Most institutional forecasters count on the worldwide financial system to lose momentum going ahead. That is sure to generate headwinds for India’s progress prospects as properly. Nevertheless, the connection between the worldwide financial system and India’s progress prospects is much from easy. Listed here are 4 charts that designate this argument intimately.

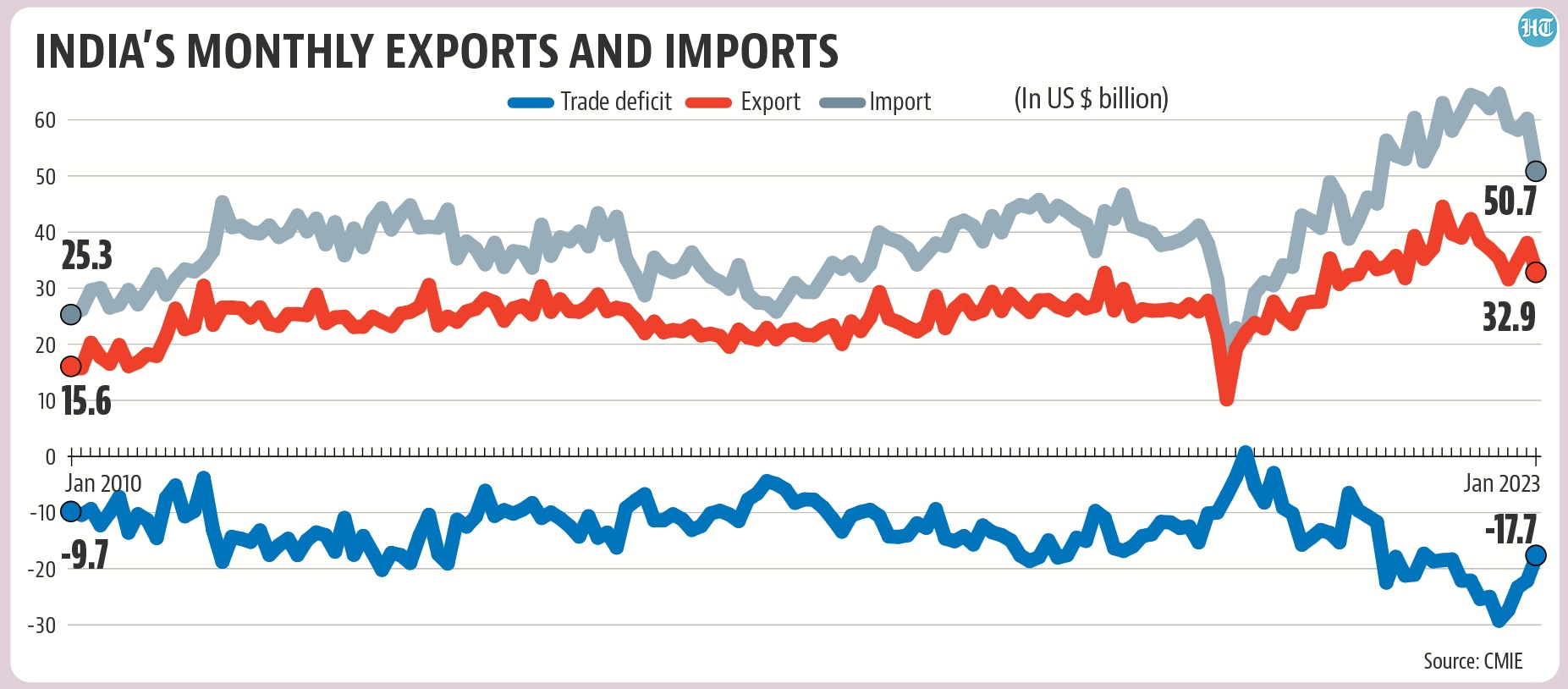

Exports are slowing, however so are imports

The most recent commerce knowledge, which was launched on February 15, underlines this truth. Whereas exports fell from $38 billion to $33 billion between December 2022 and January 2023, imports have fallen from $60.2 billion to $50.7 billion, bringing the commerce deficit down from $22 billion to $17 billion. Whereas an in depth evaluation of the explanations for decline in imports should anticipate commodity smart worth and quantity knowledge, one possible motive could possibly be a decline in commodity costs in worldwide markets. To make certain, a lack of progress momentum within the Indian financial system may be a motive for slowing imports. As a result of the web impression of commerce on the home financial exercise is dependent upon each imports and exports, a drop within the import invoice as a result of fall in commodity costs particularly that of crude oil, acts as an in-built buffer for the Indian financial system.

