A take a look at the day forward in U.S. and international markets from Mike Dolan

The ultimate week of a turbulent month and unstable quarter for world markets has kicked off with relative stability within the battered banking sector on the coronary heart of the most recent upheaval.

Two developments on the U.S. facet of the banking disturbance acted as a boon.

First Residents BancShares (FCNCA.O) mentioned on Monday it’ll purchase all of the loans and deposits of failed U.S. lender Silicon Valley Financial institution. Clients retain entry to their accounts, the North Carolina-based financial institution mentioned, and branches open on Monday.

Secondly, studies circulated on the weekend that U.S. authorities are contemplating increasing the Federal Reserve’s emergency lending program that may supply banks extra help, in an effort that might give First Republic Financial institution (FRC.N) extra time to shore up its steadiness sheet.

First Republic’s shares jumped 25% earlier than the bell on Monday, with the broader S&P500 inventory futures up 0.3%. With few recent weekend developments on the European financial institution inventory rigor late final week, European bourses and financial institution shares discovered a stage too.

Deutsche Financial institution, whose inventory lurched decrease on Friday amid fears about rising financial institution funding prices, regained about 3% on Monday. UBS, in the course of a shotgun marriage with failed rival Credit score Suisse, edged 1% decrease.

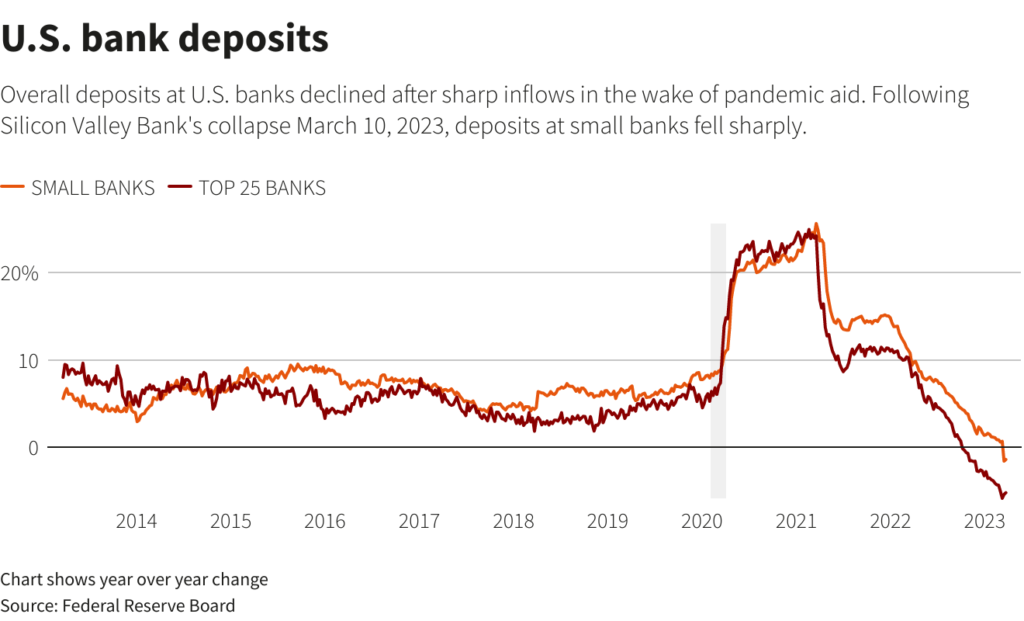

On the coronary heart of the U.S. downside stays depositor flight from smaller banks towards their greater and higher regulated rivals – and to cash market funds, which have seen an influx of greater than $300 billion previously month to a report $5.1 trillion.

Deposits at small banks fell by $120 billion within the week to March 15, whereas borrowing jumped $253 billion.

Many analysts now see the one viable answer as both huge rises in deposit charges at smaller banks – the place deposit charges lagged sharp Fed price rises earlier than the disaster hit – or a extreme cutback on lending that might seed a credit score crunch within the wider financial system, or each.

These kinds of strikes to money cash funds have previously prompted the Fed to ease financial coverage. And futures now present a two thirds likelihood the Fed stands pat in Could, whereas a July lower is priced at about 90%.

U.S. two-year Treasury yields nudged greater 3.88% on Monday, however the yield curve between three months and 10 years briefly dipped to its most inverted stage in 42 years – signalling heightened fears of recession forward.

The conundrum for central banks is that inflation stays excessive even because the banking stress mounts. Fed officers will watch the discharge on Friday of core PCE inflation information for February whereas March numbers for the euro zone are due out this week too.

Economists polled by Reuters anticipate the headline year-on-year inflation price to have cooled to 7.2% from 8.5% in February. However they see the core price – which strips out unstable meals and power costs – hitting a brand new report of 5.7%.

Above-forecast German enterprise exercise readings for March solely provides to the coverage headache, as does waves of labour strikes throughout Europe’s greatest financial system.

U.S. core PCE is predicted to have caught at 4.7% final month.

Key developments which will present course to U.S. markets afterward Monday:

* U.S. March Dallas Fed manufacturing survey

* U.S. Federal Reserve Board Governor Philip Jefferson speaks; Financial institution of England governor Andrew Bailey speaks; European Central Financial institution board member Isabel Schnabel speaks in NY.

* U.S. Treasury auctions 2-year notes

* U.S. company earnings: Carnival

By Mike Dolan, modifying by Ed Osmond, <a href=”mailto:mike.dolan@thomsonreuters.com” goal=”_blank”>mike.dolan@thomsonreuters.com</a>. Twitter: @reutersMikeD

: .

Opinions expressed are these of the writer. They don’t replicate the views of Reuters Information, which, beneath the Belief Ideas, is dedicated to integrity, independence, and freedom from bias.