April 18 (Reuters) – A take a look at the day forward in Asian markets from Jamie McGeever.

Traders’ concentrate on Tuesday rests squarely on China: From an financial and market perspective, eyes are on a raft of information together with first-quarter GDP; whereas the most recent twist in souring U.S.-Sino relations will do little to ease geopolitical considerations.

U.S. legislation enforcement officers on Monday arrested two New York residents for allegedly working a Chinese language “secret police station” in Manhattan’s Chinatown, a part of a crackdown on Beijing’s alleged focusing on of U.S.-based dissidents.

Additionally on Monday, U.S. prosecutors unveiled costs towards 34 Chinese language officers for allegedly working a “troll farm” and harassing dissidents on-line, together with by disrupting their conferences on U.S. expertise platforms.

This comes amid rising pressure between the world’s two superpowers, most not too long ago over Taiwan. A U.S. warship sailed by the Taiwan Strait on Sunday, simply days after China ended its newest struggle video games across the island.

Traders are reacting with their ft. Massive world cash managers dumped Chinese language equities in latest days, whereas including U.S. power shares to portfolios at a near-record tempo, in keeping with a Goldman Sachs report.

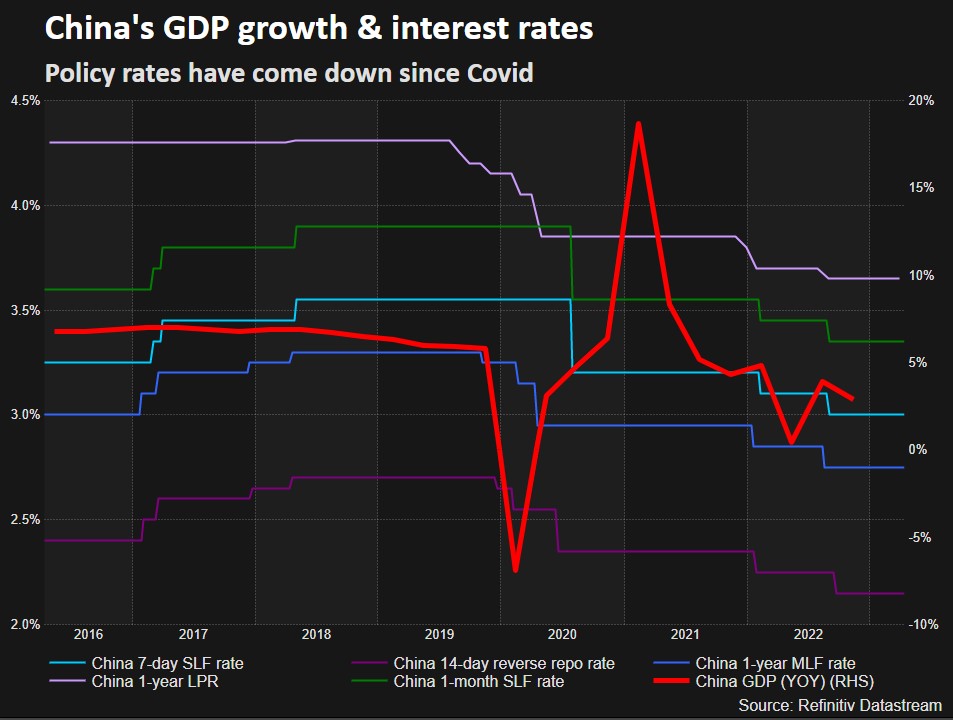

If it have been solely right down to the financial numbers popping out of China, buyers may be reacting in another way. By many measures, the nation’s re-opening from almost three years of Covid lockdown has gone higher than anticipated – China’s financial surprises index final week hit a 17-year excessive.

Figures on Tuesday are anticipated to indicate gross home product increasing 4.0% from a yr in the past and rising 2.9% from the October-December interval.

The annual readings of progress in city funding, industrial output and retail gross sales for March are all seen rising strongly too, particularly retail gross sales – economists count on a 7.4% rise, greater than double February’s 3.5% enhance.

Indonesia’s central financial institution, in the meantime, is extensively anticipated to go away its key rate of interest unchanged at 5.75% for a 3rd consecutive assembly, and for the remainder of 2023.

Though inflation has been cooling since September, March’s studying of 4.97% was nonetheless above Financial institution Indonesia’s goal vary of two%-4%. Policymakers are assured, nonetheless, that earlier tightening will get it again to focus on later this yr.

Listed here are three key developments that would present extra route to markets on Tuesday:

– Chinese language ‘knowledge dump’

– Indonesia central financial institution coverage determination

– U.S. Q1 earnings season picks up tempo

By Jamie McGeever;

: .

Opinions expressed are these of the writer. They don’t mirror the views of Reuters Information, which, beneath the Belief Ideas, is dedicated to integrity, independence, and freedom from bias.