The next tax buoyancy than 2022-23 is among the many most important assumptions within the 2023-24 Price range. Tax buoyancy measures modifications in taxes per unit change in GDP. Listed below are 4 charts that designate why this assumption is essential, and supply a wider context to the Price range’s tax calculations.

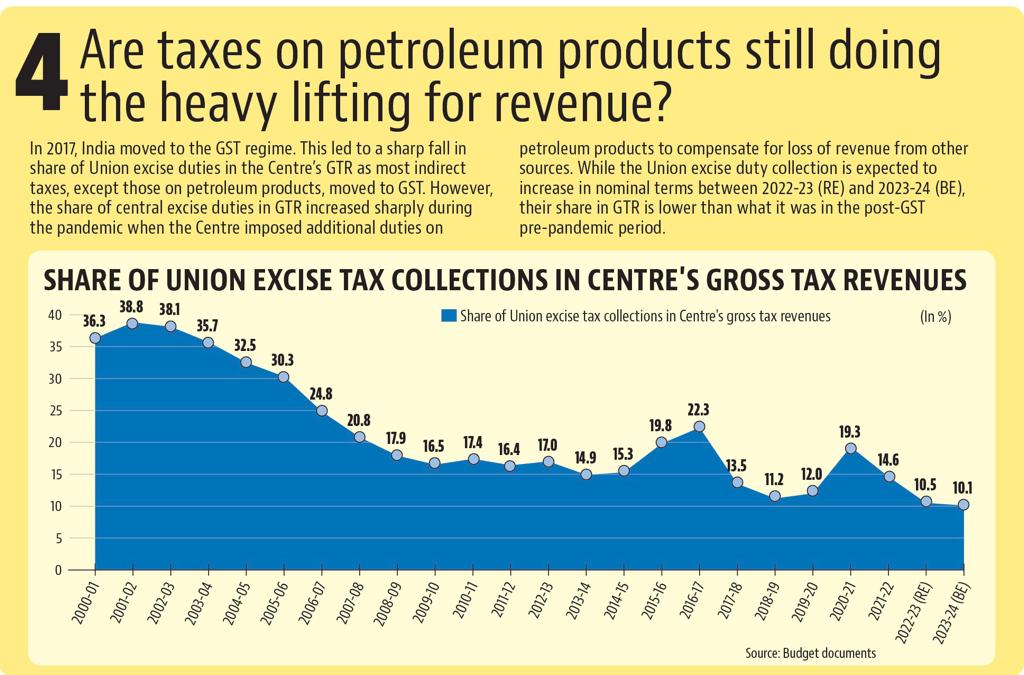

Gross Tax Income progress could be a lot decrease if tax buoyancy for 2023-24 was at 2022-23 ranges

Implied tax buoyancy for 2022-23, as per the primary superior estimates of GDP for 2022-23 and the Gross Tax Income (GTR) within the Revised Estimate (RE) for 2022-23 involves 0.8. Which means that taxes have grown at a slower tempo in comparison with GDP progress. If the identical tax buoyancy was to carry for 2023-24 – the Price range’s assumption is 0.99 – GTR would develop from Rs. 30.4 lakh crore in 2022-23 (RE) to Rs.33 lakh crore in 2023-24. That is 1.8% lower than Price range Estimate (BE) quantity for 2023-24.

Additionally learn | Decoding the massive numbers in Union Price range 2023-24

It’s attention-grabbing to notice that tax buoyancy for 2022-23, as per the RE GTR numbers and first superior estimates for GDP, has additionally ended up marginally decrease than what the 2022-23 Price range had assumed it to be (0.86). Had tax buoyancy remained on the degree that was assumed within the 2022-23 Price range, GTR quantity for 2022-23 ought to have been 0.78% greater than what the 2022-23 RE quantity is. To make certain, as a result of nominal GDP for 2022-23 has ended up increased than what final yr’s finances assumed, RE numbers for GTR are 10% increased than the BE numbers.

