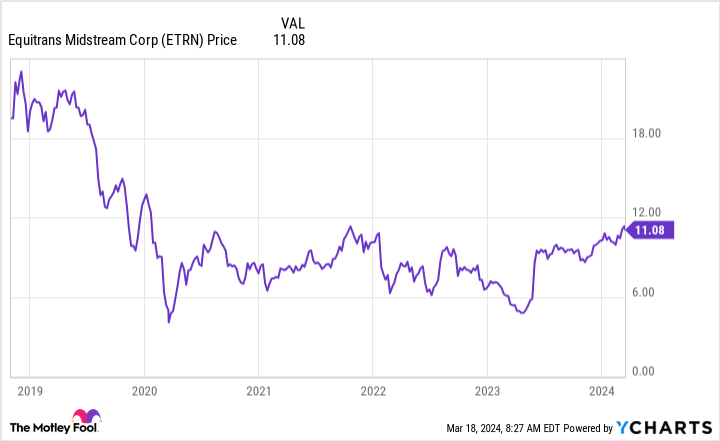

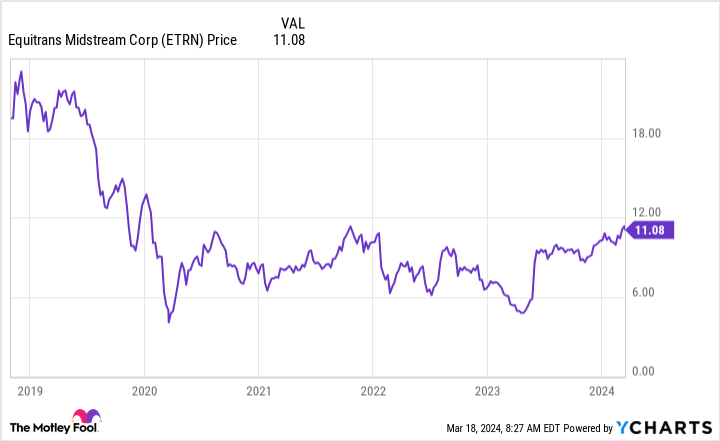

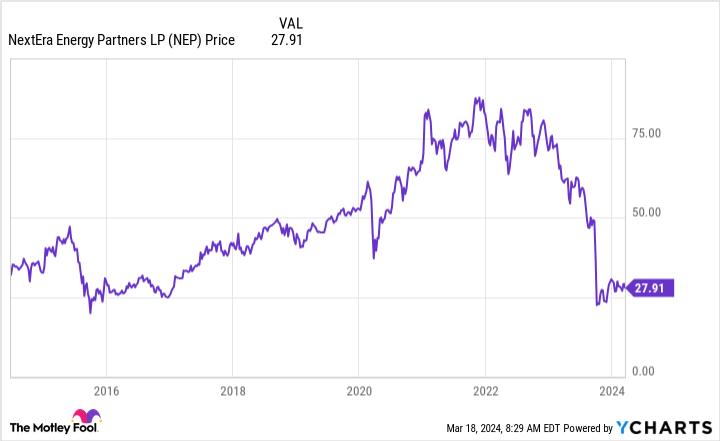

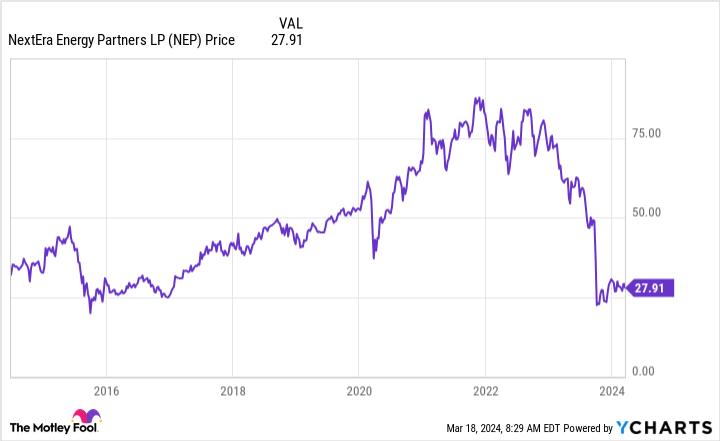

NextEra Power Companions (NYSE: NEP) is displaying up on high-yield screens in the present day due to its large 12%+ distribution yield. This wasn’t at all times the state of affairs, noting that the yield was nearer to 4% on the finish of 2022. The steep unit worth decline that pushed the yield increased is price analyzing, however the potential fallout from that decline can be price contemplating. To get an thought of why the latter consideration is necessary, simply have a look at what’s occurring with Equitrans Midstream (NYSE: ETRN) in the present day.

