A take a look at the day forward in U.S. and world markets from Mike Dolan

The Federal Reserve’s willingness to finish its rate of interest rise marketing campaign right here hinges just some high-frequency knowledge factors over the months forward – and April’s inflation readout sits excessive on that checklist.

With markets edgy concerning the U.S. debt ceiling standoff and ongoing ripples from the March regional banking blow out, the working assumption is the Fed’s marketing campaign is over and disinflation underway.

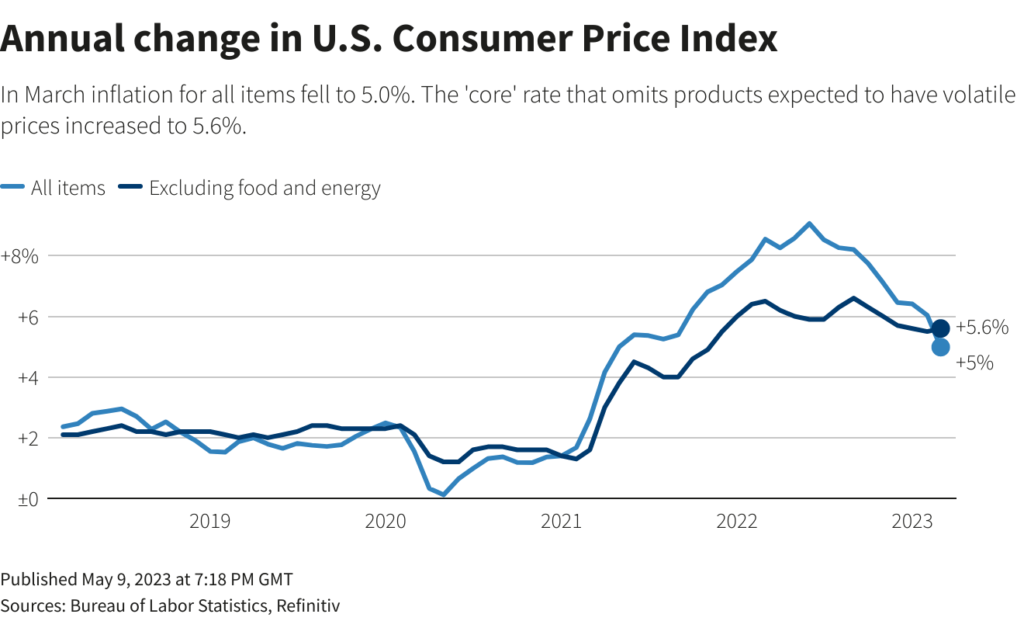

Fed officers are loath to confess that publicly nonetheless, preferring proof that the inflation dragon has certainly been slayed on condition that headline and “core” inflation charges are nonetheless working at greater than twice the two% goal.

And so Wednesday’s shopper worth snapshot types a major a part of that rolling image.

New York Fed chief John Williams mentioned yesterday it is too quickly to say the central financial institution is completed and dusted. “We’ve not mentioned we’re accomplished elevating charges,” he mentioned. “If further coverage firming is suitable, we’ll try this.”

If consensus forecasts are right, the April inflation readout in a while Wednesday could nicely drive the Fed to maintain that equivocal line up for a bit longer. Annual inflation is predicted to stay at March’s close to two-year low of 5.0% – whereas the upper core price, excluding meals and power costs, is about to ebb a tenth of some extent to five.5%.

However markets seem joyful to leap the gun once more. Futures markets present solely a 15% likelihood of one other Fed hike subsequent month, with quarter level price minimize virtually absolutely priced by September.

Visibility is low within the mounted revenue market, nonetheless, because of the debt ceiling deadlock.

Although Tuesday’s assembly between U.S. President Joe Biden and Congressional leaders was seen as constructive within the face of a good June 1 deadline for presidency coffers to run dry – and so they agreed to set additional talks in movement for later this week – the Treasury invoice market continued to gyrate.

One-month invoice yields that cross that June 1 crunch level <US1MT=TWEB rose by greater than 25 foundation factors to as a lot as 5.80%, hitting its highest since not less than August 2001 – greater than half some extent increased than the higher finish of the Fed’s present coverage price band and the 2-month invoice price.

U.S. 2-year Treasury yields nudged again above 4% forward of the CPI launch later.

Treasury Secretary Janet Yellen now heads to Japan’s G7 finance assembly this week forward of the Hiroshima leaders summit on Could 19.

In broader markets, the S&P500 futures had been flat to detrimental after a hefty half p.c loss on Tuesday. The VIX volatility gauge was increased at 18, the greenback was firmer and oil costs decrease.

China shares underperformed earlier, with this week’s poor import numbers combining with underwhelming company earnings.

Additionally unnerving traders is a sweeping crackdown on due diligence companies and consultancies in China. Reuters reported CICC Capital, a unit of main Chinese language funding financial institution China Worldwide Capital Corp (3908.HK), stopped utilizing consultancy Capvision, following an investigation into the latter on nationwide safety.

In Europe, shares of Credit score Agricole (CAGR.PA) gained 5.3% after France’s second-biggest listed financial institution beat first-quarter earnings estimates on a lift from buying and selling income.

In politics, former U.S. President and attainable candidate in subsequent 12 months’s White Home election Donald Trump was instructed by a jury to pay $5 million in damages for sexually abusing journal author E. Jean Carroll within the Nineteen Nineties after which defaming her by branding her a liar.

Occasions to look at for on Wednesday:

* U.S. April shopper worth index, April U.S. Federal Finances

* U.S. Treasury auctions 10-year notes

* U.S. corp earnings: Walt Disney

By Mike Dolan, modifying by XXXX <a href=”mailto:mike.dolan@thomsonreuters.com” goal=”_blank”>mike.dolan@thomsonreuters.com</a>. Twitter: @reutersMikeD

: .

Opinions expressed are these of the creator. They don’t mirror the views of Reuters Information, which, below the Belief Ideas, is dedicated to integrity, independence, and freedom from bias.