Nvidia shares hit a recent all-time excessive at the moment, and its good points should be within the early innings, in keeping with VanEck CEO Jan van Eck.

Van Eck, whose agency runs the biggest U.S. semi exchange-traded fund, factors to a first-mover edge within the race to manufacture synthetic intelligence chips that would bolster the efficiency of shares together with Nvidia.

“It is simply that these firms have enormous aggressive benefits, nearly quasi-monopolies,” he advised CNBC’s “ETF Edge” on Monday.

Nvidia is up 216% over the previous 12 months and 41% since Jan. 1, as of Wednesday’s shut.

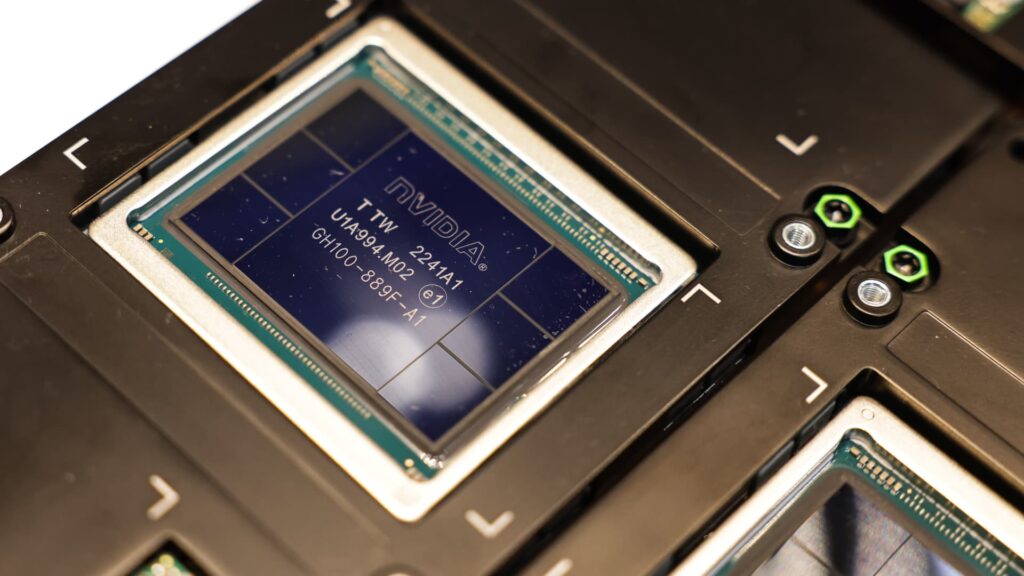

“Who competes in opposition to Nvidia for GPUs [graphics processing units]?” he questioned. “They have nice pricing energy. They have AI.”

Nvidia is the VanEck Semiconductor ETF‘s high holding. The fund tracks 25 of the biggest semiconductor firms weighted by market cap. In accordance with FactSet, Nvidia accounts for nearly 1 / 4 of the fund’s belongings.

“[Nvidia’s] lead is so huge,” van Eck added. “The return on fairness is big.”

He suggests as extra opponents enter the AI GPU house, Nvidia’s extra superior capabilities might buffer the corporate’s present standing as essentially the most priceless semiconductor inventory.

“They’re attempting to construct their moat by now having software program companies, and now they’re constructing a cloud answer,” van Eck mentioned. “However who can actually compete with them?”

The VanEck Semiconductor ETF’s high holdings as of Wednesday are Nvidia, Taiwan Semiconductor and Broadcom. The ETF is up greater than 12% this 12 months.

Disclaimer