on Tuesday is predicted to indicate shopper costs elevated 0.5% in January from a month earlier, spurred by greater gasoline prices. That will mark the most important acquire in three months.

Wilson sees the S&P 500 ending the 12 months at 3,900 index factors, about 4.7% under the place the gauge closed on Friday, with a tough trip to get there. He expects shares to fall as earnings estimates come down, earlier than rebounding within the second half of the 12 months.

Wilson, a staunch Wall Road bear, accurately predicted final 12 months’s selloff when US equities posted their worst efficiency since 2008.

“The danger-reward is as poor because it’s been at any time throughout this bear market,” Wilson wrote. “The truth for equities is that financial coverage stays in restrictive territory within the context of an earnings recession that has now begun in earnest.”

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.