Nvidia (NASDAQ: NVDA) was the best-performing inventory in the complete S&P 500 final yr. As of Feb. 7, additionally it is the best-performing inventory thus far this yr.

At first look, this accomplishment appears like Nvidia merely sustained its momentum when the calendar yr flipped, which it did. However understand that Nvidia, like the remainder of the S&P 500, had a 0% year-to-date efficiency on the morning of Jan. 1. After surging by 238.9% in 2023, Nvidia is already up an extra 41.6% in 2024. Put one other means, it’s up 379.7% since Dec. 31, 2022.

I’ve by no means seen an organization the dimensions of Nvidia observe up a banner yr with such a swift and sudden spike. In truth, Nvidia is now price greater than Warren Buffett-led Berkshire Hathaway, electrical car chief Tesla (NASDAQ: TSLA), and its fellow semiconductor big Superior Micro Gadgets — mixed.

However for these contemplating including Nvidia to their portfolios now, the true questions are whether or not the expansion inventory can proceed its rally and whether or not it is price shopping for at in the present day’s ranges.

Nvidia’s surge has been nothing in need of historic

The one worth transfer that I can consider that comes something near what we’re seeing with Nvidia is what Tesla did in 2020, when it gained 743.4% in a single calendar yr, boosting its market cap from $75.5 billion to $677.4 billion.

Nevertheless, Nvidia has topped even Tesla by way of worth creation. On the finish of 2022, Nvidia had a market cap of $359.5 billion. As of Feb. 7, Nvidia’s market cap is $1.73 trillion. So, in a bit over 13 months, Nvidia added $1.37 trillion to its market cap, roughly double what Tesla did in an identical time.

It isn’t an exaggeration to say that Nvidia’s mixture of proportion acquire and market cap acquire is altering the market. Nvidia now accounts for 4.1% of the worth of the SPDR S&P 500 ETF Belief, an ETF that mirrors the efficiency of the S&P 500. It is also 5% of the Invesco QQQ ETF, which tracks the efficiency of the Nasdaq 100. Each time somebody buys $10,000 in an S&P 500 index fund, they’re additionally investing $400 in Nvidia. That is a giant deal, and it is contributing to creating the market extra tech-heavy than ever earlier than.

The pitfalls of turning into a “story inventory”

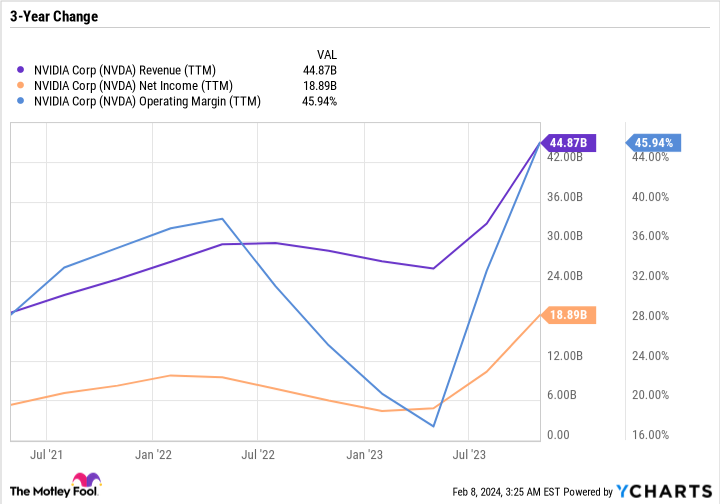

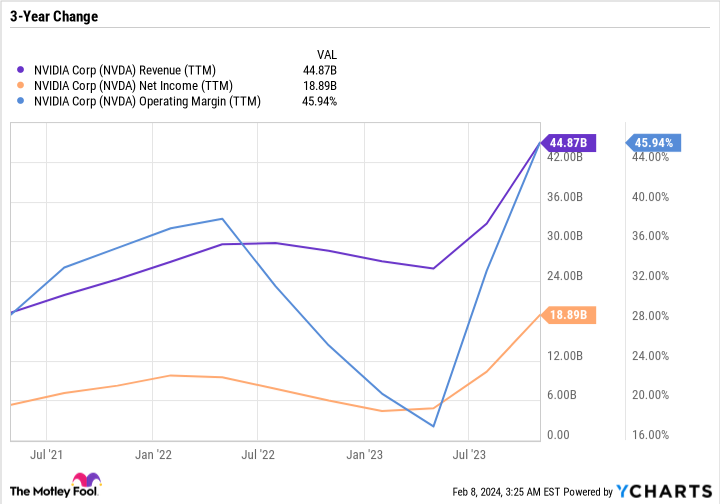

There isn’t any denying that Nvidia’s enterprise is placing up phenomenal numbers.

