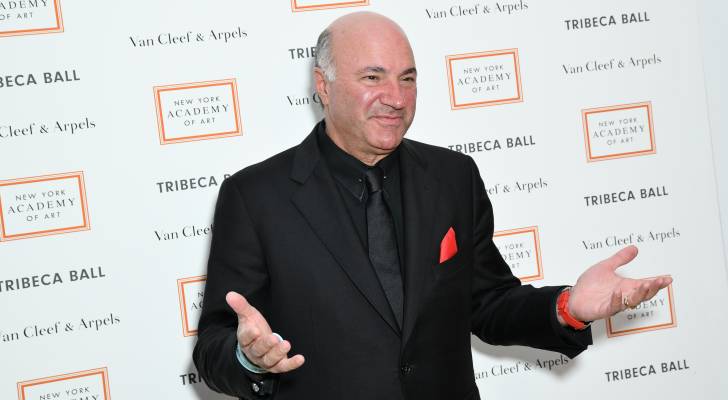

The downfall of cryptocurrency alternate FTX has impacted fairly just a few celebrities. That features Kevin O’Leary — a star on CNBC’s Shark Tank program — who was a spokesperson and investor within the alternate.

He’s was referred to as out by famed economist Nouriel Roubini.

“Kevin O’Leary is a paid hack for FTX,” Roubini stated at Abu Dhabi Finance Week. “I hope that CNBC goes to do away with him.”

To make sure, O’Leary has been one of many extra outspoken proponents of cryptocurrency, however that’s not his total investing technique — removed from it.

Do not miss

Mr. Great is definitely a believer in investing in dividend shares.

“Once I began to do a little analysis I discovered one attention-grabbing proven fact that modified my funding philosophy eternally,” he stated in a Forbes interview. “During the last 40 years, 71% of the market returns got here from dividends, not capital appreciation.”

“So rule one for me is I’ll by no means personal stuff that doesn’t pay a dividend. Ever.”

In case you share the identical view, right here’s a take a look at the three prime holdings at O’Leary’s flagship ETF — ALPS O’Shares U.S. High quality Dividend ETF (OUSA).

Residence Depot (NYSE:HD)

Residence Depot could not appear as thrilling as crypto, but it surely’s the highest holding at OUSA, accounting for five.25% of the fund’s weight.

The house enchancment retail large has round 2,300 shops, with every one averaging roughly 105,000 sq. ft of indoor retail house, dwarfing many opponents.

Whereas many brick-and-mortar retailers floundered through the pandemic, Residence Depot grew its gross sales almost 20% in fiscal 2020 to $132.1 billion.

And the corporate continued its momentum because the economic system reopened.

In Q3 of Residence Depot’s fiscal 2022, gross sales elevated 5.6% yr over yr whereas earnings per share improved by 8.2%.

The corporate additionally raised its quarterly dividend by 15.2% to $1.90 per share earlier this yr. On the present share worth, it yields 2.3%.

Microsoft (NASDAQ:MSFT)

Tech shares aren’t identified for his or her dividends, however software program gorilla Microsoft is an exception.

The corporate introduced a ten% improve to its quarterly dividend to 68 cents per share in September. Over the previous 5 years, its quarterly payout has grown by 62%.

So it shouldn’t come as a shock that Microsoft is the second-largest holding in O’Leary’s OUSA.

Learn extra: Develop your hard-earned money with out the shaky inventory market utilizing these straightforward alternate options

After all, 2022 hasn’t been good to tech shares, and Microsoft was caught within the sell-off as properly. Yr-to-date, shares have fallen by 23%.

However enterprise is heading in the right direction. Within the September quarter, income elevated 11% from a yr in the past to $50.1 billion. On a relentless foreign money foundation, income development was a extra spectacular 16%.

Notably, income from Microsoft’s Clever Cloud phase rose 20% yr over yr to $20.3 billion.

Given the downturn in its share worth, Microsoft may give contrarian buyers one thing to consider.

Johnson & Johnson (NYSE:JNJ)

With deeply entrenched positions in shopper well being, prescription drugs and medical units markets, healthcare large Johnson & Johnson has delivered constant returns to buyers all through financial cycles.

Lots of the firm’s shopper well being manufacturers — resembling Tylenol, Band-Help, and Listerine — are family names. In whole, JNJ has 29 merchandise every able to producing over $1 billion in annual gross sales.

Not solely does Johnson & Johnson publish recurring annual income, but it surely additionally grows them persistently: Over the previous 20 years, Johnson & Johnson’s adjusted earnings have elevated at a mean annual price of 8%.

JNJ introduced its sixtieth consecutive annual dividend improve in April and now yields 2.5%.

The inventory can also be demonstrating its resilience on this ugly market: whereas the S&P 500 is down double digits yr up to now, JNJ shares are literally up 4% throughout the identical interval.

The corporate is at present the third-largest holding in OUSA with a weighting of 4.28%.

What to learn subsequent

-

‘Maintain onto your cash’: Jeff Bezos says you may wish to rethink shopping for a ‘new car, fridge, or no matter’ — listed here are 3 higher recession-proof buys

-

Individuals are paying almost 40% extra on dwelling insurance coverage in comparison with 12 years in the past — this is the way to spend much less on peace of thoughts

-

‘Wealthy Dad’ writer Robert Kiyosaki urges buyers to dump paper property — he likes these actual property as an alternative

This text offers info solely and shouldn’t be construed as recommendation. It’s supplied with out guarantee of any type.