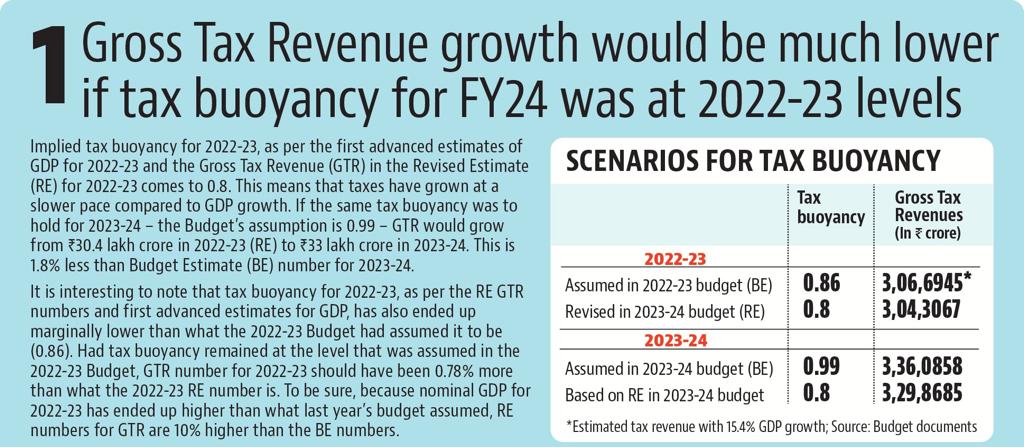

How does the 2023-24 Price range arrive at a better tax buoyancy quantity?

One of the best ways to reply this query is to have a look at tax-head clever buoyancy for main parts of the Centre’s GTR for 2023-24. Underneath direct taxes, the buoyancy for each company and private earnings tax revenues is assumed to be 1, which is decrease than their respective figures in 2022-23 (1.12 for company and 1.11 for private). In case of oblique taxes, buoyancy for customs and central excise are assumed to be 1.05 and 0.57, increased than 0.33 and -1.23 in 2022-23. The GST buoyancy is assumed at 1.14 in 2023-24 decrease from 1.45 in 2022-23.

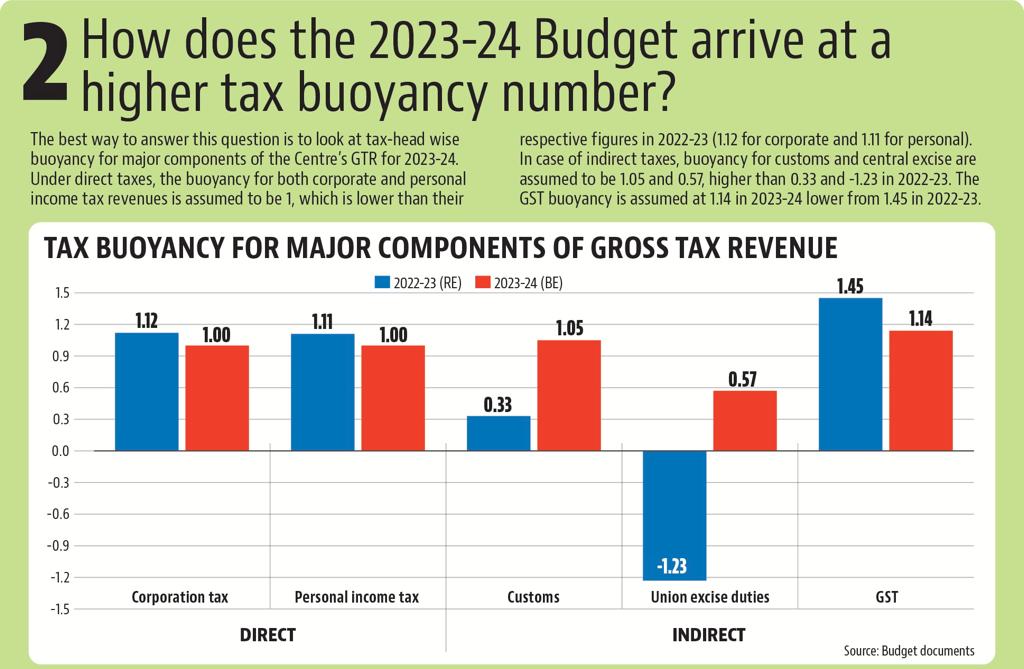

Is the Price range’s tax buoyancy estimate off the mark?

