(Bloomberg) — Federal Reserve officers concluded earlier this month that the central financial institution ought to quickly average the tempo of interest-rate will increase to mitigate dangers of overtightening, signaling they have been leaning towards downshifting to a 50 basis-point hike in December.

Most Learn from Bloomberg

“A considerable majority of contributors judged {that a} slowing within the tempo of improve would doubtless quickly be acceptable,” based on minutes from their Nov. 1-2 gathering launched Wednesday in Washington.

As well as, whereas Chair Jerome Powell stated throughout his post-meeting press convention that charges will most likely in the end go increased than officers’ September forecasts indicated, Wednesday’s report gave a extra nuanced take: “Numerous” officers — a descriptor not generally used within the minutes — had concluded that charges would in the end peak at a better stage than beforehand anticipated.

In one other revelation, Fed workers informed officers through the gathering that their evaluation of the dangers of a recession had grown to virtually 50-50. That was the primary such warning for the reason that central financial institution started elevating charges in March.

US shares and Treasuries rallied whereas the greenback fell following the report, as buyers took a dovish message from the minutes.

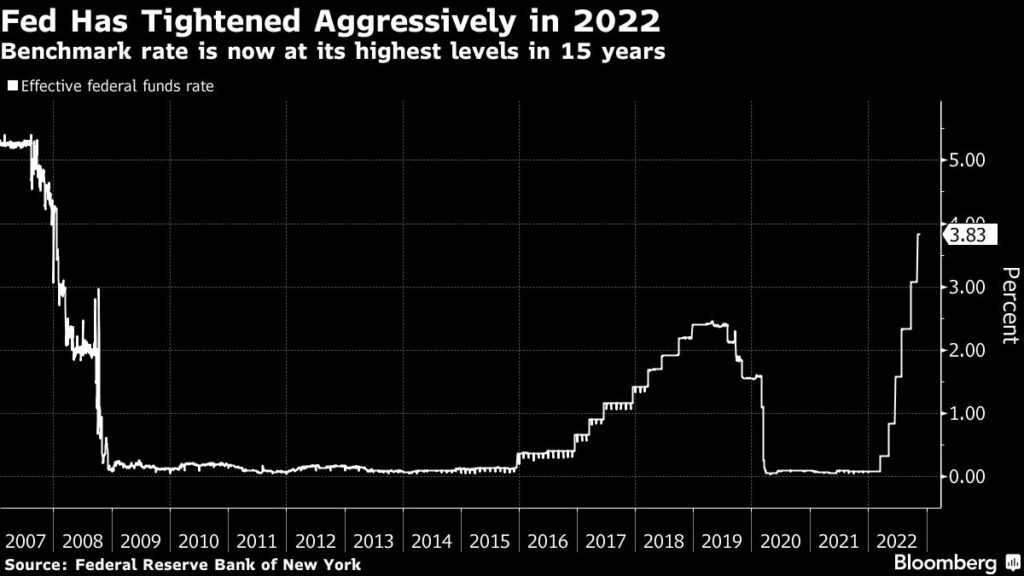

On the assembly, officers raised the benchmark price 75 foundation factors for a fourth straight time to three.75% to 4%, extending probably the most aggressive tightening marketing campaign for the reason that Nineteen Eighties to fight inflation at a 40-year excessive.

Ellen Meade, a former Fed Board economist who researched communication, stated the phrase “varied” is a not often used time period deployed when ambiguity is required.

“If the minutes had stated ‘a number of’ individuals thought the terminal price could be increased — that’s not a powerful message,” she stated. “In order that they wanted to fuzz it up.”

Buyers anticipate the Fed to lift charges by 50 foundation factors once they meet Dec. 13-14 and see charges peaking round 5% by mid-2023. Powell has an opportunity to affect these expectations in a speech in Washington scheduled for Nov. 30.

Strategically, Meade expects Powell to proceed to lean towards easing monetary situations and considerably resilient financial information.

“They’ve been anticipating the financial system to have slowed a bit. It has however not as a lot as they’ve been anticipating,” stated Meade who’s now a analysis professor at Duke College’s economics division. “They will’t cease the speed will increase till they see some measured proof that the financial system is slowing.”

Officers mentioned the results of lags in financial coverage and the results on the financial system and inflation, and the way quickly cumulative tightening would start to impression spending and hiring. Various Fed officers stated a slower tempo of price will increase would permit the central bankers to guage progress on their targets.

What Bloomberg Economics Says…

“The FOMC minutes reveal a surprisingly robust dovish tendency on the committee in addition to on the workers stage. There’s widespread settlement throughout the committee to gradual the tempo of charges hikes — a view championed by Vice chairwoman Lael Brainard, in our view — however little conviction on how excessive charges ought to go.”

— Anna Wong, chief US economist

Click on right here for the total be aware

“The unsure lags and magnitudes related to the results of financial coverage actions on financial exercise and inflation have been among the many causes cited relating to why such an evaluation was necessary,” the minutes stated.

The Fed stated in its coverage assertion that charges would proceed rising to a “sufficiently restrictive” stage, whereas taking account of cumulative tightening and coverage lags.

Learn extra: Key Takeaways From Minutes of Fed’s November Assembly on Charges

Officers in September noticed charges reaching 4.4% by the top of this 12 months and 4.6% in 2023. They’ll replace these quarterly forecasts at their Dec. 13-14 assembly.

For the reason that November gathering, financial information have proven modest progress with some indicators of slowing inflation amid nonetheless robust demand for labor. Employers added 261,000 jobs final month and the unemployment price rose barely to three.7%, although it stays very low on a historic foundation.

Monetary situations have additionally eased for the reason that early November price improve, with decrease yields on authorities 10-year notes and better US fairness markets.

“The large image stays in our view that the Fed intends to decelerate with a purpose to permit extra time for lags to function and cumulative tightening to this point to point out up within the information,” Evercore ISI’s head of central financial institution technique Krishna Guha wrote in a be aware to purchasers. “The hawkish discuss from Powell within the press convention and plenty of Fed officers subsequently is meant to offer air cowl for the slowing to happen with out an extreme easing of economic situations.”

–With help from Matthew Boesler, Chris Middleton and Catarina Saraiva.

(Updates with analyst response in sixth paragraph.)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.