[1/2] Large tortoises are seen in Floreana Island at Galapagos Nationwide Park, Ecuador, October 8, 2016. REUTERS/Nacho Doce/File Photograph

LONDON, June 11 (Reuters) – The file $1.1 billion debt-for-nature swap Ecuador simply pulled off to guard its distinctive Galapagos Islands is making a clamour amongst different nature-rich however cash-poor nations wanting to observe go well with.

Whereas a variety of governments already had plans within the pipeline earlier than Ecuador’s success, those that put these kinds of offers collectively say that breaking the $1 billion barrier has basically modified what is feasible.

At their easiest, in debt-for-nature swaps a rustic’s authorities bonds or loans are purchased up by a financial institution or specialist investor and changed with cheaper ones, often with the assistance of a multilateral growth financial institution “credit score assure”.

As these ensures shield consumers of the brand new bonds if the nation is not in a position to pay the cash again, the rate of interest is decrease, permitting the federal government concerned to spend the financial savings on conservation.

Credit score Suisse banker Ramzi Issa, who was concerned within the Galapagos deal and a key architect of different current transactions in Belize and Barbados, described this as a holy grail for eco-finance consultants.

Ecuador has dedicated to spend about $18 million {dollars} yearly for a minimum of the subsequent 20 years on conservation within the Galapagos, the distant islands whose distinctive animal life impressed Charles Darwin’s Principle of Evolution.

“I believe this transaction specifically, which is unprecedented in some ways – in dimension, in funding and when it comes to the environmental commitments – has received individuals saying, okay that is now an actual factor,” Issa stated.

“What we’ve got seen is that conversations that we had previously and that went sideways for a while have been reinvigorated, and a few of people who had been transferring alongside have been accelerated,” he added.

The rising urge for food comes as file numbers of creating world governments face debt pressures attributable to greater international rates of interest.

Gabon is predicted to be the subsequent nation to seal a swap within the coming weeks, however the mannequin can be beginning to produce offshoots.

Ilan Goldfajn, president of the Inter-American Growth Financial institution, which supplied the credit score assure for the Galapagos deal, stated not too long ago that it’s engaged on a debt-for-climate swap, the place the financial savings would go in the direction of local weather change adaptation schemes.

Scott Nathan, the pinnacle of the U.S. Worldwide Growth Finance Company (DFC), which supplied the political threat insurance coverage for the Ecuador and Belize offers – one other key instrument in reducing borrowing prices – stated debt-for-health and debt-for-gender equality had been additionally potentialities.

“There isn’t a scarcity of alternatives,” Nathan stated. “We wish to be as progressive as attainable.”

NEXT MILESTONE

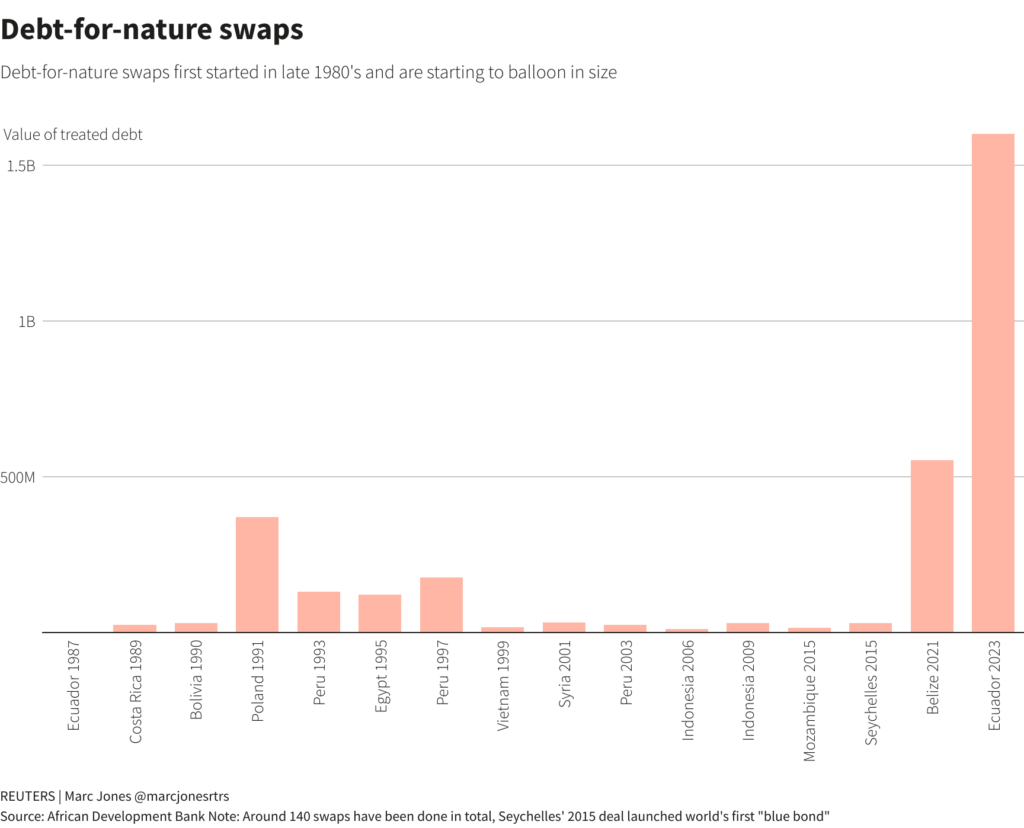

Debt-for-nature swaps aren’t new. There have been round 140 over the previous 35 years, however even together with final month’s super-sized Galapagos deal they’ve solely concerned round $5 billion of debt altogether.

Such initiatives are anticipated to obtain extra backing later this month, when French President Emmanuel Macron and Barbados’ Prime Minister Mia Mottley host a summit in Paris to debate local weather and developmental financing.

The highest-level attendees will likely be urged to do extra, not solely debt swaps, but in addition by offering overseas trade ensures and computerized debt-payment breaks for nations hit by climate-related disasters.

In addition to Gabon, a handful of different African nations are additionally engaged on debt-for-nature offers bankers say, as is Sri Lanka and a clutch of Caribbean and Indian Ocean islands.

Credit score Suisse’s Issa believes a multi-country swap would be the subsequent massive milestone although.

Colombia, Costa Rica, Ecuador and Panama have arrange the Japanese “Tropical Pacific Marine Hall”, which may quickly see the world’s largest transboundary marine biosphere established.

Kenya, Mozambique, Tanzania, Seychelles and others are additionally making a “Nice Blue Wall” within the Western Indian Ocean the place each single coral reef is vulnerable to collapse within the subsequent 50 years.

“Seeing one thing that has a gaggle of nations concerned could be wonderful,” Issa stated. “Logistically it’s extra advanced however the probably impression could be great,” he added, explaining how nations usually have very totally different debt profiles.

Ecuador says it’s eyeing one other transaction to capitalise on the halo impact from the Galapagos deal. Conservationists hope it would deal with defending extra of the nation’s share of the Amazon rainforest.

A few of these immediately concerned in final month’s swap assume it will make sense to let the market take in that one earlier than going forward, however DFC’s Nathan believes nations ought to strike whereas the iron is sizzling.

“Sitting again and ready when there are alternatives on the market does not make any sense to me,” he stated. “We’re going to maintain pushing ahead.”

Extra reporting by Simon Jessop; Enhancing by Sharon Singleton

: .