March 24 (Reuters) – A have a look at the day forward in Asian markets from Jamie McGeever.

Asian markets spherical off the week with Japanese inflation and PMI information more likely to be the principle native drivers on Friday, providing route that’s unlikely to return from one more uneven day in U.S. markets on Thursday.

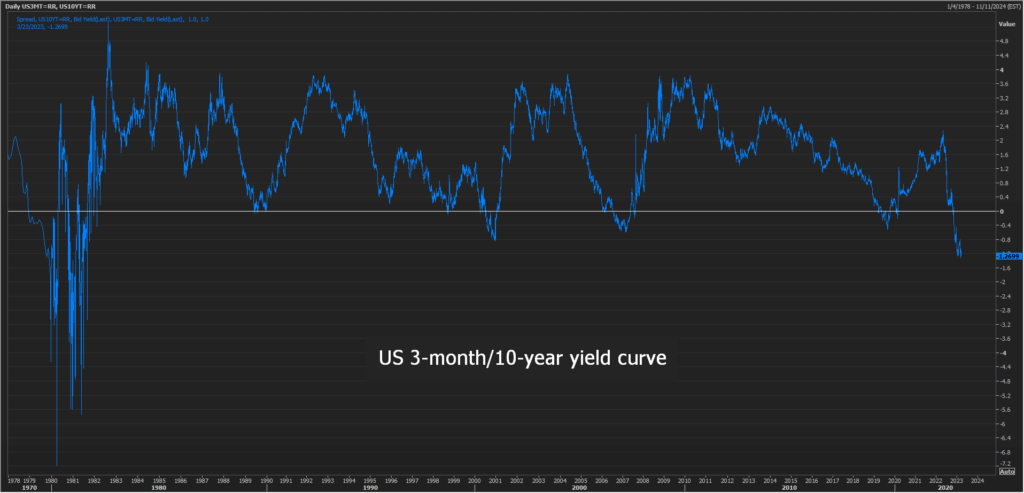

Wall Road rose – though ended up off its highs – however financial institution shares slumped to the bottom since 2020; key elements of the U.S. yield curve steepened, however the three month/10-year section is its flattest and most inverted since 1981; market-based inflation expectations fell, however so did Fed price expectations.

Charges markets are actually pricing in round 100 foundation factors of Fed easing this 12 months, one thing Fed Chair Jerome Powell mentioned on Wednesday is unquestionably not the central financial institution’s base case state of affairs.

The uncertainty is rooted in what impression the banking disaster could have on U.S. credit score circumstances within the coming months, and by extension on financial exercise and inflation. As Powell said baldly on Wednesday: “We merely do not know.”

Treasury Secretary Janet Yellen did know that she had a second likelihood on Thursday to assuage issues amongst traders and the broader public about whether or not authorities will transfer in direction of guaranteeing all financial institution deposits.

She advised a Home committee she is ready to take additional actions to make sure financial institution deposits are secure, a day after telling a Senate committee blanket insurance coverage was not on the agenda. It may not be on a par with Powell’s assurances – financial institution shares nonetheless fell – however maybe sentiment will enhance on Friday.

So Asia opens on Friday to firmer world shares, decrease yields, combine U.S. yield curves, larger world charges after the UK and Swiss hikes – however a rising sense that the world coverage peak is in sight – a rising greenback, and a notably stronger yen.

Japanese annual core inflation in February is predicted to have fallen sharply to three.1% from a 41-year excessive of 4.2% the month earlier than, because of authorities subsidies for fuel and electrical energy payments to cushion rising dwelling prices.

However many economists say broader worth pressures stay sturdy all through the economic system, which might pressure the Financial institution of Japan to part out or scrap its yield curve management coverage quickly.

Listed here are three key developments that would present extra route to markets on Friday:

– Japan shopper worth inflation (February)

– Japan flash PMIs (March)

– Australia flash PMIs (March)

By Jamie McGeever;

: .

Opinions expressed are these of the writer. They don’t mirror the views of Reuters Information, which, below the Belief Ideas, is dedicated to integrity, independence, and freedom from bias.