What went improper at NextEra Power

NextEra Power Companions was created by NextEra Power (NYSE: NEE), one of many largest utilities in the US. Along with being a big regulated utility, NextEra Power can be one of many largest producers of photo voltaic and wind energy on the planet. To benefit from Wall Road’s as soon as scorching demand for something associated to wash power, NextEra Power created a grasp restricted partnership (MLP) to personal clear power belongings.

NextEra Power Companions is principally a funding automobile for its guardian, NextEra Power. The guardian sells clear power belongings, or “drops them down,” in business lingo, to the MLP. The MLP buys the belongings by issuing items and taking over debt. NextEra Power makes use of the money from the asset gross sales to fund future investments. NextEra Power Companions makes use of the money movement from the belongings it buys to pay distributions to unitholders.

However traders have soured on the clear power house, resulting in a notable decline within the worth of NextEra Power Companions. That makes it dearer to promote items. Making issues worse, rising rates of interest elevated the price of debt capital, too. At this level, it is not almost as engaging for NextEra Power to promote belongings to NextEra Power Companions. And, as you would possibly count on, NextEra Power has introduced plans to tug again on drop downs. That, in flip, will result in slower progress at NextEra Power Companions.

What does this need to do with Equitrans Midstream?

The large story for Equitrans Midstream is that EQT Corp. (NYSE: EQT), the corporate that created the MLP, is shopping for it again. This is not the primary time {that a} guardian firm of an MLP has purchased again the MLP it created. The checklist contains utilities like Dominion Power and pipeline operator Kinder Morgan, amongst others.

As you would possibly count on, EQT is pitching its buy of Equitrans Midstream as a optimistic. In truth it known as the transaction “transformative,” regardless that it’s, in some ways, simply recreating the corporate because it was earlier than Equitrans Midstream was spun off. The true story is that Equitrans Midstream is being purchased again at a worth that’s far beneath the worth at which it was spun off.

Now suppose again to NextEra Power Companions. The aim of that MLP is to be a funding automobile for NextEra Power, but it surely simply is not as precious because it as soon as was on that entrance. With the unit worth dramatically decrease than it was, there is a very actual chance that NextEra Power merely buys the MLP again on a budget.

To be honest, the runway for progress within the clear power sector is extra engaging than the expansion alternative within the pipeline sector. That implies that NextEra Power would possibly wish to wait longer to see what occurs with NextEra Power Companions earlier than doing something rash. However there are a number of examples of MLP spinoffs being purchased again as soon as they’ve outlived their usefulness. If you happen to personal NextEra Power Companions it’s best to preserve the Equitrans Midstream state of affairs at the back of your thoughts.

Purchase with at the very least somewhat warning

The true concern right here, nevertheless, must be for traders who’re contemplating including NextEra Power Companions to their portfolio due to its hefty 12%+ distribution yield. Whereas that yield is backed, to some extent, by a robust guardian, NextEra Power might simply as simply resolve to purchase the MLP, successfully making what was a horny yield rapidly go away. Equitrans Midstream, amongst others, reveals that that is, in reality, a really actual chance and a danger dividend traders should not ignore.

Must you make investments $1,000 in NextEra Power Companions proper now?

Before you purchase inventory in NextEra Power Companions, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for traders to purchase now… and NextEra Power Companions wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 21, 2024

Reuben Gregg Brewer has positions in Dominion Power. The Motley Idiot has positions in and recommends EQT, Kinder Morgan, and NextEra Power. The Motley Idiot recommends Dominion Power. The Motley Idiot has a disclosure coverage.

NextEra Power Companions Buyers Ought to Be Watching This Acquisition Very Intently. Here is Why. was initially revealed by The Motley Idiot