April 5 (Reuters) – A take a look at the day forward in Asian markets from Jamie McGeever.

A smattering of inflation knowledge, PMIs and an rate of interest choice will seize traders’ consideration within the Asian session on Wednesday, in opposition to an more and more gloomy backdrop following the newest warning that the U.S. economic system is dropping steam.

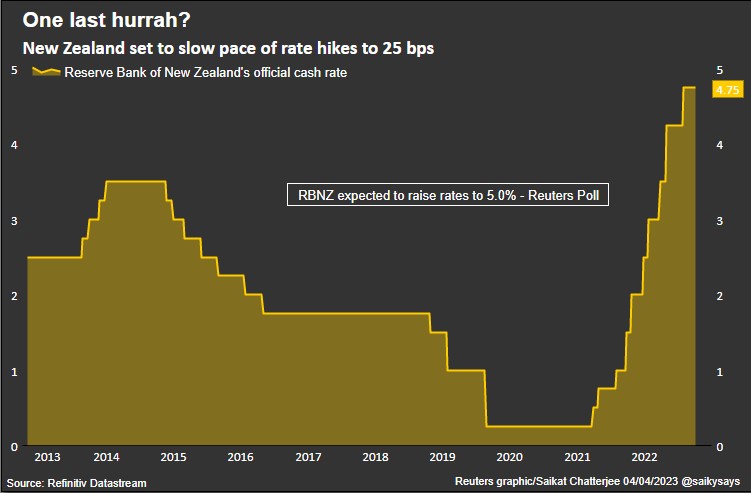

Annual shopper value inflation within the Philippines and Thailand is predicted to gradual; buying managers index surveys for Japan, Australia and India will likely be launched; and New Zealand’s central financial institution is predicted to gradual the tempo of charge hikes to 25 foundation factors.

Buyers go into Wednesday on the defensive. U.S. shares, the greenback and Treasury yields all dived on Tuesday after figures confirmed a shock fall in U.S. job openings to the bottom degree in practically two years.

The month-to-month ‘JOLTS’ report comes a day after figures confirmed that not solely did U.S. manufacturing exercise shrink in March at its quickest tempo in three years, all elements of the Institute for Provide Administration’s survey fell under the 50 development/contraction threshold for the primary time since 2009.

World manufacturing facility exercise and international demand are weakening.

Charges markets not count on the Fed to boost charges once more and are pricing in 75 foundation factors of easing this yr. However falling yields and elevated charge reduce expectations aren’t supporting shares and danger belongings – recession fears are rising.

If the Fed does pause tightening marketing campaign, will probably be following the Reserve Financial institution of Australia, which stored its money charge unchanged at 3.6% to interrupt a run of 10 straight hikes.

Australian policymakers stated they need time to evaluate the influence of previous will increase because the economic system slows and inflation peaks. An analogous message may come from the Reserve Financial institution of New Zealand on Wednesday, though it’s nonetheless anticipated to hike by 25 bps.

Buyers will scrutinize the accompanying commentary for any hints of an finish to its tightening cycle. A slowing U.S. and international economic system, and reverberations of final month’s banking shock, may tempt policymakers to ease up sooner slightly than later.

Listed below are three key developments that might present extra course to markets on Wednesday:

– New Zealand rate of interest choice

– The Philippines inflation (March)

– Thailand inflation (March)

By Jamie McGeever; Enhancing by Josie Kao

: .

Opinions expressed are these of the creator. They don’t replicate the views of Reuters Information, which, underneath the Belief Rules, is dedicated to integrity, independence, and freedom from bias.