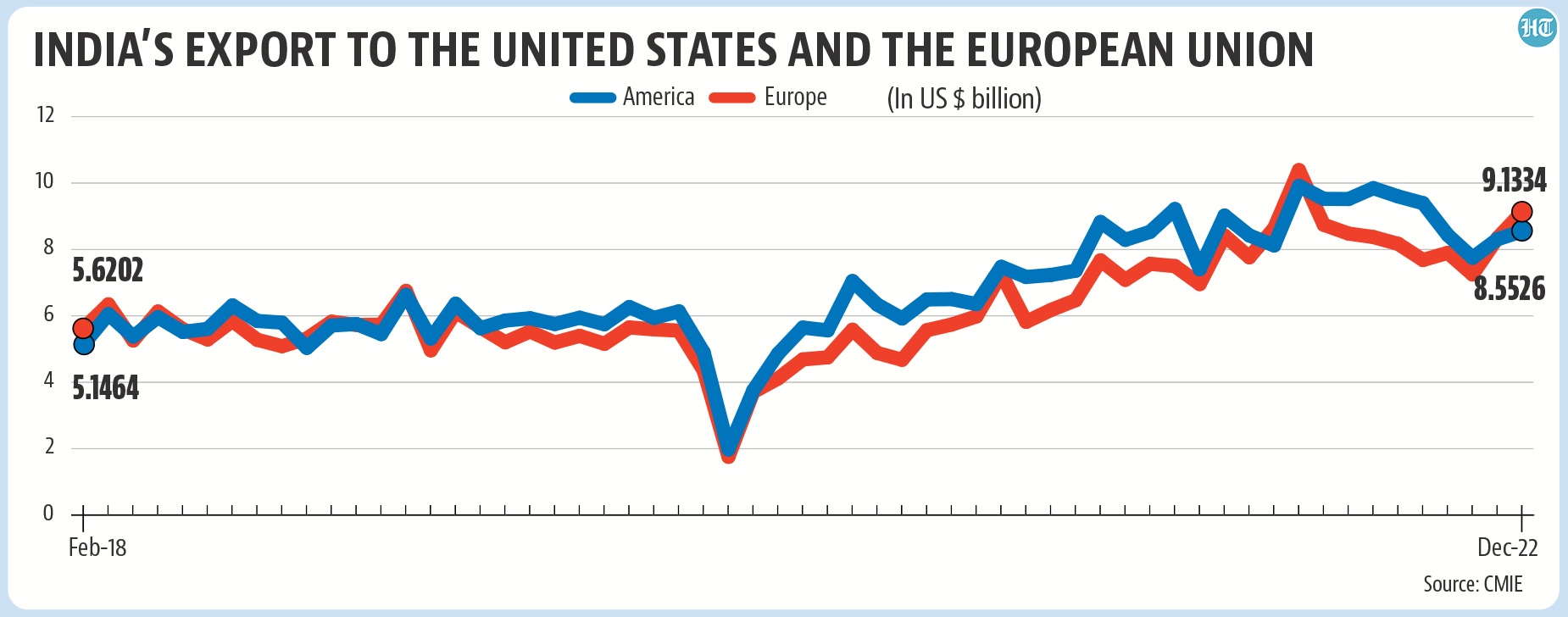

There may be additionally the geographical impression of the slowdown

The depth of a worldwide slowdown’s impression on the Indian financial system will rely upon its magnitude in nations with which India has a extra essential export relationship. That is the place the slowdown is especially dangerous information for India, because the US and Euro-zone economies are the most definitely to be affected by the slowdown and they’re essential export markets, so far as India is worried. A CRISIL report launched on February 15, underlines this level. “More moderen commentary on international progress prospects turned a tad constructive — for example, the Worldwide Financial Fund’s January 2023 World Financial Outlook — however the superior economies are projected to decelerate this yr”, the report notes. “The US and European Union (EU) are two of the biggest locations, accounting for 18% and 15.4%, respectively, of India’s merchandise exports in fiscal 2022”, the report provides. Given the significance of those nations in India’s exports, there may be sure to be a major impression on export earnings for the Indian financial system. The truth is, reminiscent of course of is already underway. “Certainly, exports to those two areas have been on a declining development since July 2022, barring a slight uptick in November and December (see proper chart above), which could possibly be a mirrored image of festive demand in the direction of the yr finish”, the report notes.

