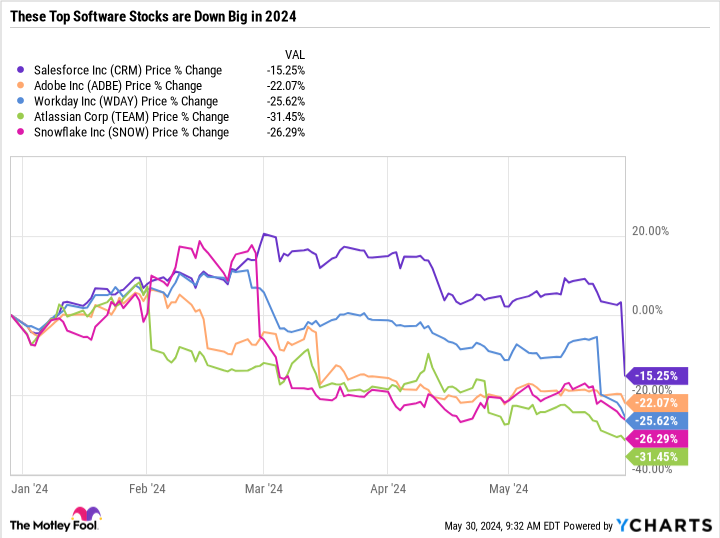

Salesforce (NYSE: CRM) inventory obtained clobbered on Could 30, a day after posting weak second-quarter fiscal 2025 steering. Salesforce and different prime software program shares — from Adobe to Workday, Atlassian, Snowflake, and others are hovering round their lowest ranges to this point this yr. The sell-off in software program software and infrastructure corporations, that are part of the tech sector, might come as a shock, given the power of the semiconductor business.

Here is what’s driving the sell-off throughout software program shares, why it presents a purple flag for the broader market rally, and a easy exchange-traded fund (ETF) to contemplate if you wish to purchase the dip within the area.

Salesforce is slowing down

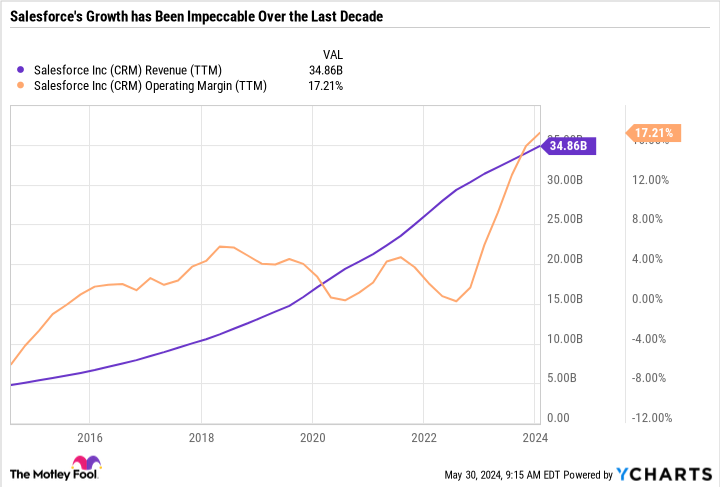

Salesforce is synonymous with progress. The software-as-a-service (SaaS) firm delivered breakneck progress regardless of the market cycle. Over the past decade, Salesforce remodeled itself from a $5 billion annual income enterprise to over $30 billion whereas enhancing profitability by increasing margins.

Even after the latest sell-off, Salesforce is the third-most invaluable software program firm behind Microsoft and Oracle. So when one thing sudden occurs in its enterprise, the market listens.

Salesforce reported good outcomes and maintained its full-year fiscal 2025 income steering. Nonetheless, it lowered its fiscal 2025 steering on subscription and help income progress and usually accepted accounting ideas (GAAP) working margin.

Given the slowdown, analysts puzzled why Salesforce did not simply reduce its income steering and reset expectations so it might get again to underpromising and overdelivering. However Salesforce appeared assured it might nonetheless hit the mark regardless of the weak upcoming quarter.

In the long run, Salesforce is extraordinarily optimistic concerning the progress of synthetic intelligence (AI) and its affect on its enterprise. Salesforce CEO Marc Benioff stated the next throughout his opening remarks on the earnings name:

However the one factor that each enterprise must make AI work is their buyer knowledge, in addition to the metadata that describes the info, which offers the attributes and context the AI fashions must generate correct, related output. And buyer knowledge and metadata are the brand new gold for these enterprises, and Salesforce now manages, as I discussed, 250 petabytes of this treasured materials. We’ve some of the and largest repositories of front-office enterprise knowledge and metadata on the planet. And on daily basis, extra corporations are adopting Salesforce as their entrance workplace, bringing all their structured and unstructured knowledge into our platform.

