Nvidia (NASDAQ: NVDA) CEO Jen-Hsun Huang has been promoting shares of his firm’s inventory over the previous two months, together with 840,000 shares final week value $59.3 million. The CEO has taken benefit of the inventory’s big rise in share worth, which has greater than doubled this yr and is up an astronomical 2,700% over the previous 5 years.

Let’s take a more in-depth shut on the current gross sales of Nvidia by executives and whether or not buyers ought to observe swimsuit.

Executives dump Nvidia shares

Huang’s disposal of Nvidia shares final week continues a sample of him promoting the inventory in current months. Since June, Huang has bought 2.88 million shares of Nvidia whereas additionally gifting one other 445,000 shares.

The gross sales are being carried out by way of what is named a Rule 10b5-1 plan, which permits company insiders to promote firm inventory utilizing predetermined buying and selling directions. The plans start after a “cooling off interval” and are typically set as much as keep away from any conflicts of curiosity and keep away from insider buying and selling points.

Huang initially arrange the 10b5-1 plan in March and plans to promote 6 million shares (cut up adjusted) by the tip of March 2025. Nonetheless, with the CEO already promoting practically half of the 6 million shares tabbed to be bought, he’s on tempo to finish the buying and selling plan within the subsequent few months.

Whereas 6 million shares of Nvidia is a variety of inventory, Huang nonetheless presently owns 864.1 million shares of Nvidia. As such, the inventory gross sales are actually only a drop within the bucket for the CEO.

Now Huang is not the one Nvidia insider who has been promoting inventory over the previous two months. CFO Colette Kress, Principal Accounting Officer Donald Robertson Jr., EVP of Operations Debora Shoquist, EVP of Worldwide Discipline Operations Ajay Puri, and some administrators have additionally been promoting shares. Most, nonetheless, proceed to carry substantial positions in Nvidia inventory.

Given the large strikes within the inventory over the previous few years, it should not come as a shock that Nvidia executives would need to money in on a few of their success. It additionally is not a foul portfolio administration transfer to diversify a few of their holding away from what very possible is their best supply of wealth by far.

Ought to buyers observe swimsuit and promote Nvidia shares?

This is a little more difficult query than it appears, as each particular person’s state of affairs is totally different. For buyers who’ve racked up big positive factors within the inventory, it might actually be a prudent resolution to trim positions and take some income. Having one place be a big proportion of your portfolio, for instance, will increase dangers, and on the finish of the day, nobody has a crystal ball into the long run.

That stated, Nvidia continues to look to have a protracted runway of progress with synthetic intelligence (AI) nonetheless in its early days and firms persevering with to look to construct out data-center infrastructure to assist AI purposes. Nvidia’s graphic processings models (GPUs) are used for each coaching massive language fashions (LLMs) and AI inference, and demand for its latest chips continues to outstrip provide.

Whereas not the one GPU maker, the corporate has been in a position to create a large moat by way of its Compute Unified Gadget Structure (CUDA) software program platform, which is this system whereby builders typically be taught to program GPUs. This, mixed with the corporate pushing the envelope on new chip structure improvement to yearly, ought to assist preserve Nvidia because the undisputed market chief within the build-out of AI infrastructure.

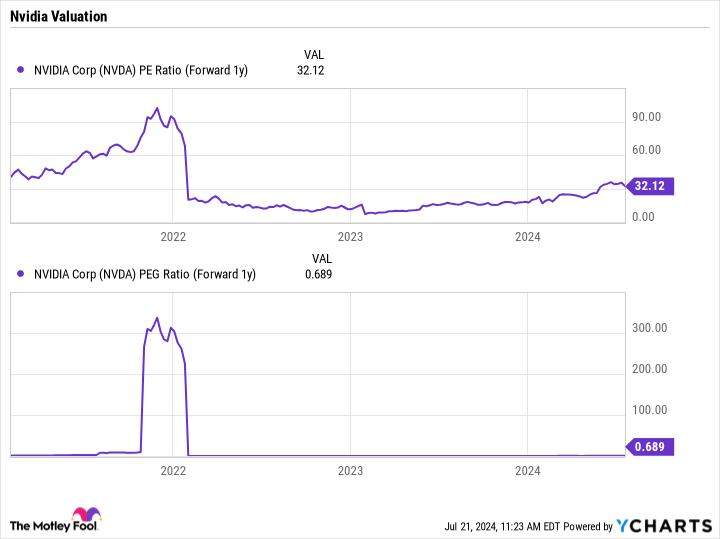

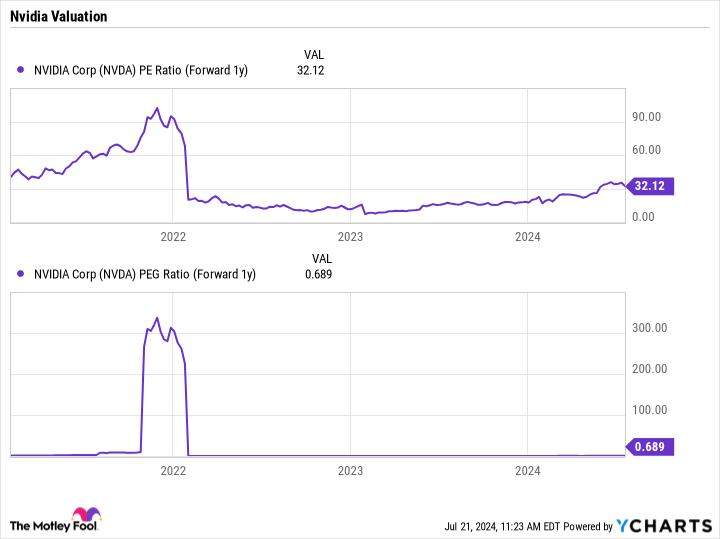

In the meantime, regardless of its sturdy efficiency over the previous few years, the inventory nonetheless trades at a lovely valuation. Primarily based on 2025 analyst estimates, Nvidia trades at a ahead price-to-earnings (P/E) ratio of about 32 occasions, whereas its ahead worth/earnings-to-growth (PEG) ratio is below 0.7 occasions. Any quantity below 1 occasions is mostly thought of undervalued, particularly for a progress inventory.

Now that does not imply that Nvidia is with out dangers. The most important danger to the inventory is that GPU demand cools as soon as the preliminary clamor for the {hardware} is met. If this occurs and baseline demand seems to be a lot decrease than present demand, then the inventory will tumble.

Thus, whereas I feel Nvidia presently continues to appear to be a lovely purchase based mostly on its potential and valuation, it is nonetheless a wise transfer to take some income on the best way up and trim positions to maintain them at acceptable ranges. That is simply good danger administration.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $757,001!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 22, 2024

Geoffrey Seiler has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

Nvidia CEO Continues to Promote Shares. Ought to Traders Comply with Swimsuit? was initially printed by The Motley Idiot