One of the best ways to reply this query is to have a look at long-term tax buoyancy in India. Since 2003-04, the buoyancy for gross tax revenues has been within the vary of 0.16 and 1.68 within the pre-2019 interval (2019-20 buoyancy was unfavourable as a result of discount in company earnings tax charges, and so collections). This places the implied tax buoyancy numbers for 2023-24 (0.99) throughout the historic vary.

Inside its parts, the direct tax buoyancy was constantly above 1.4 (and fewer than 2.74) within the post-2002 and pre-2008 interval. After falling throughout the aftermath of International Monetary Disaster in 2008, it settled to 0.75 in 2011-12. Within the subsequent years, collections turned extra buoyant to achieve 1.27 in 2018-19. The 2023-24 Price range assumed this quantity to be 1, decrease than each 2022-23 (1.11) and 2021-22 (2.51).

In case of oblique taxes, the buoyancy was 0.96 in 2011-12, peaked at 2.87 in 2015-16, however had fallen to lower than 0.6 because the implementation of the Items and Providers Taxes (GST) in 2017. Within the post-pandemic interval, this determine improved to 1.04 in 2021-22, however fell to 0.46 in 2022-23. The Price range, as talked about above, has assumed 0.99 for 2023-24.

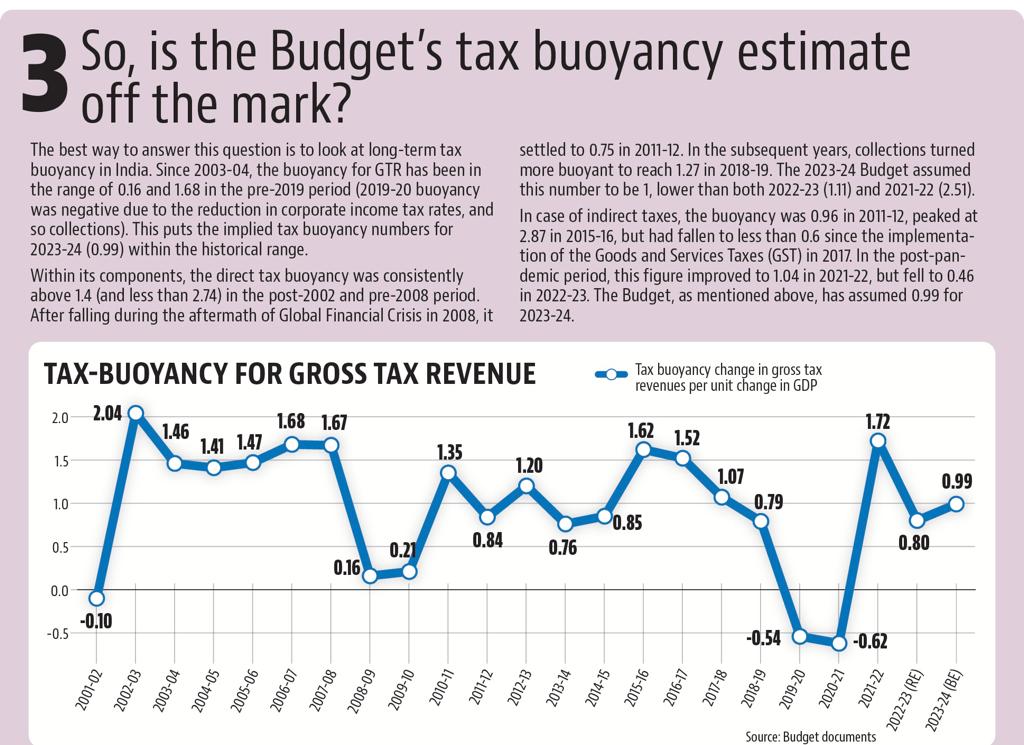

Are taxes on petroleum merchandise nonetheless doing the heavy lifting for income?

In 2017, India moved to the GST regime. This led to a pointy fall in share of union excise duties within the Centre’s GTR as most oblique taxes, besides these on petroleum merchandise, moved to GST. Nonetheless, the share of central excise duties in GTR elevated sharply throughout the pandemic when the Centre imposed extra duties on petroleum merchandise to compensate for lack of income from different sources. Whereas the union excise responsibility assortment is predicted to extend in nominal phrases between 2022-23 (RE) and 2023-24 (BE), their share in GTR is decrease than what it was within the post-GST pre-pandemic interval.