Briefly, Salesforce feels that it may use AI to run its enterprise higher and that AI fashions may even rely on Salesforce instruments and knowledge — leading to a win-win state of affairs.

That is all nicely and good, however the short-term challenges are obvious — therefore the sharp sell-off. Chief Working Officer Brian Millham stated the next throughout his opening remarks on the decision: “We proceed to see the measured shopping for habits just like what we skilled over the previous two years and aside from This fall the place we noticed stronger bookings, the momentum we noticed on This fall moderated in Q1. And we noticed elongated deal cycles, deal compression, and excessive ranges of price range scrutiny.”

In different phrases, Salesforce is saying that its fourth-quarter fiscal 2024 outcomes had been a one-off and that the medium-term development of sluggish progress persists. Second-quarter income progress is predicted to be simply 7% to eight% above the identical quarter final fiscal yr. And nominal present remaining efficiency obligation (cRPO) progress is predicted to be simply 9%. Salesforce defines cRPO as its income beneath contract that’s anticipated to be booked throughout the subsequent 12 months. It is mainly the SaaS model of a backlog. Excessive-single-digit gross sales progress and cRPO recommend Salesforce is rising at a far slower fee than in years previous, which is why its full-year steering could possibly be in jeopardy.

Cracks all through the business

Salesforce’s steering and commentary on the earnings name add to the theme of slowing progress for a lot of prime software program corporations. Adobe offered off big-time in March when it reported weak near-term steering. The corporate is investing closely in AI and is reaching some main product enhancements, nevertheless it hasn’t been in a position to monetize AI meaningfully sufficient to offset larger bills. Adobe’s state of affairs is similar to Salesforce’s. Each corporations are experiencing a lag between making AI investments and seeing these investments repay.

Workday’s first-quarter 2024 earnings beat expectations, however steering requires slowing income progress as a result of a weak order backlog. The inventory is now down over 23% yr so far.

Atlassian is down over 30% yr so far regardless of sturdy progress and efficient price administration. Considerations over its valuation, the departure of its co-CEO, and progress in its cloud section proceed to stress the inventory.

Snowflake’s income has held up pretty nicely, however its margins and earnings are chock-full of purple flags. It additionally hasn’t managed capital nicely, comparable to shopping for again its inventory at what now appears to be like to be a excessive value. The inventory is down over 25% yr so far.

All informed, many prime software program corporations are experiencing a mixture of progress and valuation considerations, which had been amplified by Thursday’s sell-off in Salesforce inventory.

An ETF to contemplate

With over $6 billion in internet property and an expense ratio of 0.41%, The iShares Expanded Tech-Software program Sector ETF (NYSEMKT: IGV) is a superb means to purchase the dip throughout the software program business. The fund was created in the course of the crucible of the dot-com bust in 2001 — giving it a protracted observe document all through intervals of market volatility.

Microsoft, Oracle, Salesforce, Adobe, and Intuit comprise 40.5% of the fund. Moreover these prime holdings, the fund is nicely balanced throughout enterprise software program corporations and prime cybersecurity leaders.

Some prime cybersecurity corporations like CrowdStrike are hovering round all-time highs and have fared higher than enterprise software program corporations. The broad-based publicity to software program software and infrastructure corporations that cater to varied finish markets makes the fund’s expense ratio nicely definitely worth the value.

Regardless of power from Microsoft and Oracle, the ETF is roughly flat yr so far — showcasing the extent of the sell-off in different software program shares.

Proceed with warning

Though SaaS corporations profit from recurring income streams, their long-term progress relies on including new clients and increasing spending from present clients. Innovation is a key driver of buyer retention and growth, however so is the financial cycle.

The shoppers of those SaaS corporations traverse the entire financial system, making SaaS corporations significantly weak to the ripple results of a broader slowdown. Steering by Salesforce and different corporations means that clients are sustaining tight spending and are conscious of their prices — which is a theme value monitoring for the well being of the broader market rally.

The funding thesis for a lot of of those corporations hasn’t modified, however their valuations are based mostly on sustained progress, so volatility might persist if there is a extended slowdown. Traders with a three- to five-year time horizon and a excessive threat tolerance might need to think about the iShares Expanded Tech-software Sector ETF as a catch-all strategy to spend money on software program whereas reaching diversification advantages.

Do you have to make investments $1,000 in Salesforce proper now?

Before you purchase inventory in Salesforce, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Salesforce wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $677,040!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Could 28, 2024

Daniel Foelber has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Adobe, Atlassian, CrowdStrike, Intuit, Microsoft, Oracle, Salesforce, Snowflake, and Workday. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

My High ETF to Purchase the Dip in Slumping Software program Shares Like Salesforce was initially printed by The Motley Idiot