(Bloomberg) — Morgan Stanley’s long-time equities bear says US shares are ripe for a short-term rally within the absence of an earnings capitulation or an official recession.

Most Learn from Bloomberg

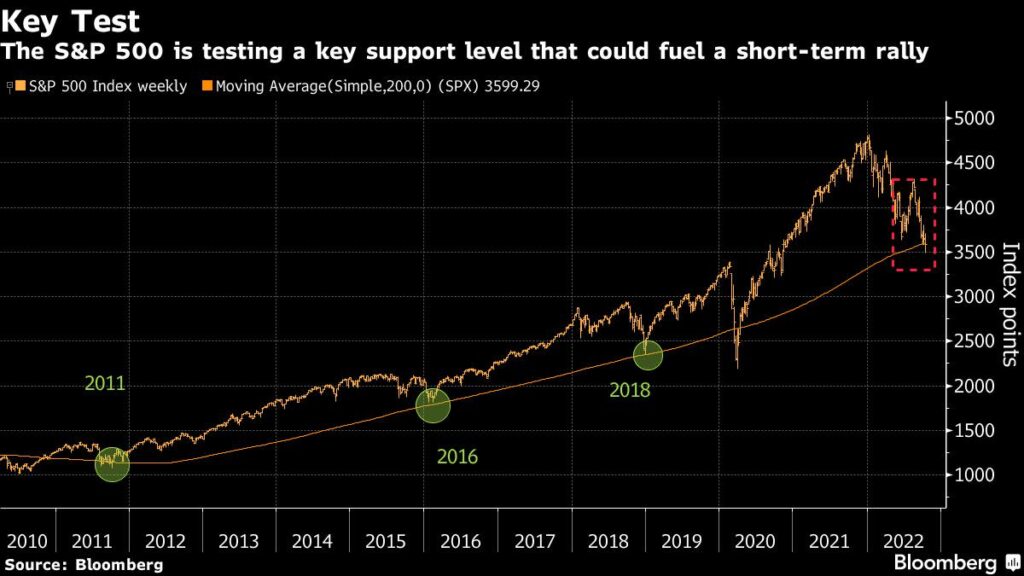

A 25% hunch within the S&P 500 this 12 months has left it testing a “critical flooring of assist” at its 200-week transferring common, which may result in a technical restoration, strategist Michael J. Wilson wrote in a be aware on Monday.

Wilson — one in all Wall Avenue’s most distinguished bearish voices, who appropriately predicted this 12 months’s hunch — stated he “wouldn’t rule out” the S&P 500 rising to about 4,150 factors — suggesting 16% upside from its newest shut. “Whereas that looks like an awfully large transfer, it might be according to bear market rallies this 12 months and prior ones,” he stated, whereas retaining his total unfavourable long-term stance on equities.

US equities have been hammered in 2022, with the S&P 500 set for its largest annual decline for the reason that international monetary disaster, as buyers concern that historic inflation mixed with a hawkish Federal Reserve and slowing progress would tip the financial system right into a recession.

An increase in core client costs to a 40-year excessive final month has cemented bets of one other aggressive Fed price hike in November, however Wilson stated he believes inflation has now peaked and “may fall quickly subsequent 12 months.” Nonetheless, the strategist stated he expects “an acute and materials earnings deceleration” over the following 12 months.

Wilson additionally warned that though it normally takes a “full-blown recession” for the S&P 500 to fall beneath the important thing 200-week transferring common, if the index fails to carry that degree this time round, the rally might not materialize in any respect. As a substitute, the benchmark may hunch to three,400 factors or decrease — at the least 5% beneath its Friday shut, he stated. Finally, he sees the bear market bottoming round 3,000-3,200 factors.

Goldman Sachs Group Inc. strategists, in the meantime, stated the S&P 500 stays costly versus historical past and accounting for rates of interest. But they see engaging alternatives in shares linked to faster money move technology, worth, worthwhile progress, cyclicals and small caps, the strategists together with David J. Kostin wrote in a be aware dated Oct. 14.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.