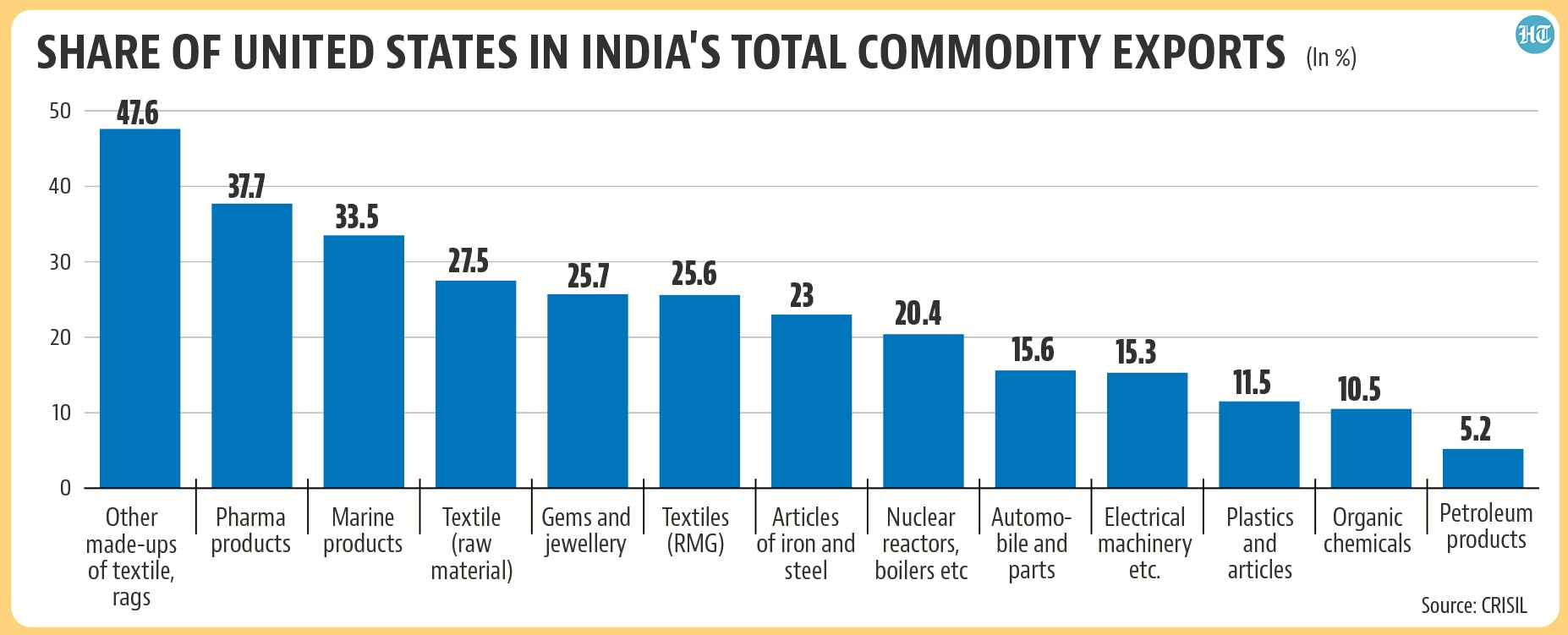

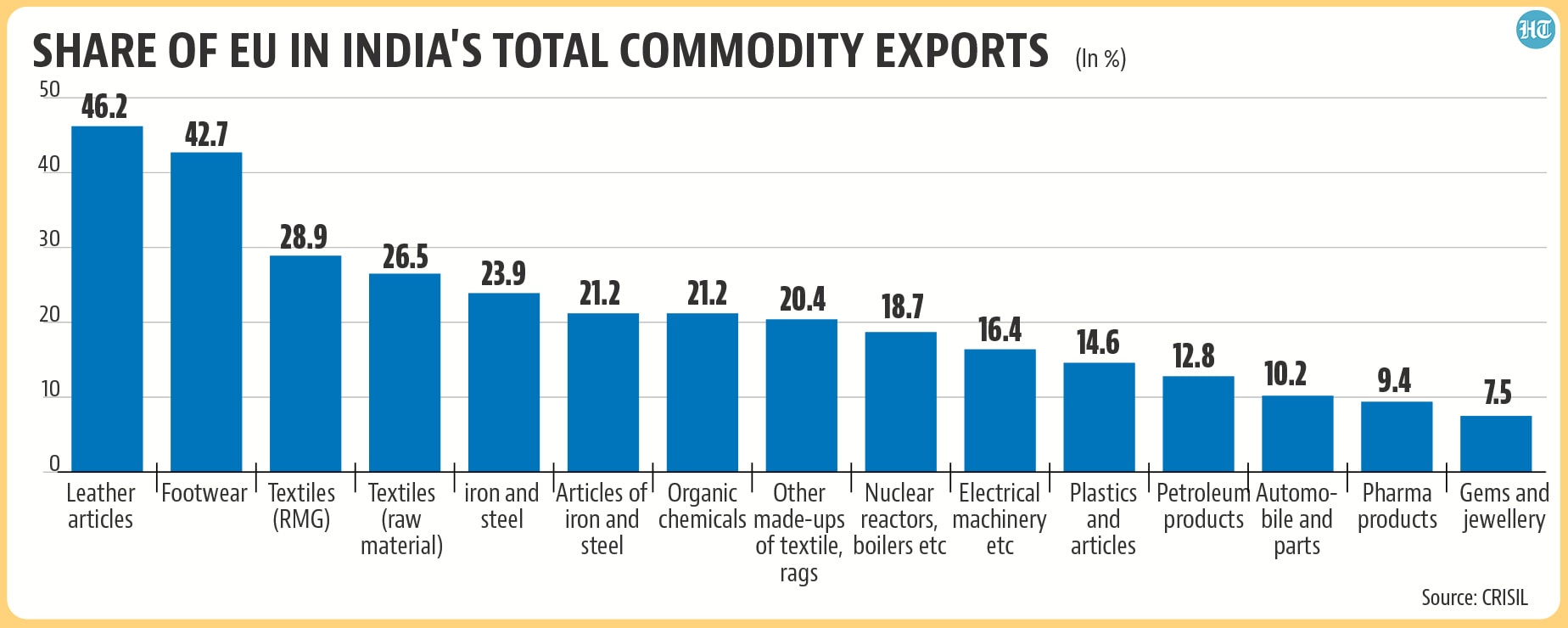

The distributional impression of an export slowdown

There may be one other side to the impression of export pushed slowdown within the Indian financial system, given the distinction in labour depth of export gadgets. The CRISIL report notes that India’s labour intensive exports could possibly be notably badly hit given the centrality of US and EU markets for these commodities. “The EU accounts for 46.2% and 42.7% of India’s leather-based and footwear exports, respectively. Likewise, the US instructions a big share in gadgets reminiscent of ‘different made up of textiles, rags’, pharmaceutical merchandise and marine merchandise”, the report notes. “It’s noteworthy that labour-intensive classes reminiscent of leather-based articles, footwear, and textiles have the very best export dependence on these superior economies”, it provides. That is dangerous information for home demand within the financial system, as a result of it may adversely have an effect on mass incomes in an already slowing manufacturing sector. To make certain, there are elements that might soften this opposed impression as properly.

“That stated, exports from resilient sectors reminiscent of electrical equipment and prescription drugs may partially offset the impression when it comes to stability of funds. We additionally draw some solace as import depth of a few of India’s key exports reminiscent of petroleum merchandise, gems and jewelry and prescription drugs is comparatively massive , indicating a slowdown within the exports of these things implies some softening in imports as properly”, the report provides.

Unlock HT Premium with upto 67% Low cost

Subscribe Now to proceed studying