April 4 (Reuters) – A take a look at the day forward in Asian markets from Jamie McGeever.

Australia’s central financial institution takes middle stage on Tuesday with its newest rate of interest choice, and past that, if the second buying and selling day of the quarter is as eventful as the primary, then traders’ plates will probably be additional full.

Oil costs posted the largest rise in a 12 months on Monday following a shock output reduce from OPEC+ over the weekend, a hunch in U.S. bond yields within the wake of recession-level manufacturing sector knowledge and a steep slide in Tesla shares after sluggish gross sales progress figures.

Wall Road took the ‘unhealthy information is nice information’ place on that, nonetheless: decrease yields and implied rates of interest, coupled with buoyant power shares, ensured the Dow and S&P 500 closed within the inexperienced – the Dow rising 1%.

Tesla’s 6% hunch dragged the Nasdaq into the purple, however the broader index’s decline was nonetheless solely 0.27%.

Not solely did U.S. manufacturing exercise in March shrink at its quickest tempo in practically three years, all parts of the Institute for Provide Administration’s survey fell beneath the 50 progress/contraction threshold for the primary time since 2009.

The renewed fall in U.S. Treasury yields – they fell 5 to 10 foundation factors throughout the curve on Monday – continued to weigh on the greenback.

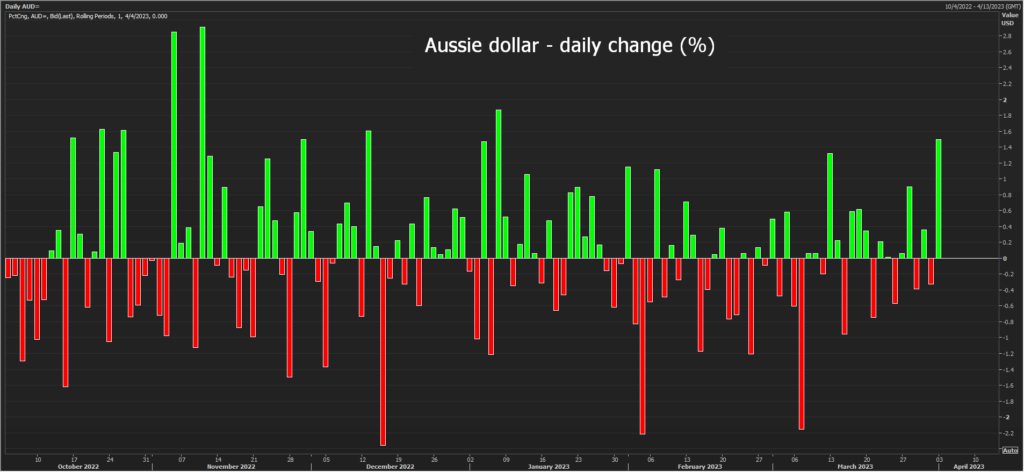

The most important gainer on the dollar was the Australian greenback – up 1.5% for its greatest day in three months – forward of the Reserve Financial institution of Australia’s coverage choice on Tuesday.

Rate of interest futures markets are attaching a near-90% likelihood to policymakers retaining the benchmark money price unchanged at 3.60%, placing the year-long mountaineering cycle on maintain a minimum of for now.

Economists polled by Reuters usually are not fairly as satisfied – 21 of 37 are forecasting a 25 foundation level improve to three.85%, and the remaining 14 are going for a pause.

Elsewhere in Asia on Tuesday, South Korea releases inflation figures for March. Economists polled by Reuters anticipate month-to-month and annual inflation charges to gradual.

Japan’s financial base has exploded past all recognition lately because of vital financial stimulus and injections of liquidity into the monetary system from the Financial institution of Japan, so the month-to-month figures not often draw a lot consideration.

Which may change with the March numbers on Tuesday although, in gentle of U.S. figures final week that confirmed U.S. cash provide falling at its quickest price because the Thirties.

Japan’s financial base has really been shrinking each month since September, on a year-on-year foundation.

Listed below are three key developments that would present extra route to markets on Tuesday:

– Australia rate of interest choice

– South Korea inflation (March)

– Japan financial base (March)

By Jamie McGeever; Enhancing by Josie Kao

: .

Opinions expressed are these of the writer. They don’t mirror the views of Reuters Information, which, beneath the Belief Rules, is dedicated to integrity, independence, and freedom from bias.