Its top- and bottom-line development is extraordinary. Its working margin can be extremely excessive, as Nvidia is pocketing 46 cents in working earnings from every greenback in gross sales. Buyers suppose the efficiency will enhance, as prospects cannot get sufficient of Nvidia’s merchandise to energy their synthetic intelligence (AI) aspirations.

The hazard for Nvidia is not how the enterprise is doing — it is the strain that buyers are placing on the inventory. The upper Nvidia goes earlier than the basics can catch as much as the valuation, the better the danger that Nvidia turns into a “story inventory.” With a 92.6 price-to-earnings ratio, some might argue it already is one.

A narrative inventory is an organization whose valuation is predicated totally on a narrative, or what it might turn out to be sooner or later somewhat than what it’s in the present day. Tesla did this in 2020 when it posted the unbelievable 743% return talked about earlier. However Tesla largely lived as much as the hype, as its income and bottom-line development have been extremely robust. Positive, the enterprise has slowed just lately. However total, it has been a formidable interval for Tesla, the corporate.

Tesla the inventory, nonetheless, is definitely down by greater than 20% from the place it traded on the finish of 2020.

The inventory’s more moderen underperformance is essentially as a result of buyers had been prepared to pay such a excessive worth for Tesla earlier than it delivered its gorgeous outcomes. When Tesla did that in 2021, 2022, and 2023, buyers had already priced that progress in. I concern the identical dynamic might play out with Nvidia.

Tesla is an ideal instance of how a enterprise can ship glorious outcomes concurrently its inventory is performing poorly, just because the inventory worth beforehand bought too far forward of itself.

A easy and comparatively protected method to spend money on Nvidia

The tailwinds for Nvidia and the remainder of the semiconductor business are stronger than ever. It is simply that Nvidia inventory is, not less than for now, priced for perfection. However that does not imply it needs to be prevented altogether.

The Vanguard Development ETF (NYSEMKT: VUG) is well-suited for buyers who really feel like they have been caught flat-footed whereas the AI ascension has zoomed previous them. Nvidia makes up 5.3% of the ETF — a large place, however not sufficient to make or break its efficiency. The “Magnificent Seven” shares — Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla — comprise over 50% of the fund.

Unsurprisingly, the Vanguard Development ETF is at an all-time excessive, and the valuations of its prime elements have gotten far more costly. However for only a 0.04% expense ratio, or 4 cents for each $100 invested, an investor can get publicity to loads of megacap development names, together with Nvidia. It is a great way to get a starter place in Nvidia with out overly committing.

Hit the pause button on Nvidia

At this level, I do not suppose buyers must concern Nvidia inventory will run away from them. In some ways, its large positive aspects are behind it; it is too late to purchase Nvidia in case you had been seeking to almost 5x your cash in a bit over a yr. Except for getting restricted publicity with the Vanguard Development ETF or an identical fund, I believe one of the simplest ways to strategy Nvidia now can be to easily hit the pause button and wait.

If the corporate’s fundamentals have improved a yr or two from now, however the inventory worth has languished, then Nvidia might be a much better worth (and doubtless a powerful purchase). However for now, so many expectations have been pulled ahead, leaving an excessive amount of scorching air and room for the inventory to fall.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 5, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Daniel Foelber has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Tesla, and Vanguard Index Funds-Vanguard Development ETF. The Motley Idiot has a disclosure coverage.

Nvidia Is Now Price Extra Than Berkshire Hathaway, Tesla, and AMD Mixed. However Will It Final? was initially printed by The Motley Idiot